The Greeks: Gamma

Our last article showed how delta could help predict the future value of options following a change in the price of the underlying asset. We also learned that delta gives an indication of the equivalent stock position (ESP) on the underlying asset.

Gamma

Gamma measures the change in the value of delta relative to a change in the price of the underlying asset.

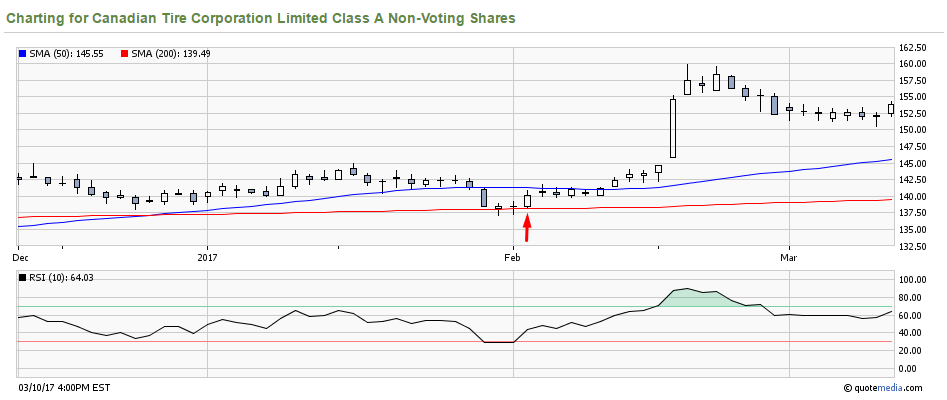

Consider the following example, which uses Canadian Tire Corporation Limited, Cl. A (CTC.A). CTC.A was trading at $140.07 on February 2, 2017. Suppose that an investor, convinced that the price of CTC.A would rise sharply over the next few weeks, bought 10 option contracts CTC 20170317 C 140 at a theoretical value of $4.02, for a total amount of $4,020.

Our ESP on CTC.A is 501 shares (10 contracts x 100 shares per contract x delta of 0.5010). Gamma is 0.0379; therefore, for each $1 increase in the price of CTC.A, delta should increase by 0.0379. If CTC.A rises to $141.07, delta should be 0.5389. We therefore have the equivalent of 501 shares in our portfolio. Now, we want to keep this quantity fixed at 500 shares. Since delta is supposed to increase as the price of CTC.A rises, we should expect to intervene to reduce our position. Gamma indicates that, for each $1 increase in the price of CTC.A, our ESP should increase by 38 shares (10 contracts x 100 shares per contract x gamma of 0.0379). As a result, we can now forecast that a $3 rise in the price of CTC.A (i.e. to $143.07) should increase our ESP to just over 600 shares. This is, indeed, what happened on February 13, 2017 when CTC.A closed at $143.30.

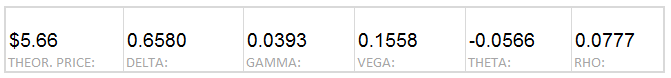

Our ESP is now 658 shares (10 contracts x 100 shares per contract x delta of 0.6580). By selling two CTC 20170317 C 140 option contracts at the theoretical price of $5.66, we collect a profit of $208 and bring our ESP back down to 526 shares (8 contracts x 100 shares x delta of 0.6580). A gamma of 0.0393 allows us to forecast that the next adjustment should occur following an increase of $2.50 in the price of CTC.A. In fact, when the price of the stock will have risen to around $145.80, our ESP will have increased to almost 79 shares (8 contracts x 100 actions x 0.0393). On February 16, CTC.A closed at $154.51, exceeding our target price by a wide margin. Although we should have acted during the day, for the purposes of this exercise, we state that we intervened when the markets closed.

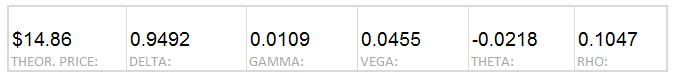

Delta is now 0.9492, for an ESP of 759 shares that we will bring back down to approximately 500 shares by selling 3 contracts at the theoretical price of $14.86, for a profit of $3,252. This is in addition to the $208 profit that we took earlier, bringing our total profit of $3,460. So now, we have an ESP of 475 shares that, taking into account our cumulative profits, has cost us $560 ($4,020 – $3,460). We then have a choice: we can either sell another contract, to lock in more profit, or simply manage the position based on our objectives for the stock.

The use of gamma allows us to develop a roadmap that defines, in advance, the actions we would like to take. This will keep us from selling too early and enable us to let the profits accumulate, something that is quite difficult for most investors, who usually take their profits quickly and let their losses mount. With a well-defined ESP, we can manage our position calmly, intervening from time to time based on our position.

Good luck with your trading, and have a good week!

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.