Year-End Opportunity in Cannabis Stocks?

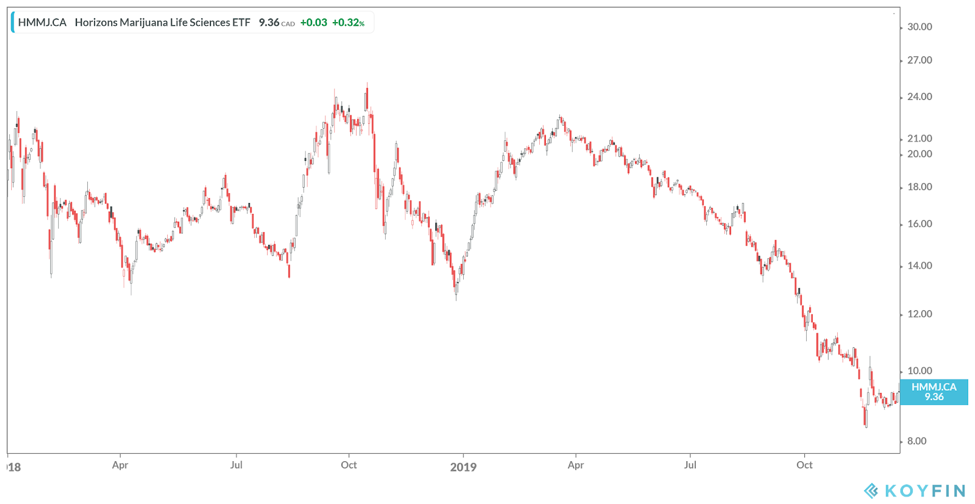

Through 2018 and into the first quarter of 2019, Canadian marijuana companies represented one of the hottest sectors in the equities market. However, since its March 19, 2019 high of $23.87, the Horizons Marijuana Life Science ETF (HMMJ) has been on a steady decline, and by November 19, 2019 it was down to $8.34, having lost 65%[1] of its value. This is a rather large loss for an ETF, and it begs the question: is it now safe to buy HMMJ?

Figure 1: Price Chart of the Horizons Marijuana Life Sciences ETF

Source: Koyfin

Sometimes the year end offers opportunities for bargain hunters as fund managers sell their losers so that the position will not appear in their annual reports. This phenomenon, combined with investors’ tendency to liquidate their underwater positions for tax purposes, means that the last couple of weeks of December are often a great time to troll for deals.

Canadian marijuana stocks neatly fit this bill. However, there is so much volatility in the individual stocks in this industry, it might be better to play for a bounce in the industry by purchasing a vertical call spread on the HMMJ ETF.

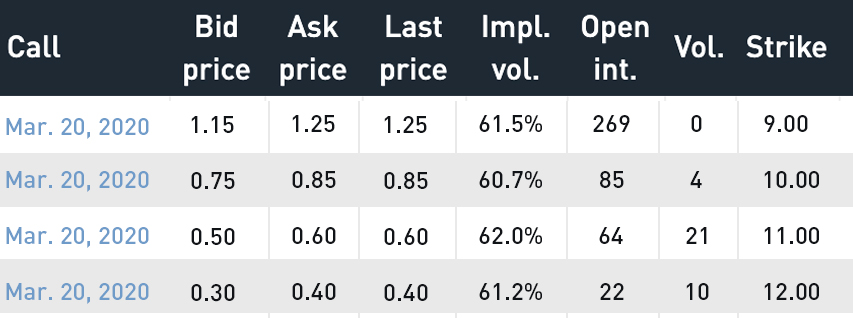

Figure 2: HMMJ Options Quotes, December 13, 2019

Source: Montréal Exchange

As quoted on December 13, 2019, the March 20, 2020 options have 96 days left to expiration, leaving plenty of time for a rally.

With the ETF’s implied volatility so high (above 60% for the March series), purchasing call options outright is a risky approach, as an investor needs to be that much more accurate in predicting the price move.

In such an environment, a better risk/reward trade for bullish investors is to enter into a vertical call spread – buying one strike while shorting a higher strike in the same month.

For example, on December 13, 2019, the March $9.00-$11.00 bull call spread can be bought for approximately $0.75. With HMMJ trading at $9.36, this means that the stock only needs to rise $0.39 for the strategy to reach its break-even point.

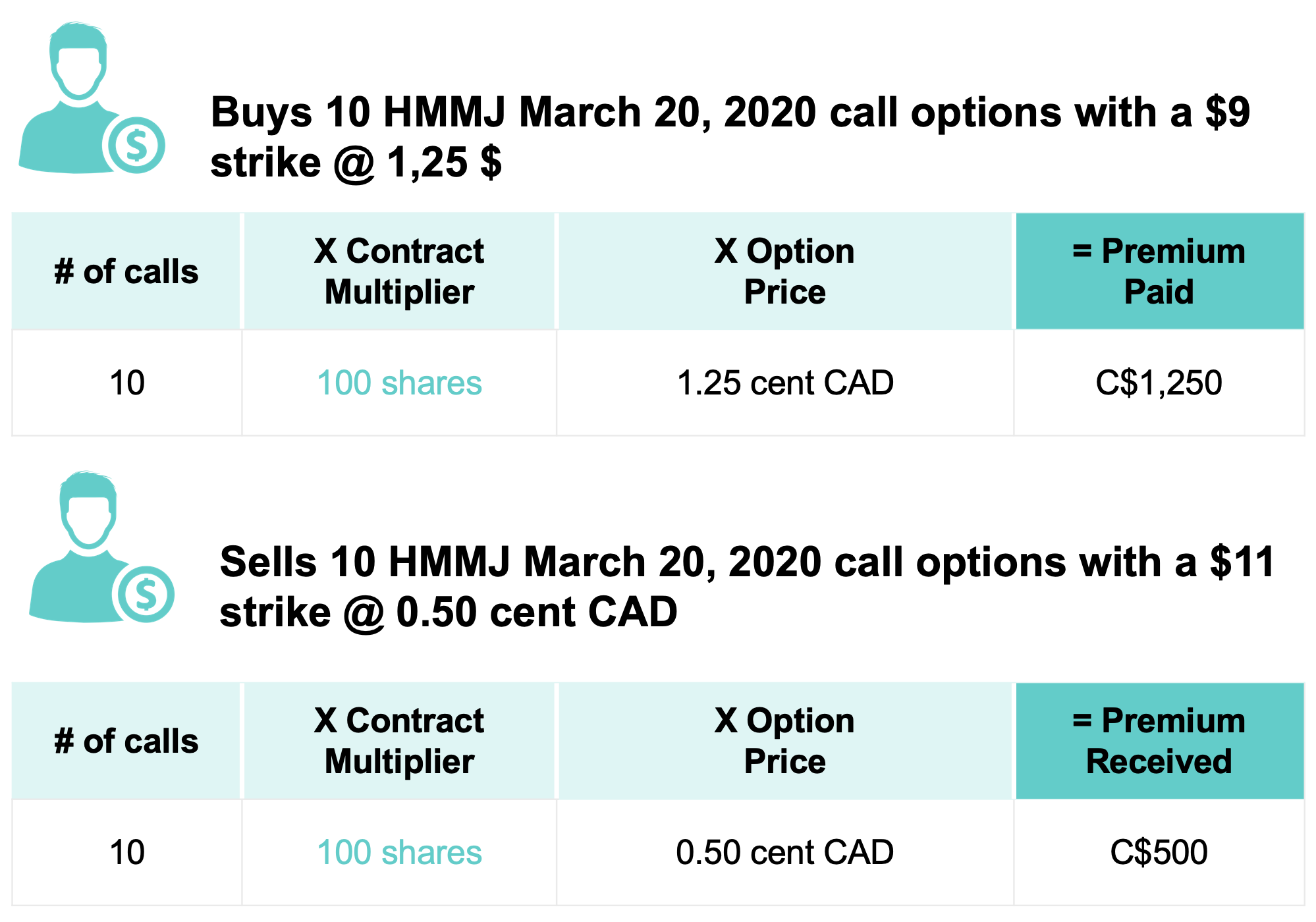

Now let us consider the transaction in detail:

Figure 3: Options Example

Source: Big Picture Trading

Although we are selling options that we do not own (the $11 strike), they are covered by the options we purchased with a lower-priced strike (the $9 call). If we get called away on our $11 strike, then we will exercise our $9 call to cover that short position. Our risk is therefore limited to the amount we paid for the position.

The net result is as follows:

Figure 4: Options Example

Source: Big Picture Trading

We have paid $0.75 for a position that already has an intrinsic value of $0.36.

If over the next three months our prediction of a relief rally in the marijuana ETF comes true, then we stand to almost double our initial outlay. When our calls expire, any close above $11 will result in the call spread being worth $2, resulting in a gain of $1.25. If the price of HMMJ does not change, staying at $9.36, then our investment will have lost approximately half its value, with the call spread expiring at $0.36. Finally, if at expiry HMMJ closes below $9, we will lose the entire outlay, as the spread will be worth $0.00. However, this would have proven to be a better risk/reward trade-off than if we had bought the $9 strike for $1.25, as we would only lose $0.75 on the vertical call spread position.

Buying vertical call spreads offers a much more attractive method of expressing a view on the direction of a security, especially when the implied volatility is high. The end of the year is the perfect time to hunt for down-and-out bargains like HMMJ and use this strategy.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

[1] Source: TMX

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.