Resource Investing with Long-term Options

Old Truism: “A bear market is the author of a bull market and a bull market is the author of a bear market”.

During our interview on MacroVoices with resource investing legend Rick Rule, Rick made a core observation that natural resource investing is different than most mainstream forms of investing. To paraphrase, resource investing it is particularly capital intensive and unusually cyclical. Mature resource companies seem fundamentally cheap at the peak of a cycle, due to high commodity prices. Correspondingly, they appear particularly overvalued at bottoms because commodities are trading at such low prices.

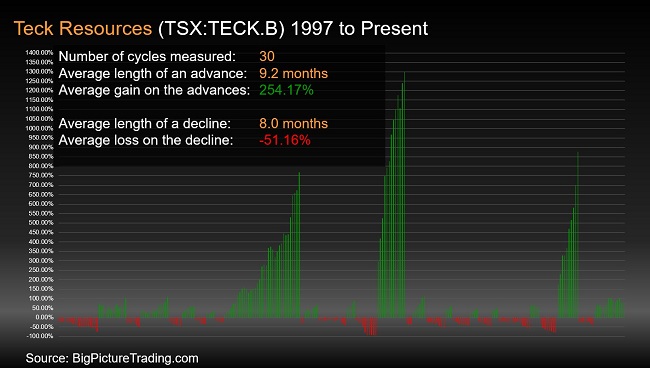

This cannot be any more true than for Canada’s largest diversified resource company, Teck Resources (TSX:TECK.B). Over the last 2 decades, Teck Resources has demonstrated extraordinary cyclical swings in which we demonstrate with a chart showing the percentage magnitude of the different cycles.

The criteria for each cycle was that it need to be longer than 2 months in duration and bigger than 20% (higher or lower) in magnitude looking at data from 1997 to present.

What can we observe?

Of the 30 cycles measured, the average length of cycles was 8-9 months with declines averaging over 50 percent losses during the declines and the gains averaging greater than 250% during the rises.

Certainly, this has been a volatile rollercoaster for the long-term buy and hold investor.

When I observed this chart, it dawned on me that if there was ever a stock where the investor could gain asymmetry from long-term options, this would be the stock.

TECK.B Summary

- July 27, 2018 Teck Resources (TECK.B) closed at $33.82

- February 2019 $32.00 put option (approx. 7 months till expiration) is $2.25 asking price

- Of 15 measured cycles, the average rise was 254.17% over an average 9.2 months

- Of 15 measured cycles, the average decline was -51.16% over an average 8 months

While this is by no means a forecast, observing Teck Resources historical cycles, suggests that it is not out of the realm of possibility that over the next 8 to 9 months that the stock is capable to dropping 50% toward $16.00 or rising to $85.00 on the upside. How can use an option to reduce the volatility experienced?

This is where buying a protective put to hedge your underlying shares will allow an investor to stay the course without enduring the proverbial rollercoaster ride.

As an example, an investor that purchases 1000 shares at $33.82 outlaid a cash investment of $33,820.00. With the purchase of 10 contracts of the February 2019 $32.00 put options at $2.25, our investor paid $2,250.00 as an insurance policy to remove the downside risk below $32.00.

From the upside perspective, the trade is straight forward. The stock is capable of extraordinary gains, and our investor would participate less the cost of buying the put options as insurance. Therefore, the real benefit is focusing on the scenario in which the stock declines.

On the surface, it appears to be rich premium for protection, until you reflect on the magnitude of a decline the stock is capable of. What most investors fail to account for is the tactical ability for our investor to reposition if in fact the Teck Resources was to decline. In our hypothetical scenario where Teck Resources declines to $16.00 before the February expiration, the $32.00 put option would have built a $16.00 intrinsic value ($32.00 – $16.00). By our investor selling the put options, they are credited the $16,000.00 ($16.00 x 1000) cash. Our investor then proceeds to use the cash to dollar cost average and buy an additional 1000 shares at the prevailing $16.00 price. Despite the stock declining more than 50%, our investor now owns 2000 shares with a market value of $32,000.00.

For stocks and securities with this kind of volatility, options offer a mechanism to reduce the volatility, reduce the stress associated with the investment and give the ability to readjust the position. Investors can only achieve this kind of optionality when they learn to incorporate options into their investment portfolios.

Thank you for reading.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.