Option Selling – It’s a Good Business to Be In

When observing option pricing, we should always remember that premiums, while certainly linked to reality, are somewhat of an imperfect predictive tool. Option prices attempt to forecast movement in equities or indices for a given period into the future, but they are unlikely to be entirely correct in the end.

For example, S&P TSX60 Index options may be forecasting 1% of daily movement in markets, but we won’t know the accuracy of that prediction until the period is over. A real-world example of this would be how an insurance company will assess damage risk when pricing home insurance. They may assume, across a sample of 500 policies, that there will be $500,000 in payable claims. If they can price the rates on those policies at an assumed $800,000 in claims, they will likely come out on top (receive $800,000 and pay out $500,000). These are very educated guesses and over time they’ve become quite good at it.

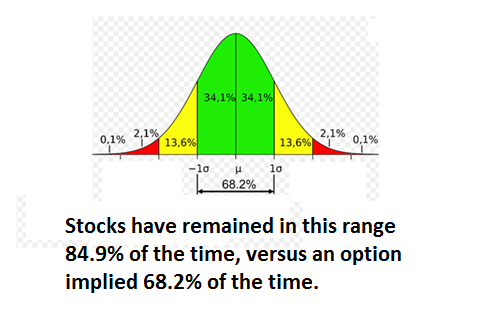

Sellers of S&P TSX60 Index option premiums have also become quite good at this game. When we look at a standard distribution of index outcomes, we see that a standard deviation of 1 suggests that 68.2% of the time, the index will trade within a certain range (e.g. up or down 1% per day, as per what option implied volatility would suggest). Therefore, this also means that options are saying that 31.8% of the time, the index should trade outside of this range.

A study by Société Générale (SocGen), accounting for a sample of market movement dating back to 1990, has suggested that equities have in fact remained within their suggested range a much higher percentage of the time. In fact, they’ve remained more range-bound 84.9% of the time, instead of an option implied 68.2%. In other words, they’ve traded outside this range much less of the time than equity index options have suggested they would.

This suggests that options have been overpriced by a great amount for the past 28 years. While options have suggested the index may move outside a standard deviation range 31.8% of the time, the fact is that this has occurred only 15.1% of the time. The “insurance company” is pricing policies that expect about double the number of claims than have in fact been made. Selling insurance for double the fair value based on 28 years of risk outcomes? It’s a good business to be in.

Normal Distribution of Market Movement

Source: SocGen/Horizons ETFs, August 2018.

Vice President, Portfolio Manager, and Options Strategist

Horizons ETFs Management (Canada) Inc

Hans Albrecht is vice president, portfolio manager, and options strategist at Horizons ETFs Management (Canada) Inc. He co-manages one of the largest option books in Canada, $800 million in covered call ETFs and oversees day-to-day options activities. Mr. Albrecht also was an options floor market maker and traded a large volatility book for National Bank Financial for many years. He has lectured at McGill and has appeared on numerous expert derivative panels. He has been quoted in Bloomberg, Investment Advisor, Globe and Mail, and is a regular on BNN. ETF Lipper Award winner.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.