A Bullish Position to Optimize Risk-Reward

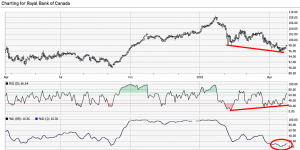

As the following graph shows, shares in Royal Bank of Canada (RY) veered into correction territory after peaking at $108.52 on January 22, 2018. At the current price of $97.98, the security is down by over 9.7%. With the RSI (Relative Strength Index) indicator on the rise and the stochastic oscillator (%K) indicating that the stock is oversold, all the conditions are in place for the price of RY to rally, given that we are still bullish on the market’s prospects in the long term. A realistic objective for the stock price would be the high of $104 reached in February.

Daily chart for RY ($97.98 on Monday, April 23, 2018)

An investor interested in profiting from this scenario could buy call options expiring on October 19, 2018, selecting the strike that would produce the best return if the stock reaches a price of $104.00 on expiration.

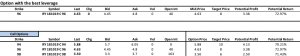

We will choose from among the following call options:

- RY 181019 C 94 at $5.88

- RY 181019 C 96 at $4.63

- RY 181019 C 98 at $3.50

Position

Comparative Table of Call Options

As the above table shows, of these three call options, it is RY 181019 C 96 at $4.63 that has the optimal combination of risk and return, offering a potential return of 72.97% if RY reaches the target price of $104.00 on October 19, 2018. We therefore execute the following transaction:

- Purchase of 10 call options RY 181019 C 96 at $4.63

- $4,630 debit

Profit and loss profile

Target price on the call options RY 181019 C 96 = $8.00 ($104.00 – $96.00)

Potential profit = $3.38 per share, for a total of $3,380

Potential loss = $4.63 per share, or $4,630

Intervention

Even though the target price for shares of RY is $104.00, our potential profit is tied to the target price of $8.00 on the call options. Consequently, as soon as the price of the options reaches $8.00, we will liquidate the position, even if RY has not yet reached the target price of $104.00.

Good luck with your trading, and have a good week!

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.