Beginner’s guide to options trading

If you’ve been trading stocks, you should have a pretty good understanding of the mechanics of buying and selling. Getting started with options trading is fairly simple. Here are a few things to know to get started.

Step 1: Setting up an options account with your broker

The options account can be in a margin or registered account. There are a few differences when using one or the other. For instance, trading options in a registered account, you can 1) buy and sells calls and puts, 2) write covered calls. Other option strategies are not allowed due to CRA regulations. However, in a margin options account, you can perform all the option strategies out there.

Step 2: Pulling up an option chain is like getting a stock quote.

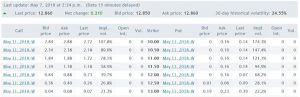

An option chain is the place to find all the strike prices and expiry dates available for trading. Here is a sample option chain (figure 1). Some options have weekly and long term expiration. There are call and put options. Call options give the holder the right to buy the stock at the strike price. Put options give the holder the right to sell the stock at the strike price. The strike price is simply the guaranteed price at which the option holder can buy (for a call) or sell (for a put) the underlying stock.

Fig.1 Source: m-x.ca

Step 3: Learning the option lingo

Buy to open means that you are buying an option to create a new position. In the stock world, it’s called a buy order.

Sell to close means that you are selling the option to close your existing position. In the stock world, it’s called a sell order.

Sell to open means that you are writing (or selling) an option that you do not possess. In the stock world, it’s called a short order.

Buy to close means that you are buying back the option that you had sold to close your position. In the stock world, it’s called a buy to cover order.

Step 4: Covered vs uncovered

When you sell to open (also known as writing) options, you are receiving a premium. In exchange, you are taking on an obligation. If you are assigned, your broker will need you to sell the underlying shares at the strike price (in the case of a call option). If you possess these shares in your account, then you are “covered”. If you don’t have the shares, you are “uncovered”.

On the other hand, if you sold a put, your obligation will be to buy the shares. Essentially, to be covered, you simply need to have sufficient funds or buying power to purchase the shares because the shares will be put to you at the strike price (when you are assigned).

Step 5: Option contract size

In most cases, buying 1 option contract gives you exposure of 100 underlying shares of the stock or ETF. When you enter an order, you cannot trade a fraction of an option contract (ex: 1.5 option contacts will not be accepted). Remember, 100 call options is not equal to 100 shares, it’s the equivalent to 10,000 shares!

Step 6: Options expire

When you trade options, you need to know that they will expire in the future. What this means is that you will only have the right to exercise the option before the expiry date. After that date, the option ceases to exist and you won’t see it in your account. Options expire on the 3rd Friday of the expiry month (except for weekly options, which expires every Friday). For example, you have a September option, this option will be valid until the 3rd Friday of September.

Step 7: Exercising an option

Only the option buyer can exercise an option. When a call option holder exercises the option, she is using her right to buy the stock at the strike price. When a put option holder exercises the option, she is using her right to sell the stock at the strike price. Exercises are done by calling your broker. Once the option holder exercises the option, the counterpart (aka the option writer) will be assigned. In this case, the option writer will be obligated to fulfill her obligations. Remember, you don’t need to exercise the option in order to realize the profit, because you can sell the option back on the market just like how you do with a stock.

There are so many benefits and usages with options, the sky’s the limit. If you wish to learn more about options and what they can offer. There are lots of educational material on the Montreal Exchange website.

Plus, MX will be hosting its 11th edition Options Education Day in Montreal on May 26th, 2018. We will have speakers showing you how you can get started with options, learn how to generate consistent income, use charts and technical analysis and combine this to different option strategies and so much more. For more information, visit the Options Education Day link to sign up!

Until next time, may the best trades be with you.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.