Options Brief- Week of July 31st

The rallying markets have led to a large pool of investors accumulating unrealized gains on their portfolio. One may believe that now is a good time to cash in a profit, but investors may wish to hold on to their stocks just a little longer if they are receiving a healthy dividend payment from these holdings or wish to avoid declaring capital gains. However, if investors believe that a correction in the market is just around the corner, they may be seeking short-term downside protection.

Let’s assume an investor holds a portfolio worth 100 000$ that is composed of 10 equally weighted Canadian blue-chip stocks. He wants to protect his portfolio for the next 2 months as he fears that a correction in the broad market will happen in the upcoming months. The investor is faced with two choices: He can purchase put options on each individual stock or he can use SXO options, cash-settled options on the S&P/TSX 60. Let’s look at the latter.

How to calculate the number of contracts to buy

To get a perfect hedge, investors using single stock options would buy 1 put for every 100 shares they own. For SXO options, the investor will use a formula that accounts for the beta of the portfolio to determine the appropriate number of contracts to purchase.

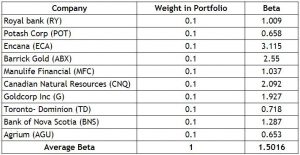

The first step is to calculate the beta of the portfolio to be hedged. The beta of a portfolio measures its volatility in relation to the overall market, in this case, the S&P/TSX 60. The market is considered to have a beta of 1. Therefore, a portfolio with a beta above 1 is considered more volatile than the market. Conversely, a portfolio with a beta below 1 is considered less volatile than the market. The beta of the investor’s portfolio in our example is 1.5016 (see table below).

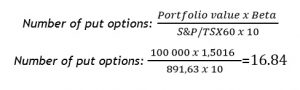

The investor will then be able to use the formula below to determine the optimal number of put options to fully hedge his portfolio. Note that the multiplier of SXO options is $10 per index point, as opposed to 100 shares, which is typically used for equity options.

Using the formula, the investor would need to buy 16.84 put options to be perfectly hedge (Index price was 891.63. on July 31),but because we cannot buy a partial number of contracts, we elect to purchase 17 SXO September 2017 885.00, which is trading at 13.80$. To calculate the total cost of the position, the premium is multiplied by $10 and the number of contracts. The investor would therefore pay $138 per contract, or $2,346 total.

Results of the hedge

Without the hedge, a 10% drop in the index would result in a 15.016% drop in the portfolio ($15, 016.00). Hence, the portfolio value would be $84 984.

With the hedge in place, the investor will suffer the same loss on his portfolio ($15,016.00), but will be gaining $14,290.71 on the put position. Hence, the actual loss will be limited to $725.29.

Why use Index options vs Single stock options

Using single stock options would results in 10 individual transactions because the investor holds 10 different stocks, which means 10 commission fees. Using SXO options requires only one transaction, making it more cost and time efficient.

Also, single stock options control 100 shares. If an investor holds an uneven lot, they are unable to purchase ‘partial’ options contracts. They will therefore be under hedged or over hedge if they elect to buy an extra contract.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.