Is Gold Breaking Out of its 4-Year Consolidation?

Over the last few years I have not been shy about my conviction that the gold bear market has ended. There is no denying that the December 2015 lows for gold bullion at $1050.00 are now history, but the enthusiasm for the shiny metal has been left for the diehards as most of the speculative money has turned its attention to cryptocurrencies and cannabis stocks. Will the glitter return to gold and usher in a new opportunity for investors to profit? One Wall Street legend certainly thinks so.

Jeffrey Gundlach from Doubleline Funds, who has been crowned the new “Bond King” has taken a firm stance on the metal. Speaking at John Mauldin’s Strategic Investment Conference back in March, he made a strong case for the yellow metal.

Here is what he had to say:

We’re also at the juncture in gold, not surprisingly, because it is negatively correlated with the dollar. We see that gold broke above its downtrend line, it’s got the same look. But now we see a massive base building in gold. Massive. It’s a four-year, five-year base in gold. If we break above this resistance line one can expect gold to go up by, like, a thousand dollars. Will it happen? Well it’s not happening right now but it’s a very interesting juncture. It’s a great time to be buying gold straddles. Because one way or the other this baby’s got to break in a big way.

Source: tradingview.com

It’s a great time to buy gold straddles?

While Jeffrey’s call on gold appears bullish, what he more accurately is suggesting is that gold is winding up for a very big move and that move could arguably be a break lower as easily as a break higher. I found it very interesting that he referenced an options straddle as a way to implement the trade. Those not familiar with strategy can find a great summary provided by the Montreal Exchange HERE.

For more sophisticated traders, turning to the options markets on gold futures is always an interesting consideration, but for most retail investors, they turn to the derivative of trading their view on gold through the gold mining companies that readily trade on the main stock exchanges. Does the same opportunity apply to gold miners?

I would argue that the opportunity is even more asymmetric. The gold bullion price rally in the first half of 2016 saw the price rise from $1050.00 lows toward $1375.00 for a 30% rise. During that same time, the iShares S&P/TSX Global Gold Index ETF (XGD) more than doubled in price rising from the low $7.00 range to almost reaching $18.00 a share.

The observation being that the miners have through history demonstrated to be more volatile and more responsive, which is ideal for a trader opening a option straddle position. Obviously, the implied volatility being priced into the option partly discounts this, but it does not change the fact that an extraordinary move in gold, to the magnitude Jeffrey Gundlach suggests, presents a compelling speculation for big returns.

Assuming an investor was motivated by Gundlach’s bold call on gold and wanted to put on a straddle, how would the trade potentially look using iShares S&P/TSX Global Gold Index ETF (XGD).

Breakdown:

- iShares S&P/TSX Global Gold Index ETF is trading at $12.00 (April 20, 2018)

- The March 2019 $12.00 call option is $1.20

- The March 2019 $12.00 put option is $1.15

- The net cost of the straddle (buying the call and the put) is $2.35

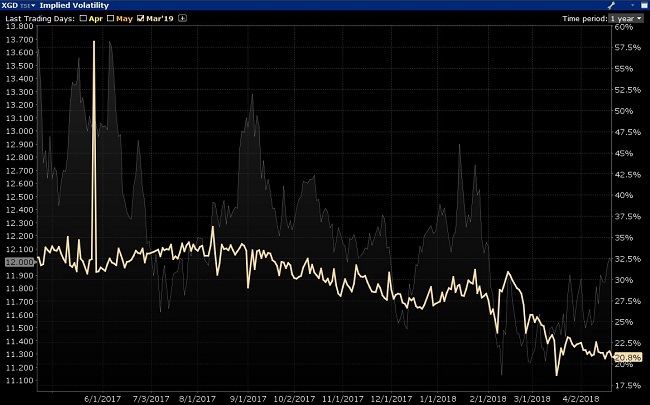

The first observation is that it appears to be a rather large percentage outlay at around 20% of the cost of the shares. But that needs to be put into context. As seen on the chart below, that the implied volatility on the XGD options remain on the bottom of the 1-year range, which at the most basic level suggests more favorable volatility risks as a spike in implied that normalizes back to the historical mean would improve the profitability of the straddle.

Source: Interactive Brokers

The other consideration is putting the context of a potential range of a breakout in the XGD. While the 2017 calendar year was defined by a relatively narrow range of $3.00 (between $11.41 low to $14.51 high), the 2016 year could arguably be a more accurate example of what the XGD is capable of if a breakout was to occur. In 2016 the XGD had a +$10.00 range (between $7.68 low to a $17.70 high). Will Jeffrey Gundlach’s bold call be proven right? It will certainly be one of the more interesting themes of the year to watch.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.