Using options to express market views

Welcome to the first article in a series of four, where we’ll lay the foundations for using options as part of your portfolio management.

To gain a comprehensive understanding of options and how they function, I recommend exploring the following articles:

Beginner’s Guide to Options Trading

Let’s Do Some Exercise: Exercising Your Options

You can also find a wealth of information on options trading in the Learning section of Disnat, the Desjardins Online Brokerage site.

Now that you have grasped the basics of options and learned how to trade them, you might wonder why options should be part of your portfolio.

Flexibility

Options offer a remarkable level of flexibility, surpassing the traditional approach of merely buying a stock.

While conventional investors typically view the stock market in a two-dimensional manner, with stock prices either rising or falling, incorporating options into your financial strategy introduces a more three-dimensional perspective. This expanded view empowers you to capitalize on various parameters when investing in shares.

You can potentially profit from the passage of time, take advantage of a stock’s relative stability, or even capitalize on its volatility. These concepts will be explored in greater detail in a subsequent article.

Furthermore, options offer a convenient alternative to short selling. Short selling is a strategy where an investor borrows shares from a broker and sells them immediately, anticipating a price decline. The objective is to buy back the shares at a lower price, return them to the broker, and pocket the difference as profit.

Short selling carries in theory infinite risk as the share price theoretically has no upper limit and could continue to rise indefinitely. This exposes the investor to unlimited potential losses, making it a high-risk strategy that is mostly appropriate for professional investors and may not even be permitted in a standard retail account. In contrast, purchasing put options allows investors to limit their risk to the premium paid for the option, providing a more controlled and manageable approach to navigating market fluctuations.

On the other hand, by purchasing a put option, you are well aware of your maximum risk from the outset, which is the premium paid to acquire the option.

Risk management

An option is often compared to an insurance contract in the sense that it serves as a tool to offset some (or all) losses when there is a decline in a stock’s price. To understand options fully, it is essential to delve into their basics, including concepts like intrinsic value and time value.

Imagine you purchased shares of ABC at $40 with the intent of holding for many years. However, market conditions turned negative and you anticipate a short-term loss of 25% in its value. In response to this potential risk, you decide to buy a put option with an exercise price of $38, which costs you $2.

In options trading, the premium you pay for the option comprises two main components: intrinsic value and time value. The intrinsic value represents the actual worth of the option if it were to be exercised immediately. In this case, the intrinsic value would be the difference between the stock’s current price and the option’s exercise price (i.e., $40 – $38 = $2). The time value, on the other hand, represents the additional value attributed to the option based on factors such as the time remaining until expiration and market volatility.

By acquiring this put option, you have paid for protection against the stock falling below $38, much like paying for insurance to partially or fully offset the financial burden stemming from an illness.

If the stock price stabilizes and shows signs of rebounding, you have the flexibility to either sell the option and claim the “insurance premium” or exercise the option to retain an actual value of $38.

You might wonder why not just place a stop order at $38? The answer is simple. The challenge with using a stop order is that it may prove ineffective, especially in a fast-moving stock where there is a plethora of sellers and few buyers. As a result, your sell order could end up being filled at a price much lower than $38.

By contrast, choosing to buy an option offers the advantage of being able to transact at the $38 mark, regardless of market ups and downs. Understanding the intrinsic value and time value of options allows investors to make more informed decisions when managing risk in the financial markets.

Return

Options provide the opportunity for leverage, meaning investors require less capital to achieve higher potential gains. Let’s explore an example to illustrate the multiplier effect of options.

| Initially invested capital | Capital appreciation after 3 months | Return on investment | |

| Investor 1 | $120 x 100 = $12,000 | 13,000 – 12,000 = $1,000 | $1,000 / $12,000 = 8.33% |

| Investor 2 | $5.85 x 100 = $585 + ($8.75 x 2) = $602.50 | $10 x 100 = $1,000 | 1000/ $602.50 = 165,97% |

Consider shares of DEF, currently trading at $120 a piece. Over the next three months, you anticipate the price will rise to $130.

A traditional investor may simply buy 100 shares of DEF at $120 each, expecting to sell at $130 and pocket a $1,000 profit. But a savvy options investor will purchase an at-the-money call option on DEF stock for $5.85.

Upon the option’s expiry, the time value diminishes, assuming no trading costs associated with the shares and an option transaction commission of $8.75 for both the purchase and sale.

The table demonstrates the significant leverage provided by options. The gain is the same in both scenarios but Investor #2 has invested less capital, resulting in a superior return on investment and the flexibility to deploy capital elsewhere.

Of course, it’s essential to mention the risks associated with options trading, as investors may also incur losses in certain situations. Let’s delve into a few examples to further understand these risks.

Leverage and increased risk

As demonstrated in the previous example, options provide the potential for a superior ROI through leverage. However, it’s crucial to recognize that leverage is a double-edged sword. While it can amplify gains, it also magnifies the potential for losses.

To better understand the leverage effect created by an option, let’s continue with the same example:

| Initially invested capital | Leverage | |

| Investor 1 | $120 x 100 = $12,000 | $12,000/ $602.50 = 19.92 |

| Investor 2 | $5.85 x 100 = $585 + ($8.75 x 2) = $602.50 |

In the example, purchasing 100 shares of DEF at $120 per share would cost $12,000, plus any applicable broker fees. The investment cost is significantly lower, amounting to only $602.50 after transaction fees. This illustrates how the leverage effect results in a multiplier of 19 for the same investment. While this leverage can lead to substantial gains, it is essential to exercise caution and thoroughly comprehend the risks associated with different options strategies.

Time decay

A critical factor to consider when using options is time decay. As the expiry date of an option approaches, its value tends to decline rapidly. It is crucial to carefully assess the time required for the expected movement in the share price to occur.

When choosing an option, finding the right balance between the time to expiration and the associated premium cost is essential. Opting for a term that is too long could mean paying a higher premium, impacting the overall profitability of the trade. On the other hand, selecting a term that is too short might not provide enough time for the anticipated price movement to materialize.

To navigate the complexities of time decay effectively, I recommend exploring the following article for more information:

Reduce the Risk Associated with Time Value Decay

These resources will offer valuable insights to help you make informed decisions when incorporating time decay considerations into your options trading strategies.

Liquidity

One important consideration when trading options is liquidity. While a stock may have high liquidity, the same may not apply in the options market. This lack of liquidity can lead to two potential problems.

First, it may become challenging to acquire or sell a particular option, making it less convenient for investors to enter or exit positions smoothly. This lack of liquidity can result in delays or potentially unfavorable prices during the transaction process.

Second, options with low levels of liquidity often come with a premium, known as the bid-ask spread. The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A wider spread means higher transaction costs, affecting overall profitability.

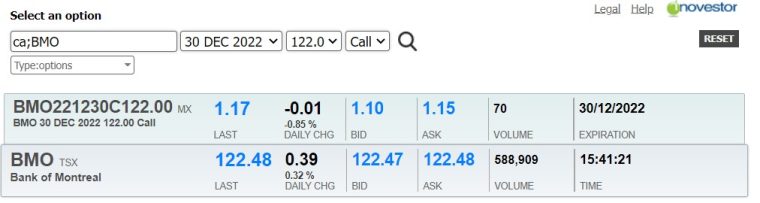

It is common to encounter this phenomenon with less actively traded securities. However, as illustrated below, options on more liquid stocks like BMO tend to have good liquidity, with a narrow bid-ask spread of only $0.05 (or +/- 4%) compared to the prices on the latest trades.

Being mindful of liquidity when trading options allows investors to make more informed decisions and be aware of potential challenges associated with certain options. Opting for options with good liquidity can enhance trading efficiency and help achieve more favorable transaction outcomes.

Source: Options Calculator (TMX)

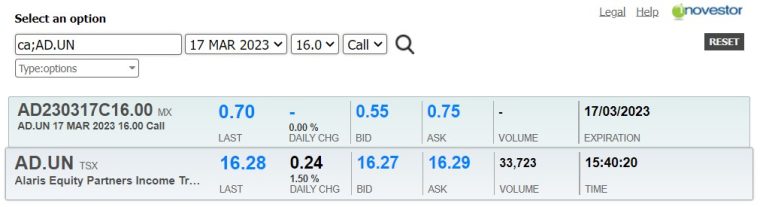

On the Alaris Royalty Corp. option, we note that the spread is $0.20 (+/- 28.57%) compared to the prices of the latest trades.

Source: Options Calculator (TMX)

This document is for information purposes only. Desjardins Securities assumes no responsibility for any errors or omissions and reserves the right to change or revise the contents at any time without notice.

Financial and economic data, including stock quotes, analyses or interpretation thereof, are provided for information purposes only and should in no way be regarded as a recommendation or advice to buy or sell any security or derivative instrument.

The information contained in this document should not be construed as legal, accounting, financial or tax advice, and Desjardins Securities recommends that you consult your own experts based on your specific needs.

In no event will Desjardins Securities, its directors, officers, employees or agents be liable for any loss or damage suffered or expenses incurred as a result of the use of the information contained herein.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.