A not so TD-ous trade

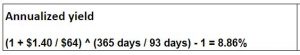

TD is an extremely well-run bank with diversification across many business lines and geographies. The share price has pulled back from its 52-week high of $71.31 set back in late February by around 8.5%. With shares hovering around the $65 mark, I want to pick up some yield or look to get long the stock at even lower prices. At the time of writing, I can sell the October $64 cash-covered put for $1.40. Collecting $1.40 is a current yield of 2.2% ($1.40/$64) and an annualized yield of 9% (see math below). 2.2% is a very attractive current yield when we consider that the trade is only 93 days long, especially given that the dividend yield is 3.67% annually. I also really like this level of premium because if we look back over the past four months the share price has been stuck in a range between $62 – $67. If the share price stays above $64, I keep the $1.40 and the options expire worthless. If the share price declines below $64 at expiry, I still keep that $1.40, buy the stock at $64 and my net outlay is $62.60 (excluding transaction costs), which is close enough to the bottom of the trading range that I am happy to own the stock there.

When selling any cash-covered put, a person wants to go through a checklist before doing so. First, I want to make sure I have the cash to buy the stock in the event that it drops. If I don’t have the cash, then it is not cash covered, and I am using leverage, which doesn’t fit with a conservative investment style. Second, I want to see what sort of event risk there is during the period. In the case of TD, they report on August 31. I like that because that date falls about halfway to expiry. If the report is good and the stock moves higher, the value of these options is going to fall dramatically and I may have the opportunity to buy them back for next to nothing and reallocate that cash to another trade. If the stock sells off, there is still a month and a half for the share price to potentially recover. Lastly, I want to make sure I’m doing this in a non-registered account. You cannot short puts in a registered account.

Overall, I think if a person is an income-oriented investor, prefers to buy on pullbacks and wants large-cap Canadian content in their portfolio, this is a great way to achieve that. If you have any questions, reach out to me.

Chris

The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Christopher Thom may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your financial advisor before acting on any matter discussed herein. Individual situations may vary.

Portfolio Manager

Odlum Brown Limited

Christopher’s investment philosophy is based on the principles of value investing. Following an investment style consistent with that of Odlum Brown’s Research Department, he focuses on good companies with solid balance sheets trading below their fundamental valuations. As a Portfolio Manager, Christopher works with clients to build portfolios based on their individual needs. A large part of his business includes using options. By incorporating various options strategies in client portfolios, Christopher aims to increase investment income, reduce portfolio volatility and hedge against large moves in the market or currency fluctuations. Christopher has completed numerous industry courses and achieved the Canadian Investment Manager (CIM), Derivatives Market Specialist (DMS) and Fellow of the Canadian Securities Institute (FCSI®) designations. In addition, he has made several guest appearances on Business News Network (BNN) segments, such as Business Day and The Close, on the topic of options and equities. Investing in the equity markets often consists of following a buy low, sell high strategy. For suitable investors, the use of options strategies can help investors protect their portfolio from downside risk, align their cash flows, improve returns, and achieve their objectives given their comfort with risk. By incorporating the use of options, Christopher helps his clients achieve their long-term financial goals. Many clients have come to Christopher after trading options on their own for years, looking for professional advice, and he enjoys the relationships he has built with them over the years.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.