Writing covered calls is like collecting monthly rent from your tenant

Owning an income property has its pros and cons. As a landlord, it gives you the right to collect monthly rent. You can also offset your rental income from the property’s related expenses. Plus, the property has potential value growth. Owning a rental property is a winning strategy on many levels. But there are also some downsides in owning a rental property, such as tenant risk. Tenants are never guaranteed to pay the rent on time, you might even have to take them to court to evict them. Some landlords are constantly sending over handymen to make countless repairs. Another drawback to owning a rental property is the illiquidity and concentration of the asset. Plus, you need to tie up a large portion of capital for the down payment and pay off the mortgage over 20 something years. Also, don’t forget about the property taxes, school taxes, and insurances that come into play. Picture this, you are a landlord, it’s in the middle of the night and it’s -20°C outside. One of your tenant calls to report that the water pipes just burst or that the fridge is not working. This is not the type of call anyone would like to receive at 2 o’clock in the morning.

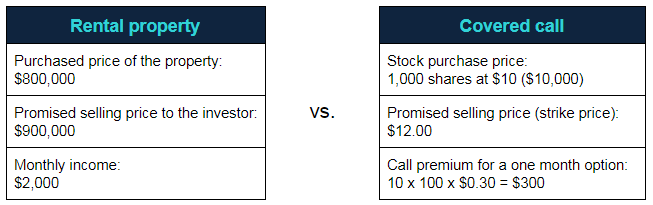

However, there is an alternative to the rental property strategy. By having an options trading account, you can “rent” out your stocks to collect monthly (or even weekly) income, in the comfort of your own home. This strategy is eligible in both, registered and non-registered trading accounts.

This is an option strategy called covered call. You need to:

- Buy a stock that you like. (Just like a property, you want to buy something that will maintain or increase in property value).

- Set a price at which you would like to sell your stock for. (Think of this as a promise price from an investor at which he could buy your property for).

In your trading account, buying a stock is easy. Simply place a buy order, enter the symbol, the quantity of shares, and a price. For the option part, you will “sell to open” a call option. Remember to check the “covered” check-box. This will indicate that you are using the shares that you own as collateral for the calls that you are shorting. (*For every 100 shares you own, you can write one call option).

Possible outcomes from the covered call strategy:

Stock purchase: $10.00

Call premium: $0.30 (3% yield on the stock price)

Strike price: $12.00 (20% potential capital gain)

ROI: Potentially 23% in 1 month

This strategy consists of writing a call that is covered by an equivalent long stock position. It provides a hedge to the extent of the call premium received and allows you to earn premium income, in return for temporarily forfeiting the stock’s upside potential.

In conclusion, the primary motive of this strategy is to earn additional income, which has the effect of boosting overall returns on the stock and providing a measure of downside protection. The best candidates for covered calls are the stockowners who are perfectly willing to sell the shares if the stock rises and the calls are assigned.

To learn more, visit m-x.ca/education

One Comment

Leave a Reply

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.

Excellent article.

The concept of option premium from a covered call being like rent is very revealing.

One advantage not touched on is the opportunity for continued reinvestment of the option premium (and possibly funds from exercise) to be reinvested.

Imagine 5% ‘rents’ each month, reinvested every month into the same stock (more options income) or an alternate stock (diversification).

Observation: Do this with a stock you want to own:)