Perspective on Trading Options on Natural Resource Companies

After our interview with Rick Rule on MacroVoices, I was inspired to share my thoughts on options trading on natural resource companies. At the start of the interview Rick pointed out the unusually cyclical nature of resource investing. Rick went on to elaborate:

“…during periods of time when mature natural resource companies appear cheap (that is their enterprise value relative to their EBIT is low), they normally correspond with periods of very high commodity prices. Meaning that the price of the commodity is about to go down, so that the free cash flow is about to go down, so that the debt is about to go up.

When, by contrast, mature natural resource companies seem expensive on an EBIT to enterprise value basis, it’s normally when commodity prices are low. Meaning that cash flow is going to get higher and debt is going to get lower.

In truth, in the 40 years that I have been involved in the game, one looks first for commodities where you believe that ongoing demand for five or ten years is assured, because of the utility afforded by that commodity to society. That is where ongoing demand is assured. Where the price of the commodity – the price that the commodity sells for worldwide – is below the median cost of production.

In other words, you buy the best producers in industries that are literally in liquidation. What that means is that you have a circumstance where, either the price of the commodity goes up, or society does without the commodity. In terms of the broadly traded commodities, the truth is that our way of life depends on commodities. And I would suggest that that’s what sets apart the resource business from other businesses.”

I could not agree more with Rick, but this is where I feel I wanted to put context on options on mature resource companies.

At first glance, it appears options on resource companies are expensive, often with implied volatilities north of 30%. But as Rick inferred when identifying the unusual cyclicality of resource stocks, I ask – does the implied volatility (the variance of expected returns) accurately reflect the cyclicality.

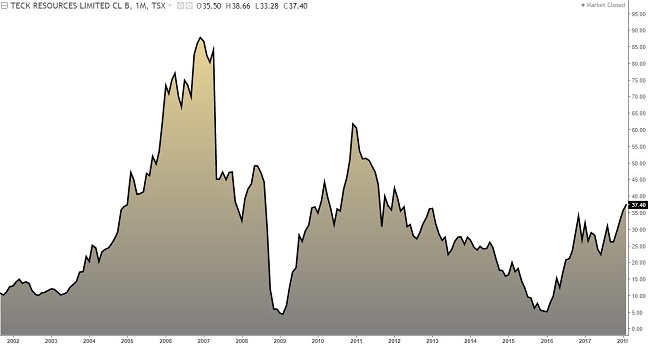

As an example, let’s take one of Canada’s largest resource companies, Teck Resources, which is currently pricing a 30%+ implied vol. Now let’s retrace the history of the companies cycles over the last two decades.

Source: TradingView.com

May 2003 – $10.10 low

December 2006 – $95.16 high

November 2008 – $3.35 low

January 2011 – $64.62 high

January 2016 – $3.65 low

Present (February 2018) – $37.40

I ask – does the implied volatility accurately reflect the extreme cycles that resource companies go through? History shows that Teck Resources makes extraordinary moves that any given year could see the company bearishly lose half its value or bullishly double in price.

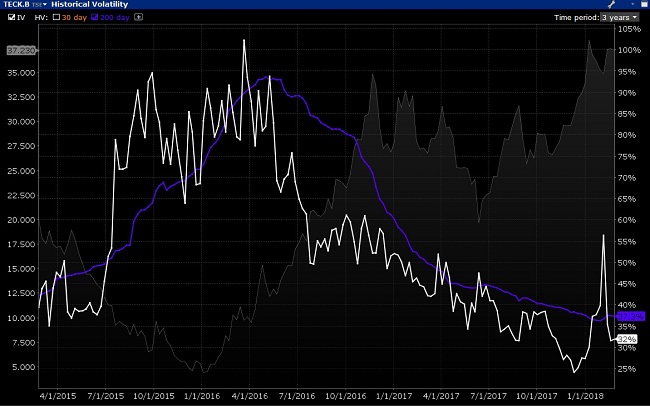

Observe the 200 day realized volatility (in blue) vs the implied volatility (white) on TECK.B. (February 26, 2018)

Source: Interactive Brokers

It is my opinion that not only are the long dated options on many resource companies “right priced”, but if you were to see the emergence of one of the big cycles these resource companies go through, options offer a compelling opportunity to build asymmetric risk reward propositions.

To demonstrate the asymmetry, one does not need to make this complex. To demonstrate let’s compare a trader buying 100 shares of TECK.B vs. buying the January 2019 $37.60 call option for $4.50.

Let’s assume 3 scenarios for Teck Resources over the next 6 months (August 31st).

Scenario 1: Similar to the Sep2017-Jan2018 rally, Teck Resources bullishly rallies $15.00 higher to $52.00. Under that scenario, the share investor is up $15.00 or 40%+. The call option, net of its intrinsic value will have a value north of $15.00, making the call buyer profitable by $10.00+ and up several hundred percent on the risk outlay. While one can look at the call option as a trade in itself, I remind you that if the call buyer remains very bullish, they could exercise the call option and take the stock ownership at the strike $37.60 price.

Scenario 2: Teck Resources ends up chopping sideways and remains unchanged in its price at $37.60. The investor with the shares is flat. The call buyer alternatively experiences time decay eroding the option to about $2.00 (assumption based on simulation) which is a $2.50 loss.

Scenario 3: Teck Resources ends up declining back to $25.00 (The level it traded back in the summer of 2017). Under that scenario, the share investor is down $12.00 and needs a material rally to get back to break even. Alternatively, the call option erodes to a $0.50 value experiencing a loss of $4.00, almost the entire value of the call. But there is one key difference, the share owner is stuck in a losing position often resorting to dollar cost averaging to reduce their cost base. Alternatively, while the call buyer did lose, they are free to walk away from the option and can buy a new call option at the $25.00 price to reset the trade.

Conclusion:

While the cost and decay of the time value is often a deterrent, I would argue the call buyer had more risk control and flexibility than the share investor, which in the very volatile resource sector is arguably an important strategic advantage.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.