The Da Vinci Code: The hidden messages within the option chains

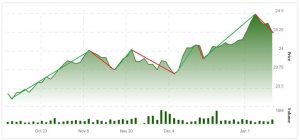

Traders are very opinionated and have their own view on everything. This is why we have a market of buyers and sellers. Otherwise, everyone would be on the same side of the trade. This behaviour is built over time from experience and knowledge. You can do it too. For example, you are able to tell if the stock is trending up or down by looking at the price movements in the following chart. As traders, we are trained to identify the trends and have an opinion on the stock’s direction. The next step is to pull the trigger, you can either buy the stock, short the stock (if you think it is dropping), or use options. By using options, you benefit from better risk management. When you commit yourself to a long option trade, your risk is predefined. Even in case of the company’s bad press overnight, the stock’s gap down at the open will not leave you with an irrecoverable losing position because you will not lose more than the premium paid for the option.

Source: TMXMoney.com

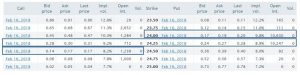

Source: TMXMoney.com

To get started, you need to find out the expiries and strike prices that are at your disposal for trading. This information can be found in an option chain. If you are new to options, this is an option chain on iShares S&P/TSX 60 Index ETF (ticker: XIU).

Source: m-x.ca

Source: m-x.ca

In an option chain, you find all the available option strike prices and expiries that are at your disposal for trading. The option chain is composed of:

• Bid price (price at which buyers are willing to buy at);

• Ask price (price at which sellers are willing to sell at);

• Last price (price of the last trade if there was one or previous day’s closing price);

• Implied volatility (the stock’s volatility that the marketplace is “implying” embedded into the option price);

• Open interest (total number of open or outstanding options); and

• Volume (traded volume of the given day). Even if there is no volume, options can be bought and sold at any given time as long as there is a bid or ask.

Let us go back to the theme of this article, the Da Vinci Code and the option chains. Every day, traders inject their prices and views into the options market and all this valuable information is encrypted into the option chains. Since option prices are embedded with a time value component, we can extrapolate how much a stock is expected to move before a specific date. This will not tell you the direction (up or down) of the stock, but rather by how much it will move. Once you decrypt this information, it will be up to you to agree or not with the market.

Here are the steps and we use XIU as an example:

As of the close on Wednesday January 10th, 2018, XIU was trading at $24.25.

1. Lookup XIU’s option chain. We use Feb 2018 expiry as an example.

2. Find the strike price that is closest to the price of the underlying. (We are fortunate to have a strike price identical to the XIU price.)

3. Take the ask prices of the Feb 16 2018 $24.25 call and put options, and add them up:

$0.30 + $0.27 = $0.57.

4. For the call option, take the ask price from the next higher strike price. In this case, we use the $24.50 strike price and the $0.17 ask price.

5. For the put option, take the ask price from the lower strike price. Thus, use the $24.00 strike price and use the $0.19 ask price.

6. If we add up both ask prices from steps 4 and step 5, we get $0.36 ($0.17 + $0.19).

7. Add the results from step 3 and 6 and divide it by 2: ($0.57 + $0.36) / 2 = $0.465.

Decryption:

This means that the participants in the options market are expecting XIU to move + or – $0.465 by February 16th, 2018. Remember, this can be up or down $0.465 from the current price of $24.25. Based on this information, you know by how much XIU could move. This is how you decrypt the option chains. This method should be taken with a grain of salt because bursts of volatility in the market could affect the model. Until next time, may the best trades be with you.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.