Hedging Canadian Bank Risk with Debit Spreads

The recent hawkish shift and rate hike by the Bank of Canada has ushered in a resounding 10% rise in the Canadian dollar in a few short months. This has not only put stress broadly on Canadian equities, but it has instilled concerns about the tightening of credit conditions on an already over indebted Canadian consumer. This particularly brings to light the growing concerns on the economic impact if the tigher monetary conditions were to start cooling off the red hot real estate markets.

A slow down in real estate and consumer spending may weigh heavily on the Canadian banking system which has been relatively strong over the last 18 months. For the average investor, the focus on longer-term investing while holding a relatively stable dividend stream, diminishes the desire to make short-term trading decisions and to focus on the bigger picture.

This is where hedging your bank stock position with an option overlay is an interesting proposition. In this case, let’s look at TD Bank as a candidate for hedging the downside risks.

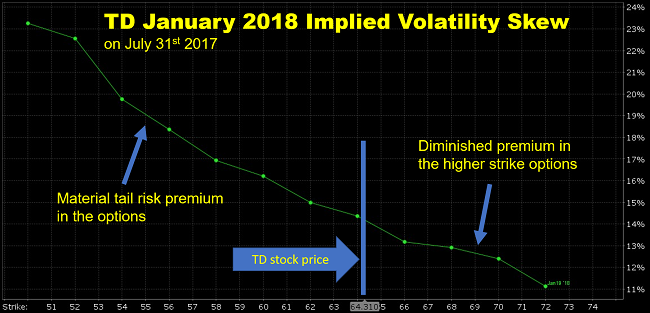

While on the surface it appears to be a simple exercise of buying a protective put, but there is some idiosyncrasy to the existing option chains that needs to be considered. The most obvious is the significant skew in the implied volatility. I would speculate that one of the precipitating factors in creating the lopsided skew (particularly the low implied in the $64-$72 range) is likely attributable to the increased popularity in premium selling strategies like covered calls.

With above average dividends being discounted into the pricing, there is a diminished attractiveness to implementing strategies like collars and outright protective put buying. So how does one consider a more prudent approach to hedging downside risk?

One strategy that naturally complements the lopsided skew are put debit spreads. This is structurally because you are buying the lower IV (implied volatility) and selling the lower strike with a higher IV. This often allows the spreads to be open with favorable risk/reward propositions. Let’s look at the current pricing of a downside hedge on TD Bank using a debit spread:

Here is the breakdown:

- TD Bank (TSX:TD) is trading at $64.30 (July 31st, 2017)

- TD Bank has a 52wk range of $55.78 – $71.31

- The January $62.00 put option is trading is bid $1.80 – ask $2.00

- The January $56.00 put option is trading is bid $0.55 – ask $0.80

- The spread is bid/ask $1.00-$1.45 (reasonable to be filled at or under $1.40)

- TD is scheduled to pay $0.60 quarterly dividends in October and January

An investor that overlays the put debit spread over a long stock position has hedged the downside risk of TD Bank below $62.00 down to its 52-week lows near $56.00. Assuming a fill price on the spread around $1.40, the investor will have a near neutral cash flow carry net of the dividend stream. For those investors that are looking to hold their bank stocks long-term but wish to hedge out intermediate risks can consider this approach.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.