Understanding Volatility Exchange Traded Products

Using volatility ETPs is a pure play way to target volatility for your portfolio – no strike risk to worry about. But make sure you understand the key points below very well before wading in…

———————

I’m often asked about long volatility exchange traded products (ETPs) – how they work and how they make or lose money. This is understandable, since there is often confusion as to what drives their underlying performance. It’s important to understand that performance in these products comes from movement in an underlying index called the S&P 500 VIX Short-Term Futures™ Index (“SPVXSP”). This Index reflects a position in the first two months of VIX futures, to varying degrees depending on where we are in the expiry cycle. Note that performance is not driven by listed option products per se, and this distinction is very important to understanding them.

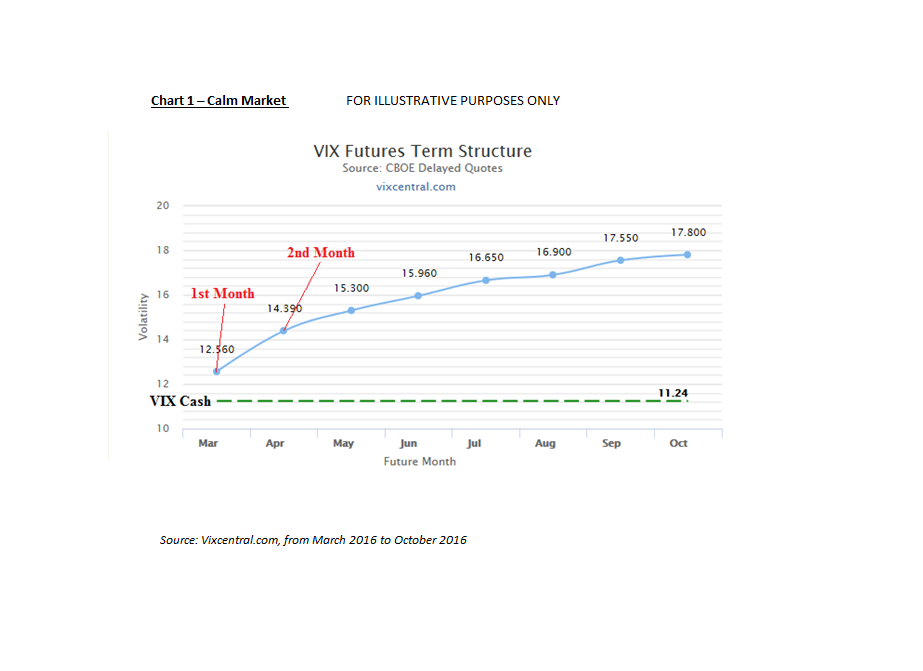

What is important to recognize is that these products do not track the VIX (CBOE Volatility Index), the one you hear about on television, which we’ll call ‘VIX Cash’. VIX Cash reflects a blend of weekly SPX out-of-the-money index call and put options that are 30 days out in duration. This is not the same as a product that reflects futures value with a maturity of 30 days. The futures do have a fairly close relationship to VIX Cash, but the VIX futures curve generally slopes upwards from spot VIX Cash, similar to how an oil futures curve might look. This state is called ‘contango’ – a shape observed when equity markets are behaving calmly (see Chart 1 below).

The SPVXSP, and products like VXX and HUV, hold positions in the front two futures and roll from the first month into a position in the second month on a daily basis. In times of calmness, or ‘contango’, this roll is executed for a loss. Referring to the chart, the Index will sell some of its March futures position at $12.56 and buy an identical amount of the April futures at $14.39. The next day, it repeats the process in order to continually maintain a blend of VIX futures with a constant maturity of 30 days.

The math in this example illustrates a loss (14.39 minus 12.56) – something called ‘Negative Roll Yield’ which is the loss due to rebalancing to a full exposure of futures 30 days out. Lately, markets have been so quiet that this steepness has been quite pronounced, and the roll-yield has been very negative. This demonstrates how a prolonged quiet environment can hurt the long volatility products, which will sustain repeated daily losses through longer periods of this negative roll-yield mechanism.

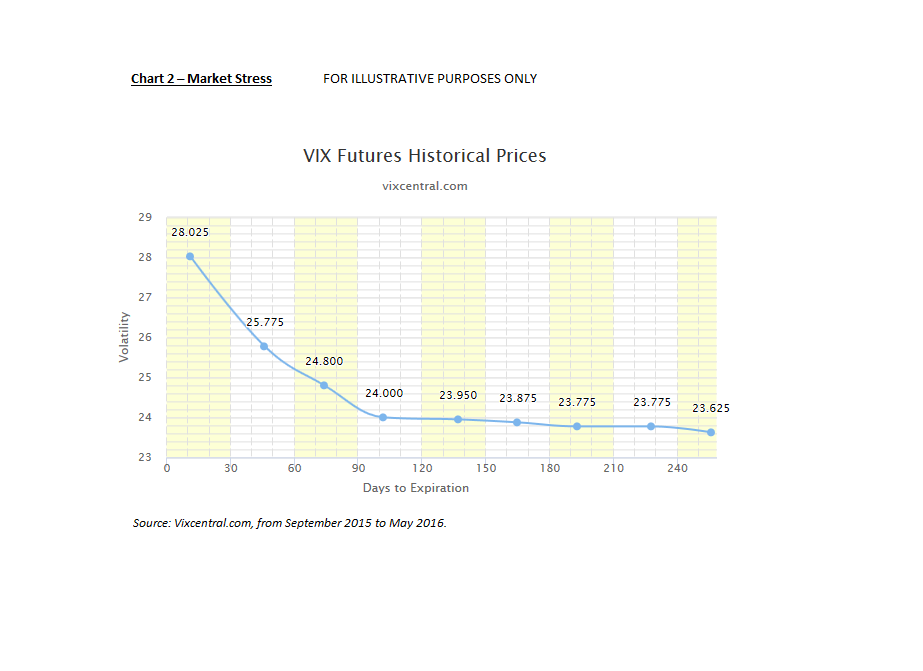

During times of market stress, when the futures curve is in a state of backwardation (when the front month is trading higher than the second month), this daily roll can actually become a positive contribution to the product. See Chart 2 which reflects the futures curve in September of 2015, a time of elevated stress and volatility in the market.

In these instances, holders of VXX or HUV can benefit not only from a futures curve that is likely shifting upwards, but also a downward sloping curve that results in a ‘Positive Roll Yield’ – hence the value in holding these ETPs ahead of larger drawdowns in equities. However, it’s important to note that approximately 80% of the time, the curve is in contango, resulting in the aforementioned daily loss to the product. There is nothing untoward happening here – another way to look at holding an ETP like this is to imagine holding a basket of monthly SPX out-of-the-money puts and repeating the process each month. Without any sort of market calamity, these puts will continually erode to zero and expire. Similarly, long VIX ETPs will ‘erode’ as futures premium seeps out over time. VIX Cash merely takes a daily rolling snapshot of option pricing levels that are 30 days out. It can reflect a drop in implied volatility, but it will not reflect much of the erosion in those options.

VIX Cash tends to bottom out in the 10-11% range because investors will not allow the cost of insurance to drop below a certain threshold regardless of how calm markets have been. Investors in these products should resist the temptation to assume that when VIX Cash is stabilizing so too will the ETPs. The long volatility ETPs will continue to roll to a loss as long as contango is present in the futures curve.

To make things slightly more difficult, the correlation of the VIX futures to VIX Cash is not set in stone. With a VIX Cash in the 12-15% range, we can expect the blend of first and second month futures to move at about a rate of 50 delta, or 50% of the VIX Cash move. This means with a 10% increase in the VIX Cash, we could see about a 5% move in VXX or HUV in the same direction. When the curve is a contango, the futures are simply less likely to react significantly to small moves in the VIX Cash. Option pricing is mean-reverting, which signifies it rarely stays high for a prolonged period, and futures, in a sense, react skeptically to any small jumps in VIX Cash. Therefore, VIX futures (and long volatility ETPs) won’t react strongly to a small upward VIX Cash move in the shorter term, particularly at very low levels of VIX Cash.

With higher levels of VIX, we can expect the futures, and therefore the long volatility ETPs, to move with a stronger correlation to VIX Cash. Why? Because in such an environment, the VIX futures curve starts to price in a higher likelihood that VIX Cash will remain high. A sustained period of uncertainty and market volatility will be reflected in VIX futures becoming more ‘convinced’ that VIX Cash will remain high. A flatter or inverted curve will help holders of the ETPS. These products are best used in a more tactical manner as they can perform strongly in times of market stress. VIX ETPs are generally not appropriate for buy-and-hold strategies, but can potentially add a great deal of value when the time is right.

The views/opinions expressed herein may not necessarily be the views of AlphaPro Management Inc. and Horizons ETFs Management (Canada) Inc. All comments, opinions and views expressed are of a general nature and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Vice President, Portfolio Manager, and Options Strategist

Horizons ETFs Management (Canada) Inc

Hans Albrecht is vice president, portfolio manager, and options strategist at Horizons ETFs Management (Canada) Inc. He co-manages one of the largest option books in Canada, $800 million in covered call ETFs and oversees day-to-day options activities. Mr. Albrecht also was an options floor market maker and traded a large volatility book for National Bank Financial for many years. He has lectured at McGill and has appeared on numerous expert derivative panels. He has been quoted in Bloomberg, Investment Advisor, Globe and Mail, and is a regular on BNN. ETF Lipper Award winner.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.