Currency Options University – Part 5

Currency Hedging for Importers

Although USX currency options are often used by speculators interested in expressing a directional view on the USD/CAD exchange rate, they also offer an interesting opportunity for corporations that conduct business in both currencies and are interested in mitigating the exchange rate risk associated with fluctuations in the USD/CAD exchange rate.

Canada’s Largest Trading Partner

There are few countries that trade as much with a single partner as Canada does with the United States.

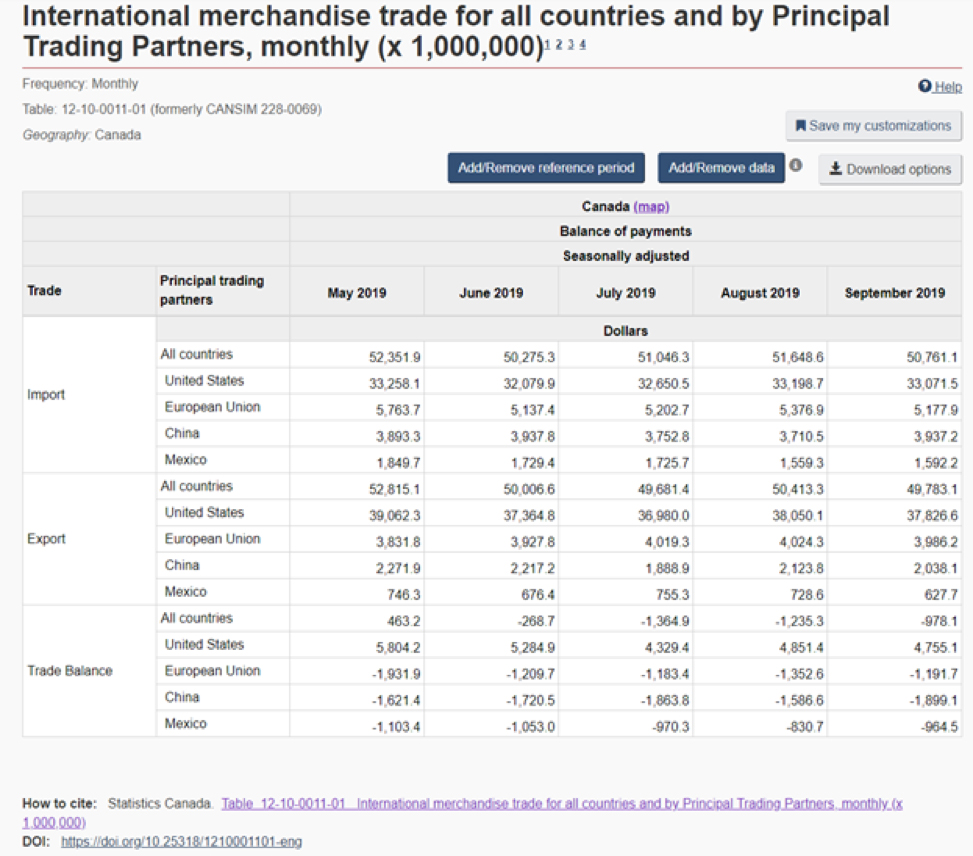

TABLE 1

Principle Trading Partners

Source: Statistics Canada

According to Stats Canada, for the quarter ending September 2019, imports from the United States accounted for over 64% of Canada’s total imports, while our exports to our southern neighbour represented more than 75% of total exports. The Canadian economy is obviously tightly integrated with America’s. Although this integration provides opportunities for both countries to benefit from trade, it exposes businesses to exchange rate risk. Concern over this risk might cause businesses to shy away from transactions with the neighbouring country, or even worse, expose companies to an unexpected loss due to a sharp move in the USD/CAD exchange rate. Either way, the massive amount of trade between the United States and Canada represents an added risk that must be managed.

Fortunately for these businesses, they have USX currency options to help mitigate this risk. These options are listed on the Montreal Exchange, where different market makers compete to offer the best prices, and use a central clearing agent to ensure the strongest counterparty exposure. In short, USX currency options are a unique Canadian-listed tool for companies looking to offset exchange rate risk.

Canadian Importer Example

Let’s take a hypothetical example of a company that imports NASCAR official die-cast replica cars. Seven-time NASCAR champion Jimmie Johnson recently announced that he will be retiring after the 2020 season[1].

Anticipating lots of demand for the No. 48 Hendrick Motorsports Chevy driven by Johnson, the Canadian importer gambles that this will be a hot-selling product. However, it won’t ship until next March, shortly after the start of the NASCAR 2020 season.

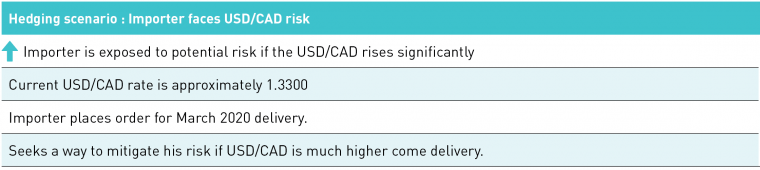

The USD/CAD rate today is approximately 1.3300 and at this exchange rate the importer believes the cars will sell briskly. But he worries that if the Canadian dollar weakens significantly, he would be forced to raise the price of the product. Given that this is an exceptionally big order for the importer, he wants to somehow limit his potential losses from exchange rate fluctuations.

TABLE 2

Hedging Scenario

Source: BigPictureTrading

What should the importer do?

Depending on how much of a move he wants to protect against, he can purchase a March 2020 call option to hedge against an adverse upward move in the USD/CAD rate.

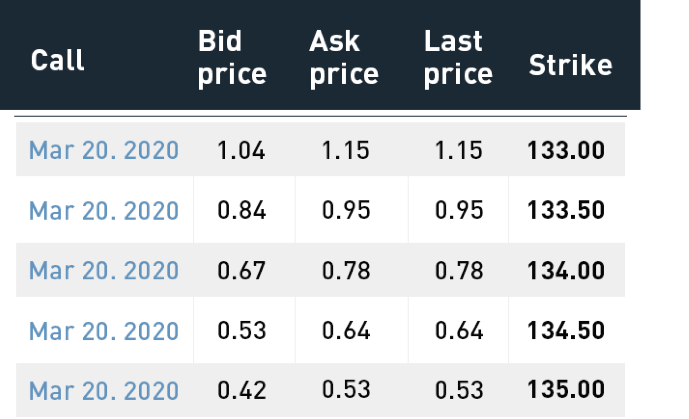

Here are the bid/offer prices on options at strikes of 133.00 to 135.00.

TABLE 3

Options Quote

Source: Montréal Exchange

The 133.00 call represents the call option purchaser’s right (but not obligation) to gain exposure to the USD/CAD rate at 1.3300.

Let’s say he was buying $50,000.00 USD of cars. He would therefore buy 5 call option contracts (5 * $10,000 USD per contract) at $1.15 ($115.00 each contract). Therefore, the total outlay would be $575.

If you need a review of the contract specifications, please refer back to Currency Options University – Part 3 – https://www.optionmatters.ca/currency-options-university-2/

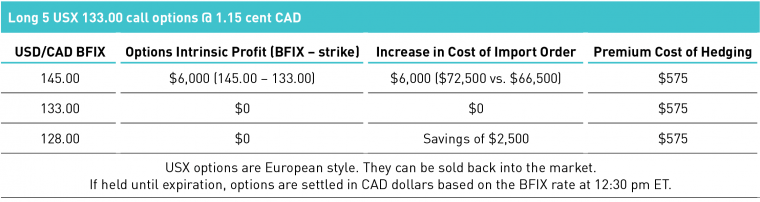

TABLE 4

Mechanics of hedging: Guarding against a rise in USD/CAD

Source: Big Picture Trading Inc.

If the USD/CAD rate were to jump to $1.45 between now and the time he had to pay for his NASCAR replicas, the cost would increase from $66,500 CAD (50,000 USD * 1.33) to $72,500 (50,000 USD * 1.45). This would represent a loss of $6,000 CAD. However, the option he purchased for $575 would expire worth $6,000, completely offsetting the loss.

TABLE 5

Potential Outcomes on Expiry

Source: Big Picture Trading Inc.

For a cost of $575 (the cost of the initial purchase), the importer guarantees that he won’t pay an exchange rate higher than 1.3300 to buy the cars. And what happens if the USD/CAD declines to 1.2800 instead? The importer’s call options expire worthless, but the total purchase price is only $64,000 and he is still ahead as the $2,500 saved more than pays for the cost of the option.

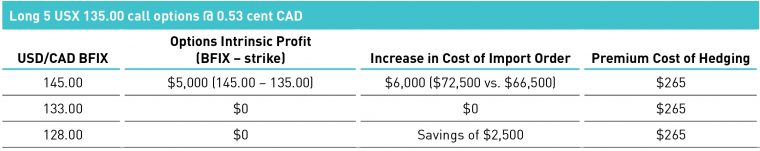

What if the importer is not worried about smaller moves and only wants to hedge against a truly catastrophic move in the currency? In that case, he can buy the March 2020 135.00 call option instead. The cost per contract is only $53 so the total cost of hedging the portfolio is $265, but the move in the currency is only hedged starting at 1.3500.

TABLE 6

Mechanics of hedging: Guarding against a rise in USD/CAD – a different strike

Source: Big Picture Trading Inc.

Choosing a strike price is dependent on the importer’s risk tolerance, but USX currency options offer a myriad of different strikes and expiries for importers to lock in the cost of their product well in advance.

TABLE 7

Potential Outcomes on Expiry

Source: Big Picture Trading Inc.

USX currency options for corporate hedging

USX currency options offers a terrific method for corporations to hedge their currency exposure. The Montreal Exchange

USX currency option product offers the following benefits:

- Centralized clearing house that eliminates individual corporate counterparty risk

- Listed product that offers transparent daily pricing

- Market participants compete for orders, which means corporations can shop around

- Option owners are not beholden to one counterparty if they would like to unwind the trade early

- Small contract size to tailor exact hedges

USX currency options are not just for speculators or finance types. They play an important role in hedging trade across the world’s longest open border: the one between the United States and Canada.

Currency options are one of many different tools used to participate in the currency markets. If it is important to take a leveraged position with high conviction while defining your risk in terms of a very specific worst-case loss, then you should consider implementing the trade with USX options.

[1] https://www.frontstretch.com/2019/11/23/a-rare-gut-feeling-tells-jimmie-johnson-its-time-to-retire/

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.