Using call options as a hedge

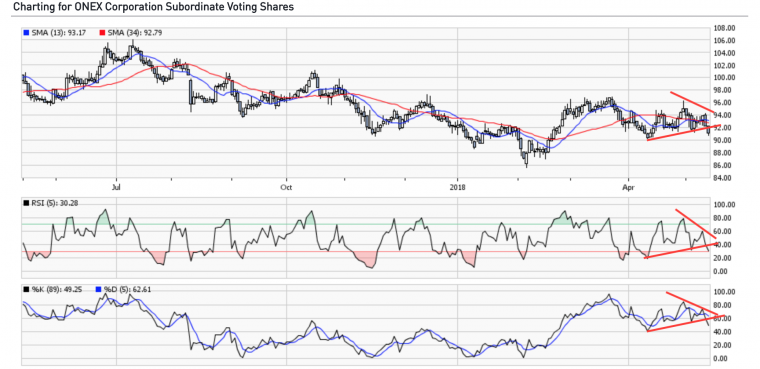

As can be seen in the following chart, the share price of ONEX Corporation (ONEX) has been weak enough to suggest that some caution may be necessary. The Relative Strength Index (RSI), which was recently in oversold territory, is trending downward. The same is true of the stochastic oscillator (%K).

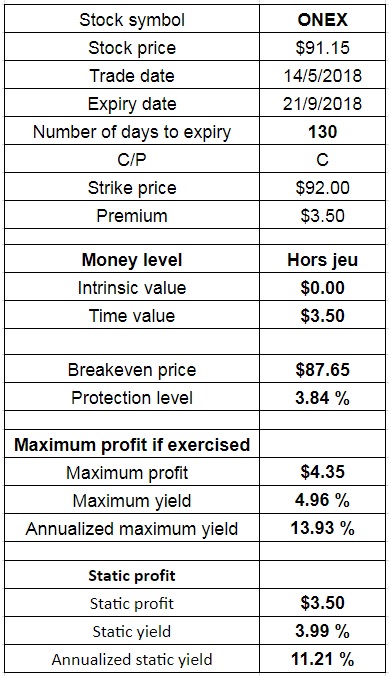

Although the scope of the decline remains to be determined, an investor interested in acquiring some protection while taking advantage of the erosion of the time value of options could write a call option for each 100 shares held. With ONEX trading at $91.15 at the time of this writing, we will select call options expiring on September 21, 2018 with a strike of $92.

Position

- 1,000 shares of ONEX are already held (current market price: $91.15)

- Write 10 call options ONEX 180921 C 92 at $3.50

- Credit of $3,500

Profit and loss profile

This out-of-the-money call option has no intrinsic value and a time value of $3.50 per share. Writing this call option provides protection against a 3.84% drop to the breakeven price of $87.65 ($91.15 – $3.50). In the event that the share price goes up, closing at or above the $92 strike on expiry of the options on September 21, the strategy’s maximum profit will be $4.35 per share, or 4.96% for the 130-day period (13.93% on an annualized basis). If the stock price is unchanged, the static return would be $3.50 per share, or 3.99% for the 130-day period (11.21% on an annualized basis).

Intervention

Since we expect the share price to fall but have no specific target for it, we will close the position if we can buy back the call options written at 10% to 20% of their initial price. Should this occur, we will need to analyze whether the right approach is to hedge the position again by writing more call options. Should the share price rise above the $92 exercise price, we need to buy back the call options at a profit or a loss, as the case may be, to avoid having them assigned and having to sell the underlying shares.

Good luck with your trading, and have a good week!

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.