Timing the Bottom on BCE

There is no shortage of analysts offering alternating fundamental outlooks for BCE (TSX:BCE). Some concerned with the business model and declining growth rates, others proclaiming the BCE dividend stream to be more sound than owning bonds. Personally, as a trader I look for the tactical play where I can profit from key turning points in major stock trends. Here’s my perspective as to what I am looking for to catch the key turn around in the battered down stock.

First off, I generally feel that the selling in BCE has been predominantly driven not by company fundamentals but rather by interest rates. As a secure high dividend paying stock, the company, like most high dividend paying securities, is considered a bond proxy. Over the last year, we witnessed 5-year interest rates on Canadian Gov. bonds rising from 0.90% to over 2.30% back in May 2018. The more than doubling of interest rates has been a serious drag on almost all higher yielding assets.

Why have rates been rising? Many will point to rate differentials between the U.S., a strong Canadian economy that can absorb rate normalization and even an attempt to cool off the real estate market. While those may have merit, to me it is all about inflation. The way I look at it, all longer duration bonds are mechanically pricing in higher inflation expectations, which force interest rate higher, bonds lower, and pressuring the bond proxy stocks like BCE.

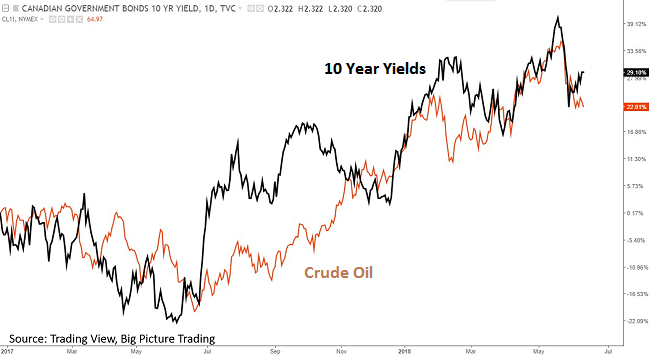

What is the driver of inflation expectations? Well there are many, but none greater than oil prices. Simply observe the chart below overlaying the performance of the 10-year yield on the Canadian government bonds and crude oil prices.

So, what am I getting at?

My speculation is that yields on the longer duration bonds are pricing higher inflation expectations due to rising oil prices and the bond proxy stocks are under pressure in that environment. Its when we see oil peak out in prices, it will peak out interest rates, which will solidify the bottom the bond proxies which includes BCE.

So, has oil peaked? We have definitely seen a short-term top that will take us into the OPEC meetings here in June, but will it be the 2018 high? That has yet to been seen.

Furthermore, this raises the question of how one should position themselves when buying in BCE? Is it too early to buy the dip or do you risk missing a great buying opportunity by staying on the sideline?

In my opinion, this is a chance for us to utilize options as a strategic tool to enter the position.

Those new to exchange traded options, the purchase of a call secures you the right (but not the obligation) to buy the stock at a specific price over a specific period of time.

As shown in this scenario,

- Our investor wants to secure the potential purchase of 1000 shares or just over $50K in investment.

- June 6, 2018 BCE (TSX:BCE) is trading at $54.82

- The July 20th, 2018 expiration BCE call option is asking $0.35 (9.2% implied vol)

Rather than take the risk of being early to the trade, our investor purchases 10 call options (each call securing the purchase of 100 shares) for $350.00 (10 x 100 x $0.35)

Our investor has defined his maximum risk to $350.00 while having the next 6 weeks to decide if they wanted to exercise their right to buy the shares at $55.00. To me, it is all about the optionality of the trade. If oil surges higher into the summer, and interest rates continue to rise, it is likely we are early and the calls will expire at a loss. In my opinion, this is acceptable as I will clearly have a better opportunity to buy BCE at better prices in the future. Alternatively, if this proves to be the bottom in the stock, I will exercise my right to buy and have accumulated the position not far from 52-week lows.

Best part, Canadians can also execute this strategy in their registered accounts.

Thank you for reading.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.