Buying Options: Single-Leg vs. Vertical Spreads

When buying options, you have several choices. How do you know which strategies to trade? A good starting point is to know the difference between buying single options and vertical spreads.

Takeaways

- Learn the benefits of buying single options and vertical spreads

- Understand which scenarios might offer more advantages for buying single options versus vertical spreads

- Know the different ways to place spread trades

Trading stock options may offer various advantages compared to trading shares of a stock, beginning with leverage. But equally important is the ability to tailor options contracts using specific strategies based on probable price movement.

The most common way to participate in a potential rally is to buy shares of a stock (assuming you think prices are headed higher). But there are two problems are associated with this approach:

- Cost per share. Buying stock shares could be expensive.

- Downside risk. In the event of a market correction, losses can mount quickly. Even something as basic as a stop loss is fraught with pitfalls.

When you purchase shares, your profits (or losses) are linear. Say you purchase 100 shares of stock XYZ for $265 per share, or $26,500. A five-point gain will generate a $500 profit; a five-point drop represents a loss of $500. Any potential market-moving event that causes volatile swings could add to the losses. An option strategy may be worth considering to protect your shares or portfolio in such a scenario.

Buying Single Options

Instead of purchasing 100 shares, say you purchase one 265 call option for $8.41/share or $841 (the option premium is multiplied by 100 since one call contract represents 100 shares). In this way, you are paying less for similar exposure. In other words, you are gaining leverage when you trade options.

But buying that call comes with some features you need to know.

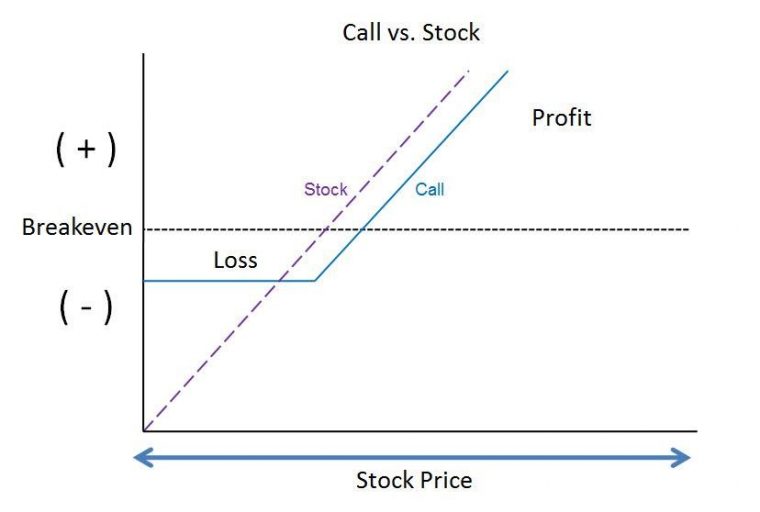

- Your profits and losses are not linear. Figure 1 shows the profit and loss (P/L) diagram of a long call versus a long stock.

Figure 1: Risk Curve of a Long Call vs. Stock. The P/L of the long stock is linear, whereas the maximum loss on the long call is defined.

- When you purchase a call contract, your risks are defined. The maximum you can lose when you buy that call contract is limited to the premium paid: in this case, $841.

- When you buy shares or a call contract, you are looking to capitalize on the rising price of the underlying. If the price of the underlying falls, both strategies would lose. But when you buy a call, the maximum loss is defined at the outset by the price paid for the options contract.

Options trading involves an element of speculation as to the direction in which the underlying security might move. If you correctly forecast a directional market move and take the appropriate position, you could profit. But when markets do not move in the expected direction, owning the correct position (a call or a put) will not necessarily be profitable. Changes in the market can threaten the potential profit of a single option position. This brings us to spread trading.

Consider Buying Vertical Spreads

Spread trading involves buying and selling options on the same stock. There are several spread strategies, but we will focus on vertical spreads. Implementing a spread strategy has advantages over trading a directional call or put.

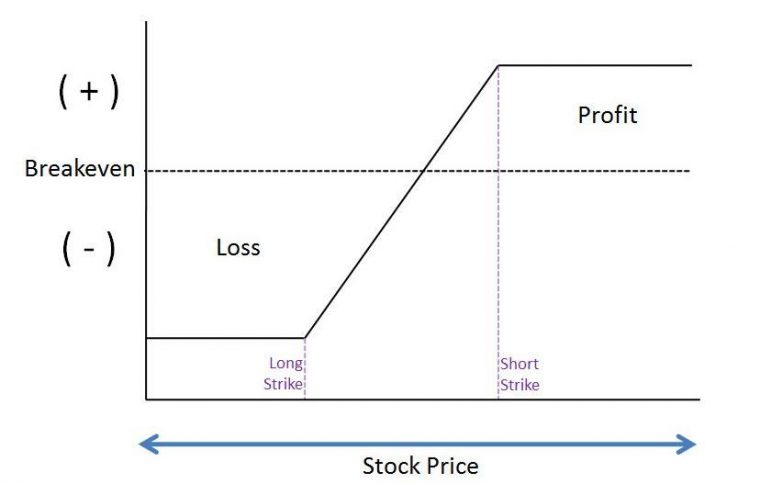

Let us look at an example of a bull call vertical spread (See Figure 2 for the risk curve).

Figure 2: Risk Curve of a Bull Call Vertical Spread. Your potential profit is limited, as is your maximum loss.

Say that you create a bull call vertical spread made up of the following two legs:

- Buy the 265 call for $841

- Sell the 270 call for $624

Both options expire on the same day.

By selling the 270 call option you have limited your upside profit as well as your maximum risk. Both are now predefined, since this is initiated at a debit ($217 max loss, not including transaction costs). In a way, this trade could help you sleep at night, which may not be the case if you simply buy shares.

Recall the following scenarios:

| Buy 100 shares | ($26,500) |

| 1 265 call strike | ($841) |

| 1 bull call spread | ($217) |

The downside here is that your profit potential is limited by adding a sell leg with a strike price of 270. The original options trade (buy one 265 call strike) offered unlimited upside potential. By selling the 270 call strike, you receive a credit of $624 ($6.24 * 100), which reduces your capital outlay but also defines your maximum profit potential. You forego participating in any price movement if XYZ rises above $270/share.

Keep in mind other variables, like the option’s Greeks—delta, theta, vega, and gamma—, that can impact option prices. Be sure to brush up on them before you place your trades.

Bottom Line

It is important for options traders to assess the different strategies available to them before placing a trade. Do you think a stock will go up or down relatively quickly, or do you think it will meander within a range for a while? Before trading with real capital, it is best to go over various “what-if” scenarios and analyze each one’s risk/reward scenario.

PLACING A BULL CALL SPREAD TRADE

Legging into a trade. You can set up a bull call spread trade as a single transaction, or put in an order to buy the long call, wait for a fill, and then enter an order to sell the short call. The idea is to try to obtain a better fill price, but this will depend on price movements. Ask yourself these questions:

- How confident are you that the price will move in the direction you expect?

- Do you have the discipline to trade the second leg, even if the stock price goes against you?

Order type. When placing trades, keep in mind the different types of orders you can use. Two of the more popular order types are market orders and limit orders.

- Market order. Your order gets filled at the next available bid or ask prices. The order may get filled quickly, but not necessarily at a favourable price.

- Limit order. You get to choose your fill prices by indicating that you want to buy or sell at a specific price or better. The downside: the order may take a while to get filled, or it may not get filled at all.

Spread price. Trading platforms may offer the choice of entering either the natural price or the mid-price for the spread.

- Natural. This represents the bid price for the short option and ask price for the long option.

- Mid. This represents the middle price of the vertical spread.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. and are used under license.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.