Flying with Condors

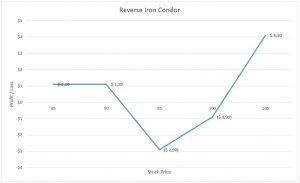

In a recent article we discussed how to get long volatility with the Long Option Straddle. In today’s piece we will discuss another less costly way to buy volatility with the Reverse Iron Condor. Condor strategies are named for the narrow-bodied and broad-winged bird that is primarily found in California. When diagramed, the Condor strategy resembles the outline of the bird.

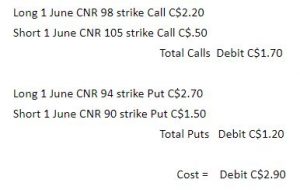

The Reverse (Short) Iron Condor, like the Long Straddle, is a strategy looking for a sharp move in either direction in the underlying security. The Reverse Iron Condor consists of being long one call and short another call with a higher strike, and long one put and short another put with a lower strike. Unlike the Long Straddle, where the options were purchased At-The-Money (ATM), both call and put strikes are Out-of-The Money (OTM). All of the options comprising the Reverse Iron Condor are of the same expiry and the distance between the call strikes is always equal to the distance between the put strikes. This strategy can also be viewed as a Bull Call Spread coupled with a Bear Put Spread.

The advantage of the Reverse Iron Condor over the Long Straddle is that the cost of the near strike long calls and long puts are reduced by the sale of the further out calls and puts. This naturally helps offset in part some time decay issues found in a long option only strategy, but it also lowers its potential profitability.

Let’s look at an example:

The Canadian investor is unsure whether CNR (Canadian National Railway Corp) will fall or rise in the next 3 months, but is forecasting that it is likely to make a dramatic move one way or the other.

CNR is currently trading at C$95.53 as of March 9, 2018

The cost of C$2.90 is also the total risk of the trade.

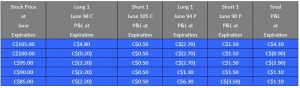

CNR trading at C$95.53

The maximum loss would occur if the underlying security treaded water between the long call strike and long put strike at expiration. In that case all the options would expire worthless.

The maximum profit is achieved when the underlying is less than the strike price of short put or greater then the short call.

The net profit would be the difference between either the call strikes or the put strikes less the premium paid to initiate the position.

There are two breakeven points:

- Bullish B/E = Strike Price of Long Call + Net Premium Paid

- Bearish B/E= Strike Price of Long Put – Net Premium Paid

As seen in both the table and graph, the potential profit and loss are both very limited.

Final Thoughts: Condors used to be considered Cadillac trades, so named for the commissions required to place a 4-legged trade. Discount brokerages have lowered the cost of these spreads in order to make them more practicable and affordable. Lastly, there are many versions of Condor strategies. They can be constructed with all calls, all puts and as both credit and debit strategies.

It is essential to point out that this strategy needs to be actively managed, so it is only suitable for investors with ample options trading experience.

CEO

Grigoletto Financial Consulting

Alan Grigoletto is CEO of Grigoletto Financial Consulting. He is a business development expert for elite individuals and financial groups. He has authored financial articles of interest for the Canadian exchanges, broker dealer and advisory communities as well as having written and published educational materials for audiences in U.S., Italy and Canada. In his prior role he served as Vice President of the Options Clearing Corporation and head of education for the Options Industry Council. Preceding OIC, Mr. Grigoletto served as the Senior Vice President of Business Development and Marketing for the Boston Options Exchange (BOX). Before his stint at BOX, Mr. Grigoletto was a founding partner at the investment advisory firm of Chicago Analytic Capital Management. He has more than 35 years of expertise in trading and investments as an options market maker, stock specialist, institutional trader, portfolio manager and educator. Mr. Grigoletto was formerly the portfolio manager for both the S&P 500 and MidCap 400 portfolios at Hull Transaction Services, a market-neutral arbitrage fund. He has considerable expertise in portfolio risk management as well as strong analytical skills in equity and equity-related (derivative) instruments. Mr. Grigoletto received his degree in Finance from the University of Miami and has served as Chairman of the STA Derivatives Committee. In addition, He is a steering committee member for the Futures Industry Association, a regular guest speaker at universities, the Securities Exchange Commission, CFTC, House Financial Services Committee and IRS.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.