Risks Stemming from Current Low Volatility Conditions

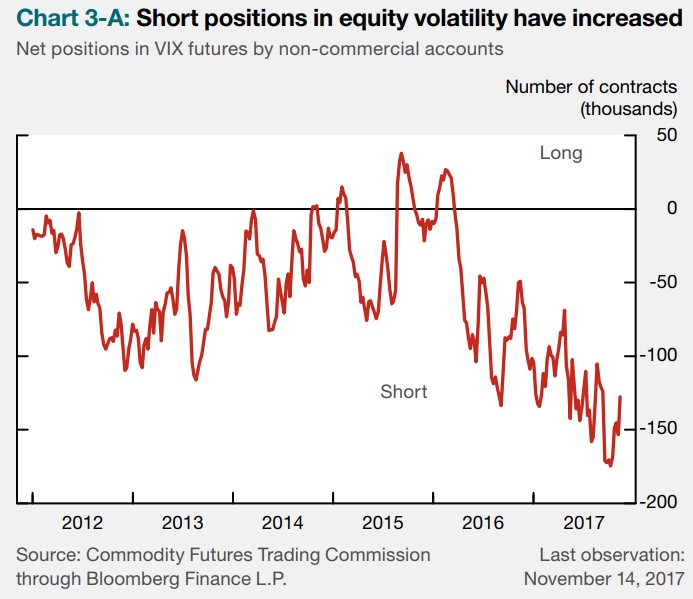

Over the last year we have seen an incredible period of low volatility that is arguably building systematic liquidity risks when we enter a period of normalization. These risks were highlighted in the Bank of Canada’s November 2017 Financial System Review. In that review, the BoC discussed the assessment of vulnerabilities and risks, highlighting the driving strategies in the low-volatility market environment. They propose that there is a chance that the pricing of risk may be in line with fundamentals, but there is equally a chance it is not. If it is not, it could be leading to investors taking excessive exposure to risky assets by using financial leverage. They go on to highlight the growing popularity of the short VIX trade “suggesting that investor expectations of a persistent low-volatility environment have become more entrenched.”

Source: Bank of Canada November 2017 FSR

This arguably is growing big enough to impact markets if a catalyst drove volatility back to its historical norms. Through volatility targeting strategies and direct short volatility products, it is suggested that there is as much as $2 trillion of exposure. In that report, the BoC particularly highlights the risk-parity strategy. Those not familiar with the vol targeting funds, they often, on a leveraged basis, seek to rebalance the portfolio asset allocation based upon targeting a specific level of risk. Today’s low volatility environment has essentially allowed this managed money to leverage up. Arguably the question many quantitative analysts have openly asked – will there be sufficient liquidity in the market when all of these funds are forced to sell to rebalance the risk? This remains one of the most prominent known threats to the well-established bull market.

At MacroVoices, we had the opportunity to bring Chris Cole from Artemis Capital on the show, discussing these imbalances. He further expands on his views that this short volatility exposure is not just the explicit short VIX trade, but rather much greater. While there is that further implicit short volatility trade of near $2 trillion dollars, this is further fueled by company share buybacks which arguably added a further $3.8 trillion dollars of price-insensitive buyers (since 2009) that have been systematically buying the dips a suppressing overall volatility.

So, what is the problem with that?

According to Chris, “part of that is the expectation that markets remain low volatility or low realized volatility. So, there is this implicit short Gamma exposure.”

This implicit short gamma, could arguably could force risk parity and volatility-controlled funds to deleverage in the tune of $500 billion dollars if the markets were to correct 5% lower, accompanied by a 50%+ increase in implied volatility.

Is this guaranteed to happen? No. Is it a risk? Absolutely.

How does this impact us in Canada?

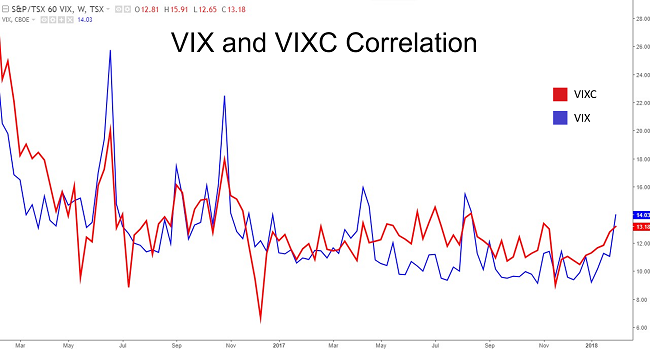

Canadian stock markets share a strong correlation to global markets and particularly to the U.S. markets. Systematic risk can spread like contagion leaving Canadian markets indirectly vulnerable. To demonstrate the correlation, observe the overlay of the American VIX and the Canadian VIXC.

What to do? I continue to advocate that investors that have profited from the very bullish market advance to consider buying portfolio insurance in the form of protective puts. While the market volatility is off the lows of November/December, the VIXC is still within the 2017 ranges.

To illustrate the ideal of buying protection, we can use the Canadian iShares TSX60 Index ETF (XIU). The ETF rallied 10% from its September 2017 lows at $22.00 to its late December 2017 highs near $24.50. With it currently trading at $23.82 (January 30, 2018), an investor would pay a very reasonable $0.17 per share or $17.00 per contract to hedge all downside risk of $2,300.00 of exposure below the $23.00 level out to the March 2018 expiration (IV 13.50%). Each investor approaches investing differently, but in my mind, I never blink twice to spend some of my profits to hedge risk and create less volatility in the accounts.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.