Currency Options University — Part 6

Currency Hedging for Exporters

In the previous post we examined the role that USX currency options can play in hedging a company’s import costs. In this instalment of Currency Options University, we will explore using Montréal Exchange USX currency options to mitigate the risk that Canadian exporters face when selling goods in the U.S. marketplace.

Canada is known for our friendly people, unparalleled natural beauty and stunning landscapes. We export a wide variety of goods, but nothing says Canada more than our delicious maple syrup.

A barrel of maple syrup is more valuable than a barrel of crude oil, so it is important that we maintain this national industry. The Montréal Exchange USX currency option market is here to help.

Let us walk through an example of how a maple syrup exporter can use the USX currency market to hedge its U.S. dollar exposure. For this example, we will use a fictitious company – the Great Sticky Canadian Maple Syrup Company.

Following a prominent appearance in a recent pop music video, the Great Sticky Canadian Maple Syrup Company has become the hottest thing to hit the U.S. scene since puffy Canadian winter jackets. A big-box U.S. company has requested $2,000,000 of syrup in a special rush order, to be in stores by Christmas. However, the retailer’s payment will only be received two months later.

Our exporter wants this sale, but worries that the price of the U.S. dollar might decline between now and mid-February. Is there a way to hedge this risk?

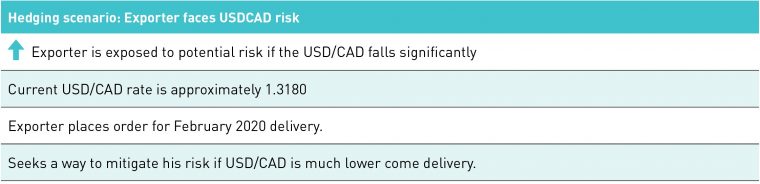

FIGURE 1

Hedging Scenario, December 13, 2019

Source: Big Picture Trading

Fortunately for the exporter, Montréal Exchange USX currency options offer a convenient way to hedge its risk.

FIGURE 2

USX Options Quotes, December 13, 2019

Source: TMX

The company can purchase the 132.00 put for 1.10 and lock in a minimum guaranteed price for the value of its exports, while also maintaining the ability to participate if the USD/CAD rate rises.

FIGURE 3

Mechanics of Hedging: Guarding against a fall in USD/CAD

Source: Big Picture Trading

Two months later, when the big-box store pays our syrup producer, the proceeds from the sale will be hedged independent of the current USD/CAD rate in the market.

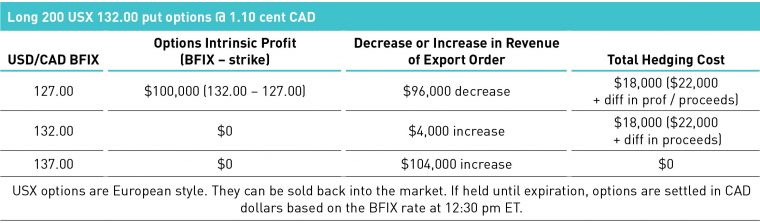

FIGURE 4

Potential Outcomes on Expiry

Source: Big Picture Trading Inc.

The original currency rate was 1.3180. At any level below 1.32, the exporter will achieve a net rate of 1.3090 (1.3200 minus the 0.0110 paid for the option). The exporter has locked in a minimum amount of proceeds from the sale, regardless of the final USD/CAD rate. And what if the exporter is fortunate enough to have the USD/CAD rise to 1.37? After the initial cost of the hedge is covered, any additional proceeds represent extra profit for the exporter.

USX currency options for corporate hedging

USX currency options are a terrific tool that corporations can use to hedge their currency exposures. The benefits of the Montréal Exchange USX currency option product include:

- Centralized clearing house that eliminates individual corporate counterparty risk

- A listed product that offers daily, transparent pricing

- Market participants compete for orders, so corporations can shop around

- Participants are not beholden to one counterparty if they would like to unwind a trade early

- Small contract size allows hedges to be tailored to needs

USX currency options are not just for speculators or finance types; they play an important role in hedging the trade across the world’s largest open border between the United States and Canada.

Currency options are one of many different ways to participate in the currency markets. If it is important for you to take a leveraged position with high conviction while defining your risk to a very specific worst-case loss, then you should consider implementing the trade using USX options.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.