Currency Options University — Part 7

Currency Hedging for US Dollar Investors

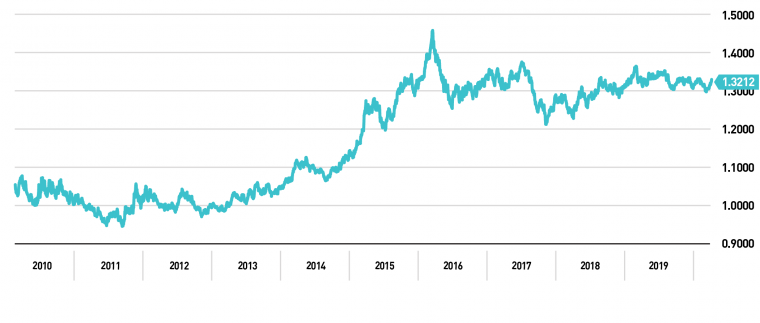

For the past decade, Canadian investors of US dollar-based assets have had it good. No, they have had it great. Not only have American financial assets been the best performing assets in the major markets, but over that same period the value of the Canadian dollar has fallen dramatically.

FIGURE 1

US Dollar / Canadian Dollar

Source: Bloomberg

At the beginning of the last decade, the US dollar was worth only 1.04 Canadian dollars. During the next ten years, the value of the loonie fell to 1.32 Canadian dollars per US dollar.

For Canadian consumers, this was a decline in our real wealth. However, it came with a silver lining for investors who had purchased US financial assets. It provided a massive tailwind that caused the already appreciating US assets to rise all the more in Canadian dollar terms.

As we kick off the next decade, the prices of US stocks are trading at all-time US dollar highs, but when converted into Canadian dollars, the returns seem almost too good to be true. An investor should examine whether this trend can continue indefinitely.

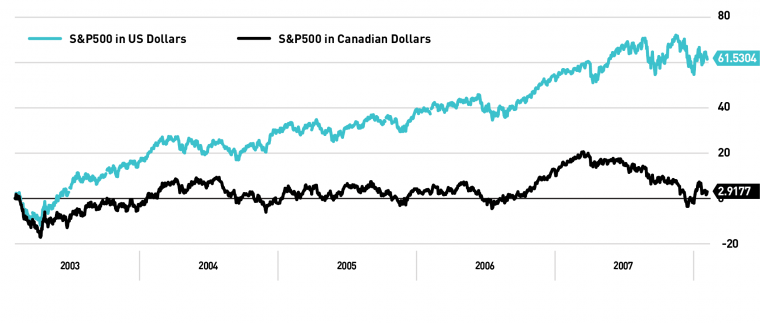

Let’s look at what the previous bull market of the 2000’s looked like in US-dollar and Canadian-dollar terms.

Here follows a chart showing the percentage appreciation of the S&P 500 in USD dollars (the blue line), along with the corresponding S&P 500 in Canadian dollar terms (the black line), from 2003 to 2007.

FIGURE 2

Performance of the S&P 500 in US Dollars vs. the S&P 500 in Canadian Dollars

Source: Bloomberg

The S&P 500 managed a respectful 61.5% return over that period, but for a Canadian dollar-based investor, that worked out to only 2.9% in our local currency. That represents a difference of almost 60%!

Can this happen again? It certainly can. You can almost be sure that, at some point in the future, the trend towards a weaker Canadian dollar will reverse, and US financial assets will once again struggle in Canadian-dollar terms.

So what is an investor to do?

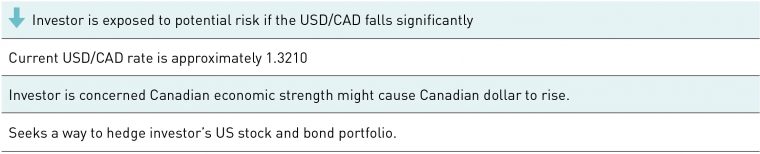

FIGURE 3

Hedging Scenarios: Investor faces USD/CAD risk

Source: Big Picture Trading

The Montreal Exchange’s USX US Dollar options offer an attractive way for an investor to hedge this risk.

Let’s imagine an investor with a portfolio of US stocks and bonds totalling $500,000.00 USD. Today, the USD/CAD rate is 1.3210, so the portfolio is worth $660,500.00 CAD.

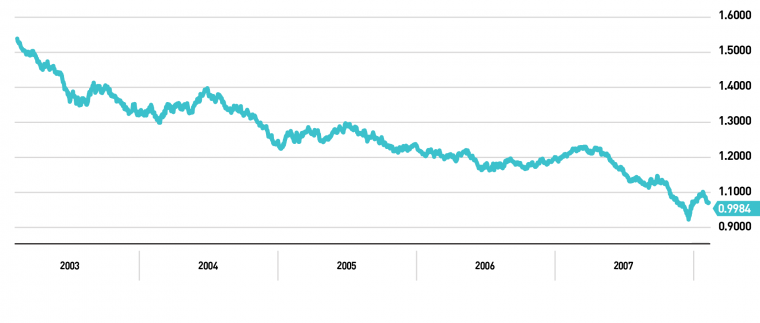

However, during the last Canadian dollar bull market the USD/CAD rate fell from 1.5800 to 0.9985!

FIGURE 4

US Dollar / Canadian Dollar 2003-2007

Source: Bloomberg

A decline of that amount would wipe out almost $250,000.00 from our investor’s portfolio! Obviously that was an extreme move, but an investor needs to be aware that such large repricings do occur.

This is why investors should consider buying protective puts on the Montréal Exchange as a way to hedge a US dollarbased portfolio.

FIGURE 5

Mechanics of hedging: Guarding against a fall in USDCAD

Source: Big Picture Trading

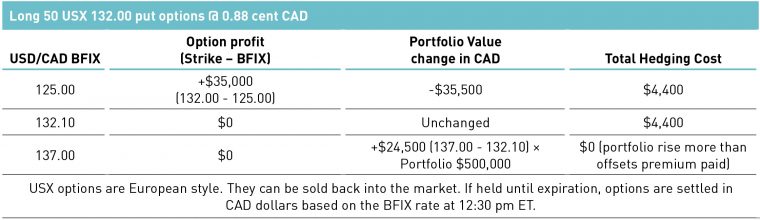

For an amount of $4,400, investors can protect a $500,000.00 USD portfolio by purchasing 50 puts March 2020 at $0.88 per contract. What is the best part of this strategy? Well, if for some reason the Canadian dollar continues to weaken, despite the premium paid to buy the option, the investor will still benefit from the higher USD/CAD rate.

FIGURE 6

Potential Outcomes on Expiry

Source: Big Picture Trading

Given that US assets have experienced large increases in value over the past decade and the Canadian dollar has declined over the same period, many investors are sitting on the largest portion of US dollar-based assets in history. Never before has it made so much sense to hedge, and the Montréal Exchange’s USX US Dollar options represent the perfect vehicle for Canadian investors to do just that.

Conclusion of this 7-Part Series

The Montréal Exchange’s Options on the US Dollar (USX) offer investors an attractive method for both speculating on the level of the US/Canada foreign exchange rate and hedging against changes. The friendly contract size of US$10,000 allows retail investors to initiate positions that are a good fit to their portfolio size, and it gives institutional investors the ability to more closely match their desired exposures.

Speculators can use a wide variety of strategies to express their views on the direction of the USD/CAD exchange rate, while USX option spreads can be used to take advantage of an investor’s views on volatility and future currency paths, in a much cleaner way than simple spot FX trading. As for hedging, USX options offer cost-efficient opportunities for both exporters and importers to offset their risk.

Montréal Exchange USX options are a terrific Canadian product that allow investors and hedgers of all stripes to trade the USD/CAD rate. If you haven’t checked them out yet, now is a good time!

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.