What do Cannabis, Nelson Peltz and Hedging Have in Common?

On March 13th, Aurora Cannabis Inc. (TSX: ACB) announced that they had appointed Nelson Peltz as a Strategic Advisor to help explore potential partnerships and advise on the company’s global expansion strategy.

This is a big deal given Mr. Peltz’s business history and reputation for delivering results. For more details around this new relationship, check out this TMX Money article: Aurora Cannabis Appoints Nelson Peltz as Strategic Advisor.

The impact of this decision can be clearly seen in the price action of the stock as noted in chart 1.

Chart 1: Aurora Cannabis Weekly

Source: www.tradingview.com

While the current trend appears to be on the upside, history has shown us that stocks within the cannabis sector are volatile.

Understanding volatility is critical to determining which option strategy may give us the best chance at profiting from a directional bias on a stock.

There are two types of volatility to consider:

1. Historical Volatility (HV)

A measure of the deviation in price for a stock above or below its average. The greater the share price trades above or below the average, the higher the historical volatility.

2. Implied Volatility (IV)

This is factored into the price of an option contract and reflects the anticipated future movement in the underlying share price. The more uncertain the future share price of the company, the higher the implied volatility.

It should be noted that stocks with a higher historical volatility will typically have options with higher implied volatility.

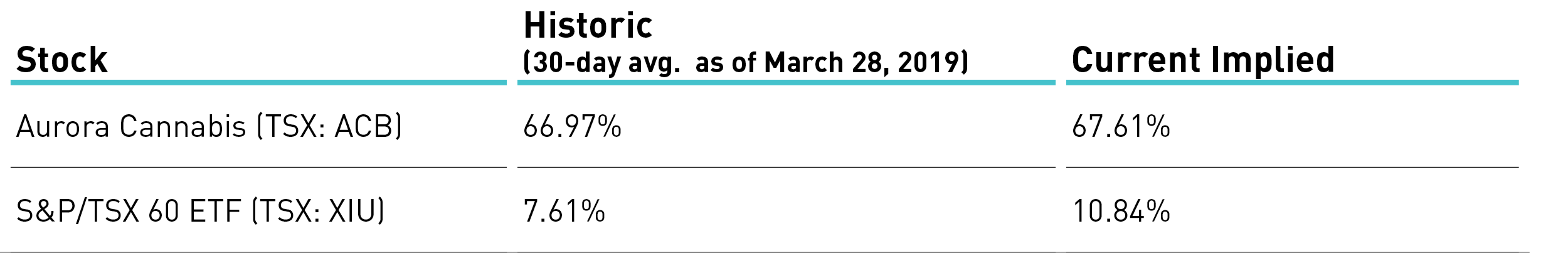

Table 1 compares the current HV and IV of Aurora Cannabis (TSX: ACB) to iShares S&P/TSX 60 ETF (TSX: XIU)

Table 1: Historic Volatility vs. Implied Volatility

Clearly TSX: ACB is the more volatile of the two.

Let’s tie this into something that we can use in our strategy selection process if we feel that the decision to bring in Nelson Peltz as a Strategic Advisor supports further upside for the stock.

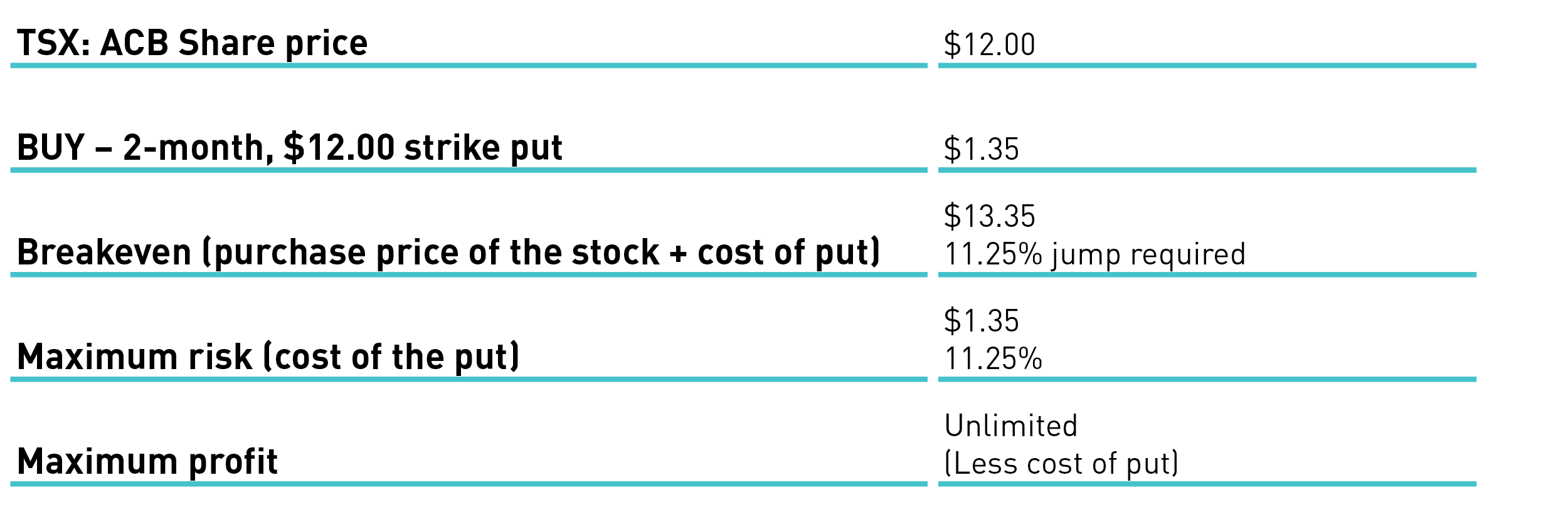

If we were to consider buying shares of the company, adding a Protective Put or Married Put would be a way to hedge our risk on a perpetually volatile stock. For a brush up on this Protective Put strategy, CLICK HERE.

This would allow us to participate in the upside, with a limited and identifiable risk exposure until the put option purchased expires or until we choose to close the position.

That said, buying a put option to hedge risk can be compared to buying car insurance, the more unpredictable the driver, the more expensive the insurance. In the options market, as risk and uncertainty increase, so does the price of the “insurance policy” or put option in this case.

Consider the following:

Table 2: The Protective Put Example (As of March 27th)

Since the share purchase price and the strike price of the put are the same, this leaves the cost of the put option as the maximum risk, which represents 11.25%. Overcoming the breakeven point would require an 11.25% jump in the share price.

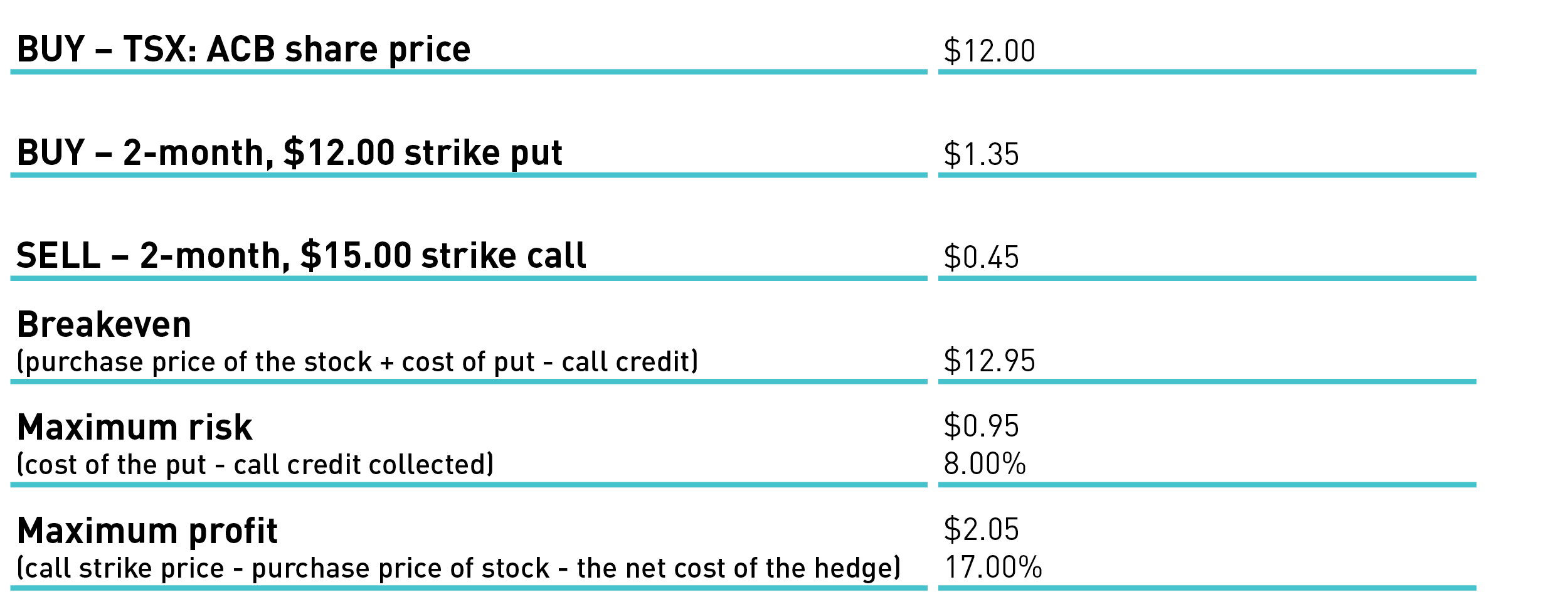

If hedging the risk on this opportunity seems cost prohibitive due to the expensive nature of the options market, the Collar Strategy is a great way to offset the cost. If you need a refresher on this hedging strategy, CLICK HERE to review.

The Protective Collar will allow for upside participation on the stock (albeit limited) while reducing the cost of the hedge.

The strategy:

- Offsets the volatility premium paid

- Lowers the breakeven point

- Lowers the maximum risk

Consider the following:

Table 3: The Protective Collar Example

The upside is limited to $15.00. This works out to be approximately 17.00%, an annualized return of 102.00%.

The maximum risk has been reduced to 8.00%.

By selling the call, we reduce the cost of the hedge. Our breakeven point is now lowered requiring less of a jump to break even and we have an attractive risk/reward opportunity.

So, what does cannabis, Nelson Peltz and hedging have in common? By understanding a couple of simple option strategies used for hedging and the impact of volatility on option pricing, you can take advantage of a positive headline associated with a volatile stock with a limited and identifiable risk exposure.

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

CEO and Director of Business Development

R.N. Croft Financial Group

Jason is CEO and Director of Business Development at R N Croft Financial Group, a member of the Croft Investment Review Committee and a Derivative Market Specialist by designation. In addition, he is an educational consultant for Learn-To-Trade.com and an instructor for the TMX Montreal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.