Perspective on the Volatility on Cannabis Stocks

Speculation is enthusiastically running wild in the Canadian cannabis industry over the last 2 years. This has led to extraordinary volatility and gains for investors who seek a stake in the industry. For this article I will refrain from offering my opinions to the merits of this investment and rather focus on sizing up the options markets for these cannabis companies.

Options often offer a powerful strategic tool for investors to:

- Use call and put options to buy-in stock at strategic prices

- Use the put options a protection to offset downside risk

- Use strategic option writing to generate cash flow income off the stocks the own or are committing to own in the future

- Using the options as a speculative tool to attain leverage to enhance profitability on their high convictions of future market direction

While I consider myself an evangelist on the use of options for investors, it behooves me to say that to use options, one must assess the risk/reward propositions of the current market conditions.

So, let’s size up the current conditions in the Cannabis stocks to understand where we are and what investors could consider. In this case, we will use Canopy Growth as sample of the current conditions in the options markets.

Study of the options market on Canopy Growth (TSX:WEED)

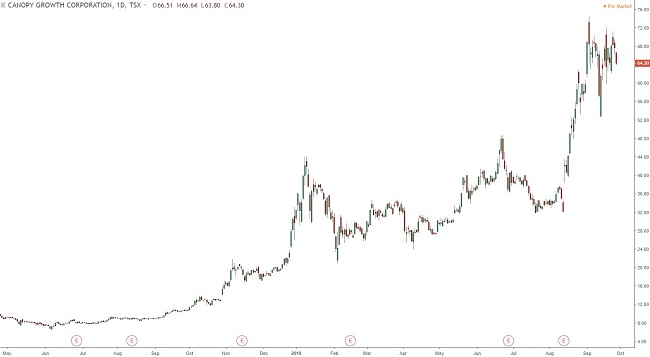

As the first chart illustrates, the price of the stock has exploded to the upside. The 460 day rise from its June 2017 lows near $7.00 has seen a rise of near 1000%. This has almost any speculator frothing.

source: tradingview.com

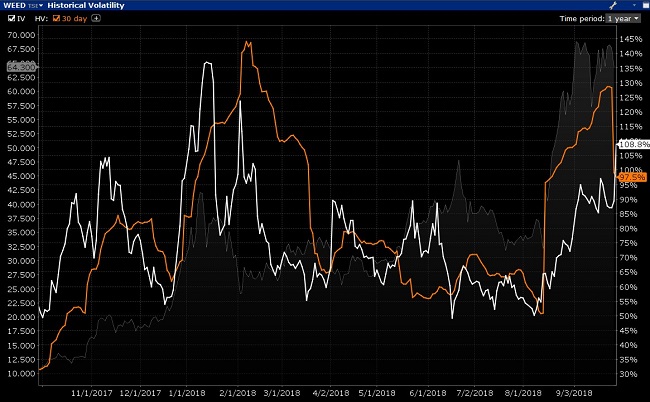

That being considered, the current options market is reflecting the material increase in the historical volatility of the very bullish August 2018 rise where the stock doubled in its price in just 15 trading sessions. As illustrated in the chart below, that rise drove the 30-day Historical Volatility to rocket higher from 50% to almost 130%. This, like a magnet, draws the Implied Volatility to rise to reflect the current market conditions.

source: InteractiveBrokers

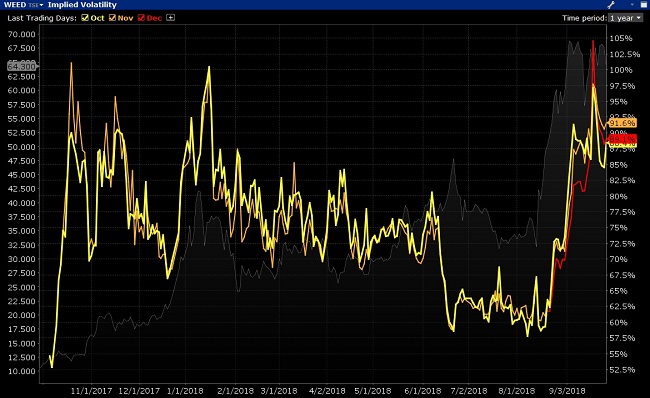

Looking at the implied volatility of the October, November and December options, one can immediately identify the impact of the August rise as the IV% rose from around 60% to now trading near 90%, an increase by 50%.

source: InteractiveBrokers

What does it mean?

It is now reflecting a much more expensive options market. Does that make it wrong or bad? No

In my mind it is simply reflecting the unfolding reality that these cannabis stocks are hot, they are moving very fast and options sellers need to be properly compensated for taking on the counter party risk.

So, where are the opportunities?

This depends on your outlook.

Bullish conviction

If you believe that there is further upside, and more importantly, that upside will be achieved with the same velocity as in August, then the options are right priced and can still be used as a strategic tool, even with outright call buying.

Neutral conviction

If you believe that the current rise has the securities trading at their fair value and there are only marginal gains to be had. Under this premise, there is material risk that there is a mean reversion in the volatility conditions that expose options traders to considerable Vega risk at IV could easily return to 60% (where it was during the summer). This on the other hand is very advantageous to the options seller. Here investors can handsomely profit from covered call writing on existing shares or selling puts or credit spreads for income.

Bearish conviction

This scenario has two assumptions. That you are right about the time frame from which these stocks would drop and second that the drop occurs violently pinning the implied volatility at very high levels. If the bearish investor is right about their two assumptions, the current expensive options are still fairly priced for the magnitude of price swing these stocks are capable of. This scenario could have the trader simply buying puts or trying to build further asymmetries from opening bearish put debit spreads.

Whether your bias is bullish or bearish, when using options, one must simply size up the current conditions to be able to fairly assess what options strategies are appropriate in these types of circumstances.

Thank you for reading.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.