Hedging With SXO Options Using Portfolio Beta

This year has been one of headline risk and investor hypersensitivity to say the least. Yet despite all the market moving tweets and the ongoing trade tantrum, both U.S. and Canadian markets continue to climb a wall of worry. In fact, I would suggest that global markets in general have been climbing a wall of worry since 2008.

Regardless, risk is something that a prudent investor always has on their mind. In fact, our emphasis here at Croft Financial Group is managing risk first with the expectation that the profits will follow. To assess risk, it’s important understand where your exposure lies.

Unsystematic Risk

Unsystematic risk is also considered “specific” risk and is based on the uncertainty surrounding a specific company or industry. A diversified portfolio seeks to limit this kind of exposure by only investing a small amount of capital in each company/industry thus avoiding over concentration. Beyond diversification, the investor may choose to use an option strategy to hedge the risk specific to a company. For example, you may feel that your position in Agnico Eagle Mines (AEM.TO) may be at risk due to specific concerns for the company or sector, however you may be very comfortable with your exposure to Canadian banks. With that in mind, a protective put, or collar strategy may be built around the AEM.TO position to hedge the unsystematic risk and the bank position left un-hedged

Systematic Risk

The other type of risk exposure is called Systematic risk. This is also known as “market” risk and is not as easily diversified out of a portfolio or offset with a company specific option hedge. The phrase “when the tide goes out, all ships sink” describes this type of risk well. The concern is broad based, with geo-political and economic fears prompting investors to sell shares, raise cash and run to the sidelines until conditions look more favorable.

Hedging Systematic Risk in a Diversified Portfolio

To offset the risk of a broad market sell off in a diversified portfolio, an investor may want to consider a strategy using SXO options. SXO options are priced based on the S&P/TSX 60. Remember that the S&P/TSX 60 is an index designed to track leading Canadian companies in leading Canadian industries.

For more details on the Canadian index, click here.

Why SXO Options?

One of the considerations when using a “typical” equity or ETF option is that the contracts are exercised and assigned using the underlying shares for settlement. An investor with a longer term positive outlook for a company, may not want to consider the idea of selling their shares due to what may be a short-term risk. Not to mention that in a non-registered account, this may have tax implications. An option strategy may be off-set (closed) at any time before expiration to avoid the possibility of having to give up shares, but this does require effort.

SXO Options on S&P/TSX 60 offer a few advantages:

- Requires no buying of selling of individual stocks

- Cash settled at experation vs. share settled

- Reduction in transaction costs as the investor is not buying puts for every stock and ETF position

- No interruption to dividend stream as shares continue to be held during the “risky” period

- No tax disposition of underlying shares since they are cash not share settled

- Some stocks in the portfolio may not be options eligible, but the risk may be offset by using SXO options

How Many Index Options to Buy?

There are a couple of important consideration here.

- Trading specifications

- $10.00 per S&P/TSX 60 Index point

- European style settlement (cash not shares)

- Last trading day is the close of market the day prior to expiration

- Settlement price is the opening level of the index on the expiration day

- Investor portfolio is not likely to move exactly like the index

Point number 2 requires a little more consideration. It’s important to understand that an individual stock may be more or less volatile then an index. This measure is referred to as the Beta.

The weighting of each stock would then influence how the investor’s portfolio behaves, relative to the index. In order to properly hedge a diversified portfolio, its Beta must be calculated.

So, What’s the Beta?

The Beta of portfolio represents the amount of variance in value compared to the overall market (S&P/TSX 60).

Beta is an absolute value:

- = 1: Portfolio will move with the market

- > 1: Portfolio is more volatile than the market

- < 1: Portfolio is less volatile than the market

Knowing that the market Beta is 1.00, let’s look at an example if the market rises by 3.00%

Scenario 1

If the portfolio Beta is 2.00, the portfolio should rise approximately 6.00%

Scenario 2

If the portfolio Beta is 0.50, the portfolio should rise approximately 1.50%

Negative Beta

A negative Beta indicates that the portfolio should move in the opposite direction of the market.

Again, knowing that the market Beta is 1.00, let’s look at an example if the market rises by 3.00%

Scenario 1

- If the portfolio Beta is -0.50%, the portfolio should drop approximately -1.50%

Scenario 2

- If the portfolio Beta is -3.00%, the portfolio should drop approximately -9.00%

Portfolio Hedging Example

The following equation can be used to calculate the number of contracts required based on the Beta of the portfolio.

Number of put options = (Portfolio Value X Beta) / (S&P/TSX 60 X 10)

Note that this does not factor in the options Delta, which could be used to if the investor was trying to create a “perfect hedge”.

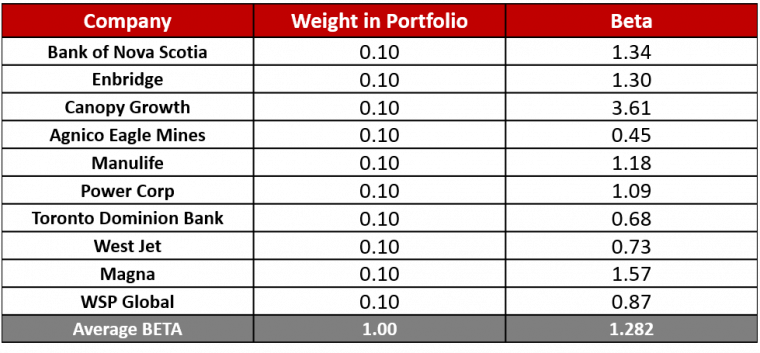

To calculate the Beta of a portfolio, the investor must first identify the Beta of the individual stocks and their weightings.

For example:

For educational purposes only…these companies were chosen at random. BETA courtesy of Yahoo Finance

The Numbers

Portfolio value: $100,000.00

Beta: 1.282

S&P/TSX 60: 975

2-month 975 strike put: $19.30

$100,000.00 X 1.282 = 13.15 contracts

975 X 10

$19.30 X 10 = $193.00/contract

Cost of the hedge: $193.00 X 13 contracts = $2509.00

Cost of the hedge represents approximately 2.5% of the portfolio value

Impact of the Hedge

Without the hedge:

- A 10% drop in the S&P/TSX 60 = approximate 12.82% drop in the portfolio

- This corresponds to an approximate loss of $12,820.00

- Portfolio value would be $87,180.00

With the hedge:

- S&P/TSX 60 now sits at 877.50

- 975 strike put now worth $97.50 (975 strike – 877.50 S&P/TSX 60 settlement

- $97.50 – $19.30 = $78.20 estimated profit at expiration (Put value – original cost)

- $78.20 X $10.00 multiplier X 13 contracts = $10,166.00

- $87,180.00 + $10,166.00 = $97,346.00 portfolio value

- Loss limited to approximately 2.5% or the cost of the SXO put options

Settlement

- European style

- SXO option holders account is credited cash which is the difference between the settlement value of the S&P/TSX 60 and the SXO put strike on the expiration date

Conclusion

Investors wishing to hedge a diversified portfolio against a broader market decline can us an index option such as SXO options instead of purchasing individual puts on each stock. to do this as effectively as possible, the investor must first try to approximate how their portfolio is likely to behave comparative to the market. This can be accomplished by calculating the portfolio Beta.

Note that the SXO option chain may not be as easy to find as the stock and ETF option chains you are used to using. If you are having trouble, don’t hesitate to contact your broker for support.

CEO and Director of Business Development

R.N. Croft Financial Group

Jason is CEO and Director of Business Development at R N Croft Financial Group, a member of the Croft Investment Review Committee and a Derivative Market Specialist by designation. In addition, he is an educational consultant for Learn-To-Trade.com and an instructor for the TMX Montreal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.