Bottom Fishing Cenovus? Hedging may be Appropriate

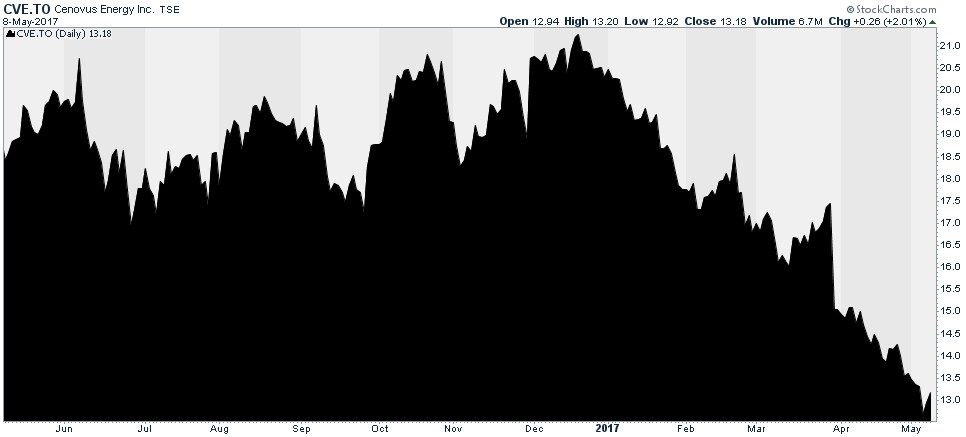

Cenovus stirred up the Canadian oil industry back on March 29th with an announcement on the $17.7 billion-dollar purchase of ConocoPhillips’ Canadian oil sand assets. To say the deal was not well received is an understatement as the stock dropped over 10% on the announcement and continued to actively distribute lower. From its peak prices at $22.00 back in December 2016, the stock proceeded to decline to a low under $13.00 a share.

Chart: Courtesy of StockCharts.com

There are two very distinct sets of opinions on the deal. First off there are a core group of investors and analysts that feel the company grossly overpaid and the shareholders will suffer from the increased stresses on the balance sheet and generally has been destructive to the company’s investment value. To add further concerns to the deal, many are alarmed about the timing of the acquisition, just as crude oil has begun to weaken potentially adding stress on the company over the short-term.

The second, more optimistic group of investors, believes that while there will be short-term financial stress, the company will demonstrate operational synergies that would allow the company to trade at much higher valuations.

Clearly those looking to abandon Cenovus on the short-term are prevailing as the stock has now approached the levels it traded in the 1st quarter of 2016 when spot prices of West Texas Intermediate flirted under $30.00 a barrel.

So how do we size this up as traders?

The first observation is that the stock is very oversold and the current velocity of the selling must slow as it approaches the price levels where value investors see little risk to accumulate. But the problem with just randomly buying the dip is that there is little evidence that this is where the selling stops and that the stock cannot lose further value. This emotionally keeps many traders on the sideline observing, but not acting.

This is where exchange traded options can offer a valuable tool to hedge risk for those bold enough to start their buying. Those familiar with options know that there are many alternative hedging strategies to build the asymmetry, but my focus is to demonstrate the use of a protective put hedge as an insurance to define the maximum risk to give the investor staying power to see through a potential bounce.

Details at the time of writing (May 8, 2017):

- Cenovus (TSX:CVE) is trading at $13.18

- June $12.00 put option (39 days) is asking $0.25

In this example, our investor believes the stock can trade from its current price of $13.18 back to $15.00-$17.00 on the upside but clearly is concerned about the short term selling pressure on the stock and the immediate risk that they may be early.

Our investor buys 1000 shares for $13,180 and simultaneously purchases 10x June $12.00 put options for $0.25 or $250.00. What has our investor done? They have contained their maximum risk over the next 39 days down to $12.00 a share where they have secured a guaranteed price exit.

To some value investors that appears to be unnecessary, but that is a matter of opinion. To me the cost of the protection offers an important safety net to take a decisive stance on an investment theme, knowing you have a clear exit strategy if you find out you are early or some further news accelerates the selling pressure lower. The certainty of knowing you have a fixed exit strategy if you are wrong gives the investor an important psychological anchor to make an initial investment with conviction.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.