Real Estate, Canadian Banks and Downside Risks

I want to take a dive into the most passionately debated issue of a correction in Canadian real estate and the impact on Canadian banks. The general consensus is that over the long-term home prices will continue to rise and the risks directly to the banks are limited as mortgage default risk predominantly sit with the mortgage insurance issuers like the CMHC and private insurers like Genworth.

Erik and I had the opportunity to bring Josh Steiner, head of the financial research department at Hedgeye, to the MacroVoices show to discuss his perspectives on Canadian real estate and more importantly the impact it could have on Canadian banks. Here is an excerpt from interview:

Erik: And I guess a particular question that’s on my mind is in the US nobody was immune because almost everybody had exposure to the paper if not to the real estate. If I think about the big Canadian banks – like the Royal Bank of Canada, which was famously immune to problems in the 2008 crisis when the rest of the world was going through a lot of trouble – are they exposed to this? Or is it just mortgage lenders in Canada? Where’s the risk, where are the shorts, where is the investment trade here?

Josh: I think the reality here is a little bit different. I don’t think you have this ticking time bomb in the form of exotic CDOs, CDO-squared products, lacing the balance sheet across the entire banking system.

But what I do think you have is an enormous amount of concentration risk on the part of first and second lien mortgages across the “Big Six”. Like I said earlier, I think the Canadian economy has really become very much a one-cylinder economy that’s driven by this property bubble.

And then from a valuations standpoint, you have a lot of the large banks – you mentioned Royal Bank as being one – where valuations are north of two times tangible book value.

So, think about what I said earlier, which is that when home prices are appreciating rapidly you have all-time lows in delinquencies. That’s an absolute function. It’s like the economic equivalent of a physical law, like gravity. When prices are appreciating rapidly, and an asset class is inflating, naturally you’re going to have very low delinquency rates. And that’s exactly what the rear view of the last 12–18–24 months looks like across the big Canadian banks.

Our point is that when prices start to slow down – God forbid they should actually start to go negative – those delinquency rates are going to rise. And as they rise, the banks will have to provision for those loan losses. And that’s going to erode earnings power.

Kind of like what I was saying about the housing system, where you can have this collective mindset undergo this phase transition of thinking i.e. one day I think of housing as a consumption good (I need somewhere to live), and the next day I think of it as an investment good. All my friends and family made all this money on real estate, I should be there too. Then all of a sudden, the bottom falls out and now it’s back to being a consumption good.

Bank stock investing is no different. When things are good, you trade these things on earnings. When things aren’t great, they start to converge between earnings multiples and book value. And when things are poor, then you throw out the book and you trade straight to tangible. And then it’s well, how low, how long, how fast? And then it’s what level of discount do I apply to tangibles?

Our thought process is that if you have a market that’s coming off its fastest rate of appreciation in history, and delinquencies are at all-time lows and understated, and you’ve got the banks reflecting that (trading north of two times tangible book value), and you think the earnings power is at significant risk because delinquencies are going to rise, then I think there’s a lot of downside.

And the way I frame it up is that it won’t take much of a property correction for earnings power to be largely impaired for the banks across Canada. In that scenario you can undergo this pretty rapid phase transition from trading from an earnings multiple to suddenly, well, what are the earnings? The earnings are shrinking. Are the earnings potentially going to go negative for a period of time? Therefore, I trade to tangible. And that equates to 50%–60% downside for most of these banks.

So, you don’t need, necessarily, this gigantic powder keg of CDO exposure to catalyze a significant amount of downside when you’re trading at pretty high multiples.

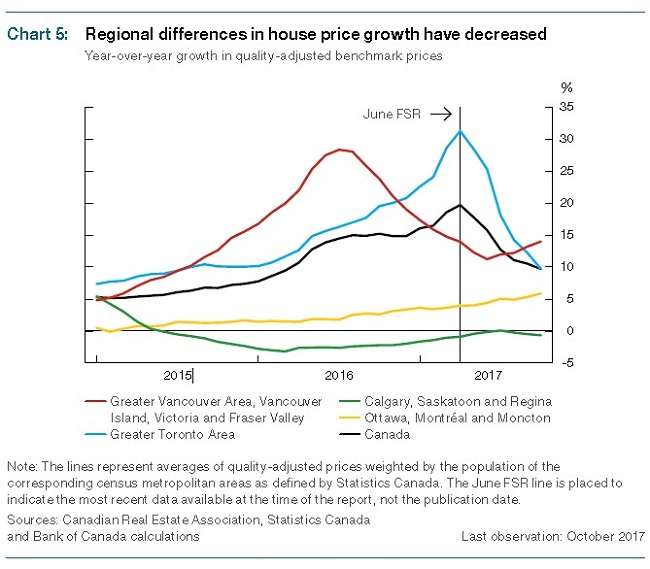

Whether you agree with Josh, there is no denying some basic facts. First, broader Canadian real estate peaked in April of 2017. Some markets have already seen 20+% corrections from peak prices. At some point, the Canadian banks are going to start reflecting lower new mortgage origination and increased delinquencies. While I do agree with most optimists, that this will likely not lead to a banking failure in Canada, but what if it does have a material drag on earnings, that gives investors uncertainty.

Under those conditions, could we see banks trade toward tangible book value? I for one am unwilling to rule that out as a risk.

So, what can a Canadian investor with a large investment in Canadian banks do? Obviously, if an investor is overweight in Canadian banks, one can simply rebalance their investment portfolios to have a more equal to underweight exposure. The obstacle for many are considerations like capital gain taxes and interruptions in a stream of dividends if the stocks are not replaced.

This is where an investor can learn to utilize put options to hedge outlier risk. I think most long-term investors would agree that the stock fluctuating 10% higher and lower is just noise. The real risk is in a bear market style decline where the stock’s decline more than 20%.

My favorite way to approach this is with a protective collar. Those not familiar with the strategy, read this great summary provided by the Montreal Exchange: https://www.m-x.ca/f_publications_en/strategy_collar_en.pdf

For this example, we will use Royal Bank (TSX:RY). The question we can ask, how can we create a “near-zero cost” collar to remove all downside risk below 10% further loss.

- Royal Bank is trading at: $99.21 (March 23rd, 2018)

- The July 2018 $105.00 covered call is paying $0.85 bid

- The July 2018 $90.00 protective put costs $1.10 ask

- Net cost $0.25 debit

This hedge wrap allows the long-term investor to remain invested, continue collecting dividends and have no tax disposition. At the same time, the investor has room for the stock to return back toward its year highs and removing all downside risk below $90.00 or about 10% lower than where the stock is currently trading. For investors that want to own their banks for the long term but yet see validity for short term concerns, this collar strategy offers an alternative to just selling the shares outright.

In a future blog, I will explore the action points for managing a collar after you have put it on.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.