Improving order execution efficiency

On July 27, 2007, the Montréal Exchange launched a penny trading pilot project that ended on February 26, 2016 with the implementation of a permanent program.[1] Before the pilot project began, only options priced below $0.10 were allowed to trade with a minimum price increment of $0.01 (“penny trading”), while all other options were quoted in increments of $0.05. For eligible securities, the pilot project allowed all equity option series priced below $3.00 to be quoted in increments of $0.01. Equity option series priced above $3.00 were quoted in increments of $0.05. Meanwhile, option series for eligible exchange-traded funds (ETFs) were quoted in increments of $0.01, regardless of their price.

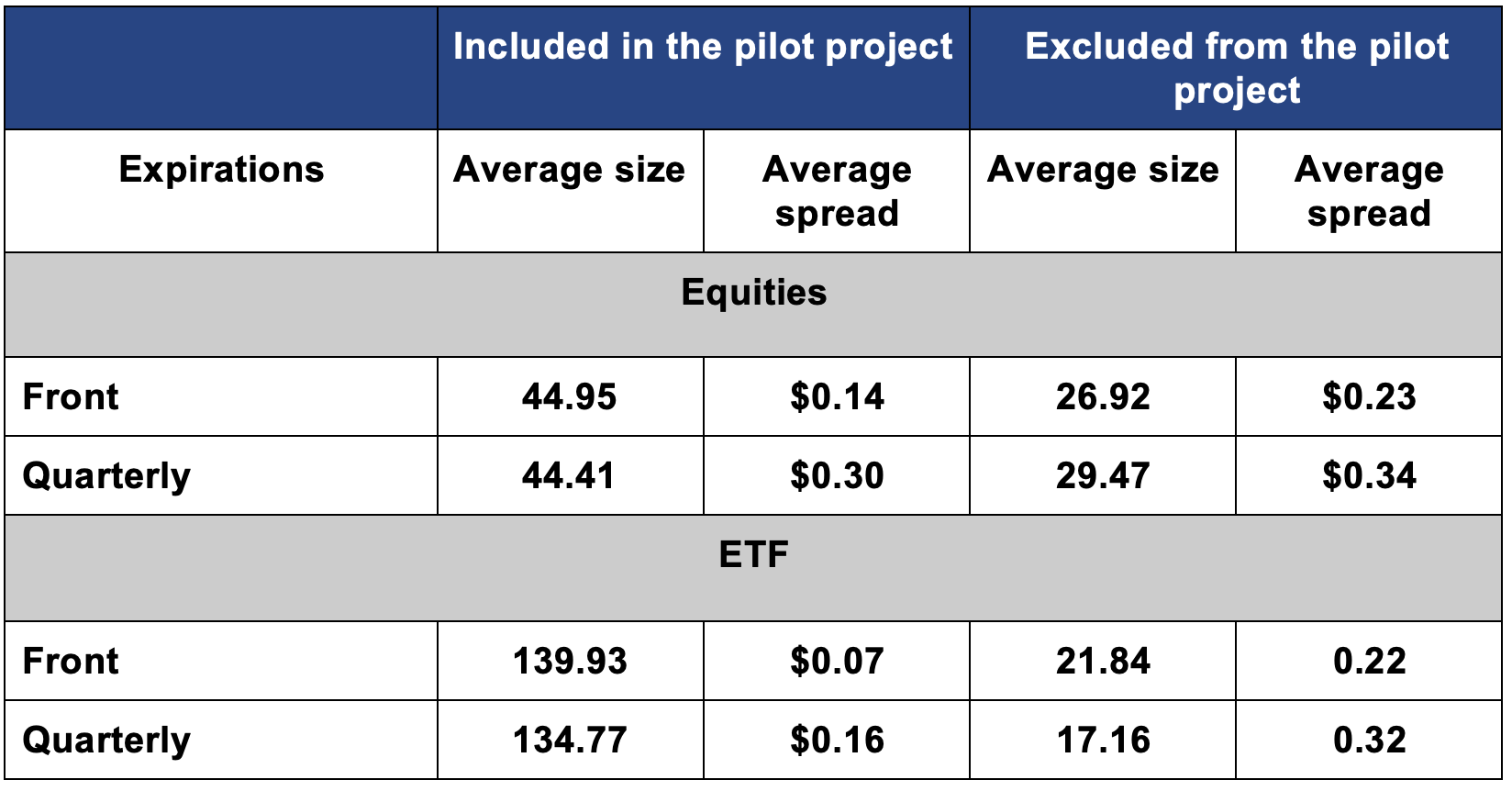

Four impact analyses carried out in 2007, 2008, 2009 and 2011 reveal a general tightening of spreads, along with a reduction in quantities posted on the bid and ask, but this phenomenon was less significant than in the United States. Table 1 below, which uses data from July 2015, confirms this trend. It compares the option classes quoted in penny increments against the rest. These results show that the classes included in the pilot project had a tighter spread than those that were not. However, this is due not only to penny increment trading, but also to the fact that the included classes are those that are the most traded.

Table 1[1] : Market quality on penny & non-penny option classes (July 2015)

In light of the above, we can conclude that penny trading on the most active classes improves the bid/ask spread and therefore reduces the costs of opening and closing a position. However, this does not mean that investors do not have to seek out the best price when entering an order. Posted markets for options reflect the best bid price, i.e., the highest price a buyer is willing to pay, and the best ask price, i.e., the lowest price a seller is willing to accept. As investors we follow the same line of reasoning. We want to buy or sell our options at the best price possible. Consequently, when we place an order on the markets, our goal is to get buyers to pay our price when we want to sell and get sellers to accept our price when we want to buy. The party that is the least eager to trade always has the most bargaining power. Eager investors must buy or sell at the listed prices if they don’t want to miss their chance. This guarantees that their trade will be executed based on the listed quantities and prices.

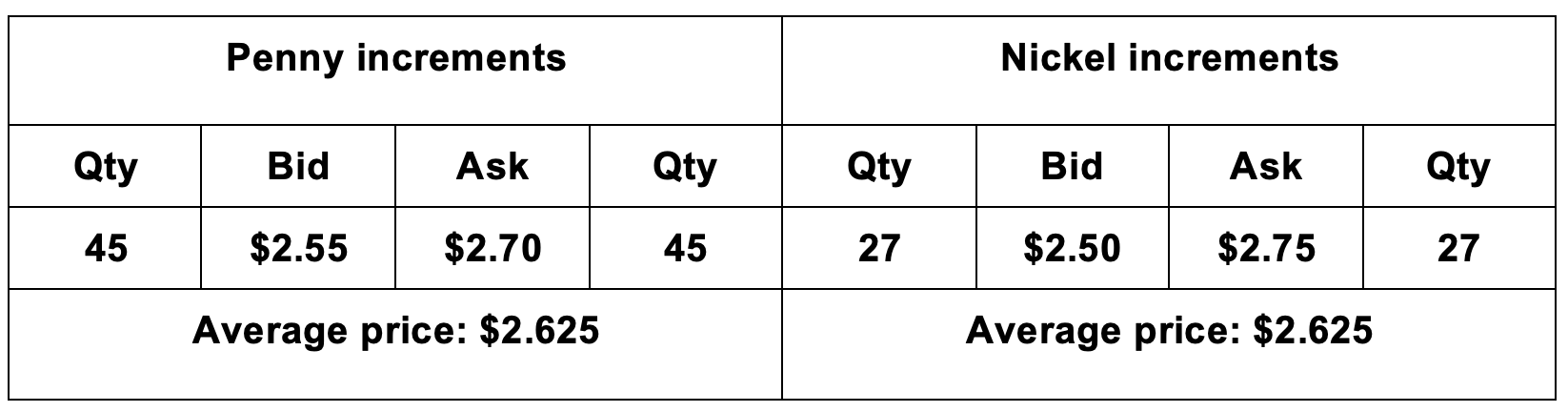

Table 2: Market comparison for options trading in penny and nickel increments

Table 2 above shows the quantities and bid/ask spreads for options trading in increments of $0.01 and $0.05. It shows that an eager seller could sell an average of 45 contracts at $2.55 if the options were trading in penny increments, but could only be sure of selling 27 contracts at $2.50 if they were trading in $0.05 increments. This means penny trading offers an additional gain of at least $225 (45 x $0.05 x 100 stocks per contract). The same holds true for an eager buyer, who could buy an average of 45 contracts at $2.70 if the options were trading in penny increments versus 27 contracts at $2.75 if they were trading in $0.05 increments. Once you factor in the opening and closing transactions, an eager investor who wants to trade in average quantities could save an average of $450 for a single position. All of these small gains build up over time and could make the difference between a winning and losing strategy over the long term.

A patient investor could try to boost their returns by placing an order at a price between the bid and ask. Entering an order at the average of the bid and ask prices is the most common technique. As we can see in Table 2 above, the average of the bid and ask prices are identical for both options: $2.625. However, a patient buyer could place a purchase order at $2.63 if the options were trading in penny increments and at $2.65 if they were trading in $0.05 increments. For patient investors, placing the order at the midpoint means there is no guarantee that the order will be executed at their price. However, in the first case, they can increase their order price penny by penny until they reach the ask of $2.70 (i.e., seven times). In the second case, they can only raise the price twice (in increments of $0.05) before reaching the ask of $2.75. Once again, penny trading offers a slight advantage.

The most effective way to achieve best execution is to consider a security’s short-term trend. Consequently, if I want to buy call options but I’m in no rush to do so, when the security is on an upward trend, I’d normally place a buy order at $2.65 for penny-traded options and $2.70 for options traded in increments of $0.05. But if the security is on a short-term downward trend, I’d set my buy order price at $2.60 for penny-traded options and $2.65 for options traded in increments of $0.05 in the hope that an eager seller takes me up on the offer. The same holds true when I’m placing a sell order but I’m in no rush to sell. If the security is on a short-term downward trend, I’d set my sell order price at $2.60 for penny-traded options and $2.55 for options traded in increments of $0.05. If the security is on a short-term upward trend, I’d set my sell order price at $2.65 for the penny-traded option and $2.60 for options traded in increments of $0.05 in the hope that an eager buyer takes me up on the offer.

Of course, this method does not guarantee the trade will be executed at the price we want, since market conditions can change suddenly: a trend that’s moving downward over the short term could start moving upward and vice-versa. In these situations, we should adapt our strategy and react quickly, but above all we must make sure not to panic. Because of this, I recommend against placing market orders for options because this can lead to some unhappy surprises. Let’s say you place a market order thinking you’ll buy your options at $2.70 but someone faster scooped them up before you did. Since it’s a market order, it will then be executed at the next quoted price, which is higher than $2.70. If that price is $3.00, your order will be executed at $3.00. I’d rather miss an opportunity than open up a position at a bad price. Over the long term, these little details will impact your portfolio’s returns.

Good luck with your trading, and have a good week!

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

[1] Source: Montréal Exchangehttps://www.m-x.ca/f_circulaires_en/117-15_en.pdf)

[1] Source: Montréal Exchangehttps://www.m-x.ca/f_circulaires_en/117-15_en.pdf)

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.