Covered Calls: Managing Risk Exposure and Generating Value During Volatile Times

Key facts on covered calls

This strategy consists of writing a call that is covered by an equivalent long stock position. It represents a simple way for investors to manage their short-term risk exposure, allowing them to earn premium income (i.e. the money received from writing the calls) in return for part of the stock’s upside potential until expiration of the call. This article discusses selected historical examples and how the strategy can be deployed to achieve different investment goals.

This strategy may be best viewed as:

- A partial stock hedge that does not require additional up-front payments

- A good exit strategy for a particular stock

Covered calls are usually put in place by investors:

With a neutral or bearish view of the market who seek protection from some of stock’s downside

Who want to collect a premium on options on stocks experiencing a high volatility

The Montréal Exchange (MX) has published a guide1 for investors interested in learning more about how the strategy works. MX also provides a Covered Call Screener2 for optimal selection of strike and expiration for investors who are ready to start implementing this strategy.

Defining option expirations and moneyness according to the scenario

A covered call strategy can be adjusted according to the scenario that the investor forecasts or expects to face in the near future. More importantly, by selecting from among different expirations and strikes, investors can adapt their covered call strategy to better suit their beliefs and investment objectives. To demonstrate the full potential of this strategy, the following examples show how a covered call strategy compares to simply buying and holding (“BH”) the underlying asset (a stock), using different combinations of strikes and expirations. Each coloured segment of the covered call charts represents a roll of the strategy where the investor holds a long position on the underlying asset (i.e. the stock) and a short covered position on the call.

To facilitate comparison across different examples, instead of using the option’s strike, we convert it to moneyness.3

Therefore, investors who expect a significant drop on the stock’s price would be better served by an ITM option to mitigate their losses, while investors who are afraid of underperforming during a bull market rally would be better served by an ATM or OTM option.

Examples:

In all the following examples, buy and hold strategy (BH) and covered call strategy (CC) returns are applied to a base 100 to facilitate comparison of results over the historical series.

Generating income with volatile stocks

Our first example, spanning from 2015 until the end of 2018, demonstrates how a covered call strategy can be used to extract income from stocks experiencing high volatility. Option prices are strongly affected by the volatility of the underlying asset, so Suncor, because of its volatility over this period, could have been considered by an investor wishing to generate income using derivative instruments.

Suncor Energy (“SU”) is Canada’s largest energy firm. In 2015 it reported gross proved and probable reserves of 7.6 billion barrels of oil equivalent. Its financial review4 presents a company in a volatile industry, with net income that fell 26% from 2017 to 2018, only to bounce back 86.3% from Q1 2018 to Q1 2019.

This uncertainty is reflected in the stock’s daily annualized volatility of 25% on the period.5

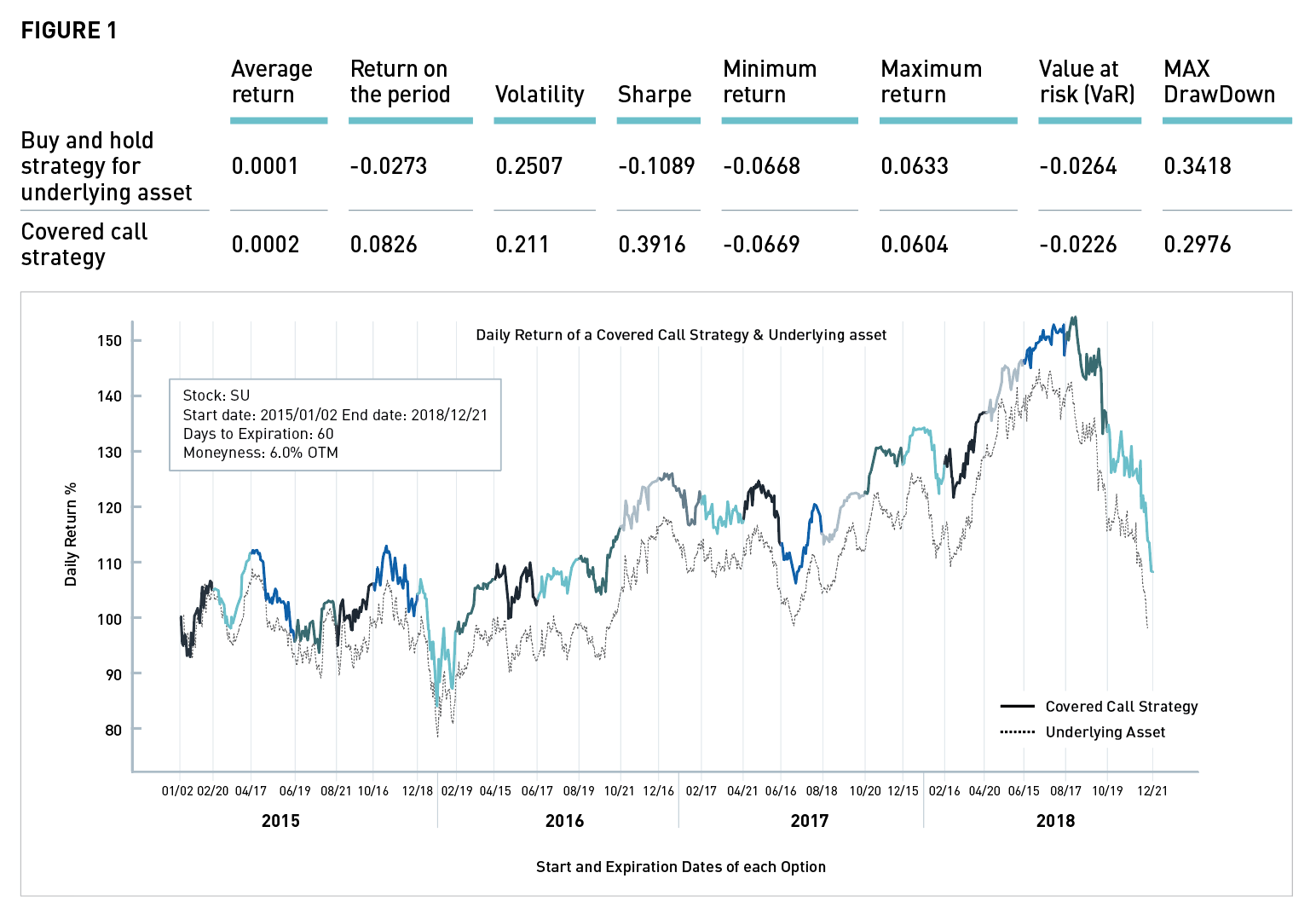

Figure 1 presents a covered call strategy deployed during a 4-year period using 6% OTM options with a 60-day expiration.6

In this example, not only is the volatility of the covered call strategy 16% less than that of owning the stock (i.e. 25% vs. 21%), the covered call strategy has a positive return of 8% on the period, while the stock finished the period in the red (i.e. -3%).

Additionally, the covered call strategy achieves this positive return with a maximum drawdown (the return, from peak to trough, during the period) that is 13% lower than the buy and hold alternative (i.e. 34.18% vs. 29.76%) without significantly sacrificing its maximum return (i.e. 6.33% for the buy and hold vs. 6.04% for the covered call).

This example should reinforce the idea that writing calls on stocks with high volatility can generate a significant improvement on several different risk metrics, even when the market is trending upward.

Protecting your position during times of uncertainty

One common question posed by investors who are starting to use covered call strategies is how it can be used to manage the position’s risk during times of high volatility and uncertainty.

To illustrate this situation, the financial crisis of 2008-2009 provides a perfect scenario for demonstrating the usefulness of a covered call. September 2008 is considered a key moment in what has been called the Great Recession of 2008. In this month Lehman Brothers, a 100-year-old financial services firm, went bankrupt after the Federal Reserve declined to guarantee its loans. This triggered a global panic and caused the Dow Jones to post its worse decline in a decade.

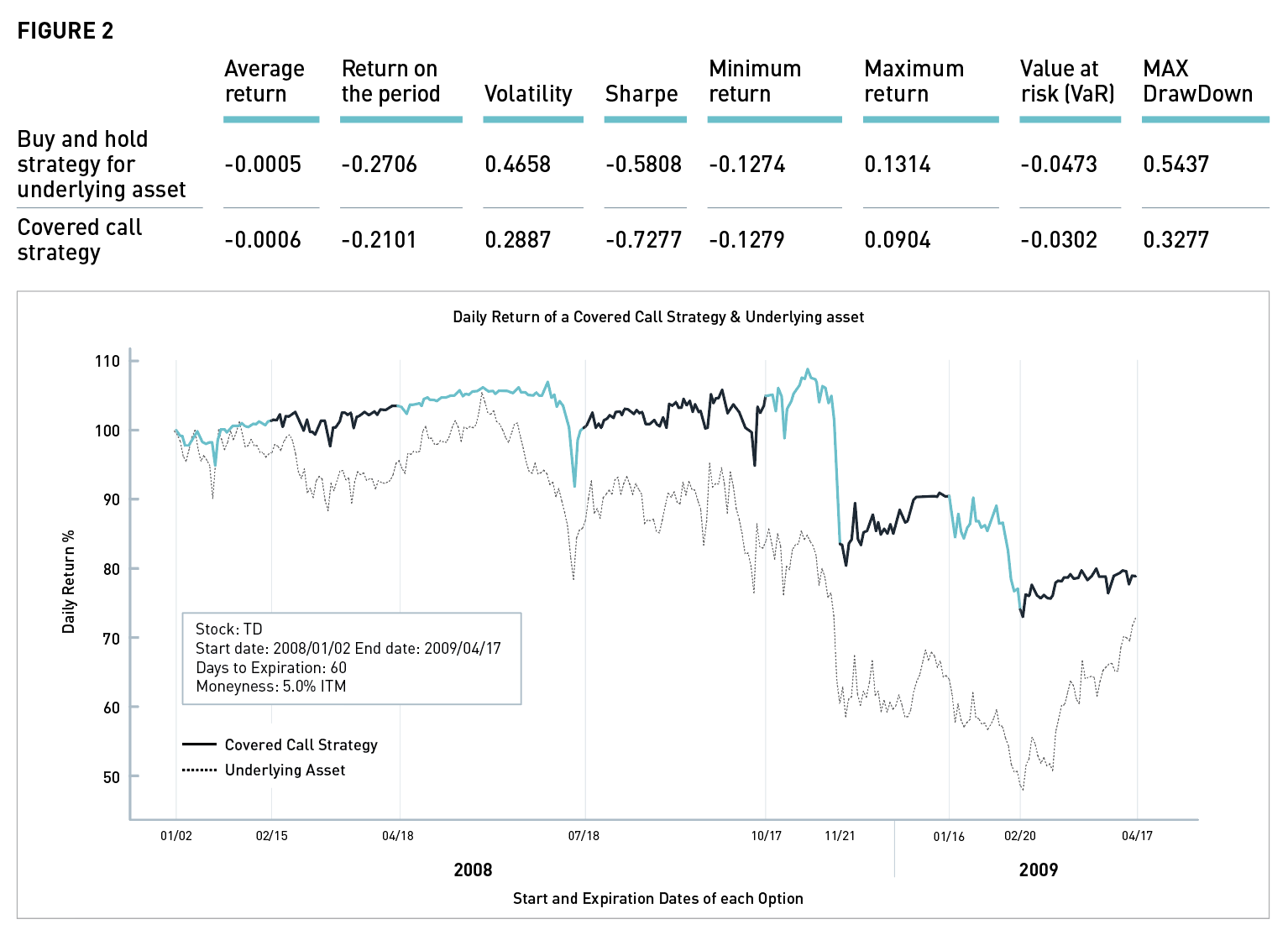

The example presented in Figure 2, covering the period from the beginning of 2008 to mid-2009, shows how an in-the-money (ITM) covered call could have been used to minimize the loss on a position on a stock in the financial sector during the crisis. Although the investor finishes with a loss, with both the covered call and buy and hold strategy, the improvement provided by the covered call layer stands in stark contrast to the BH strategy.

The first important point is that the loss has been reduced by about 22% (-27% for the BH vs. -21% for the CC) on a relative basis. More importantly, the volatility and the maximum drawdown of the CC position are 40% lower compared to the BH strategy (i.e. 47% vs. 29% and 54% vs. 33%, respectively), providing a cushion of protection and reducing the position’s uncertainty.

This kind of systematic use of covered calls is particularly appropriate for clients that either need or want to keep a certain position during a turbulent time, highlighting the effectiveness of the covered call as a hedging and risk management tool.

Generating income in a sideways market

Our last example involves BlackBerry Limited, a Canadian multinational company specializing in enterprise software and the Internet of things.

Formerly known as Research In Motion (RIM), the company’s sales peaked at almost $20 billion in 2011 before dropping to less than $4 billion in 2015. At the end of 2015, BlackBerry launched Android smartphones, starting a transition period from its former business model.

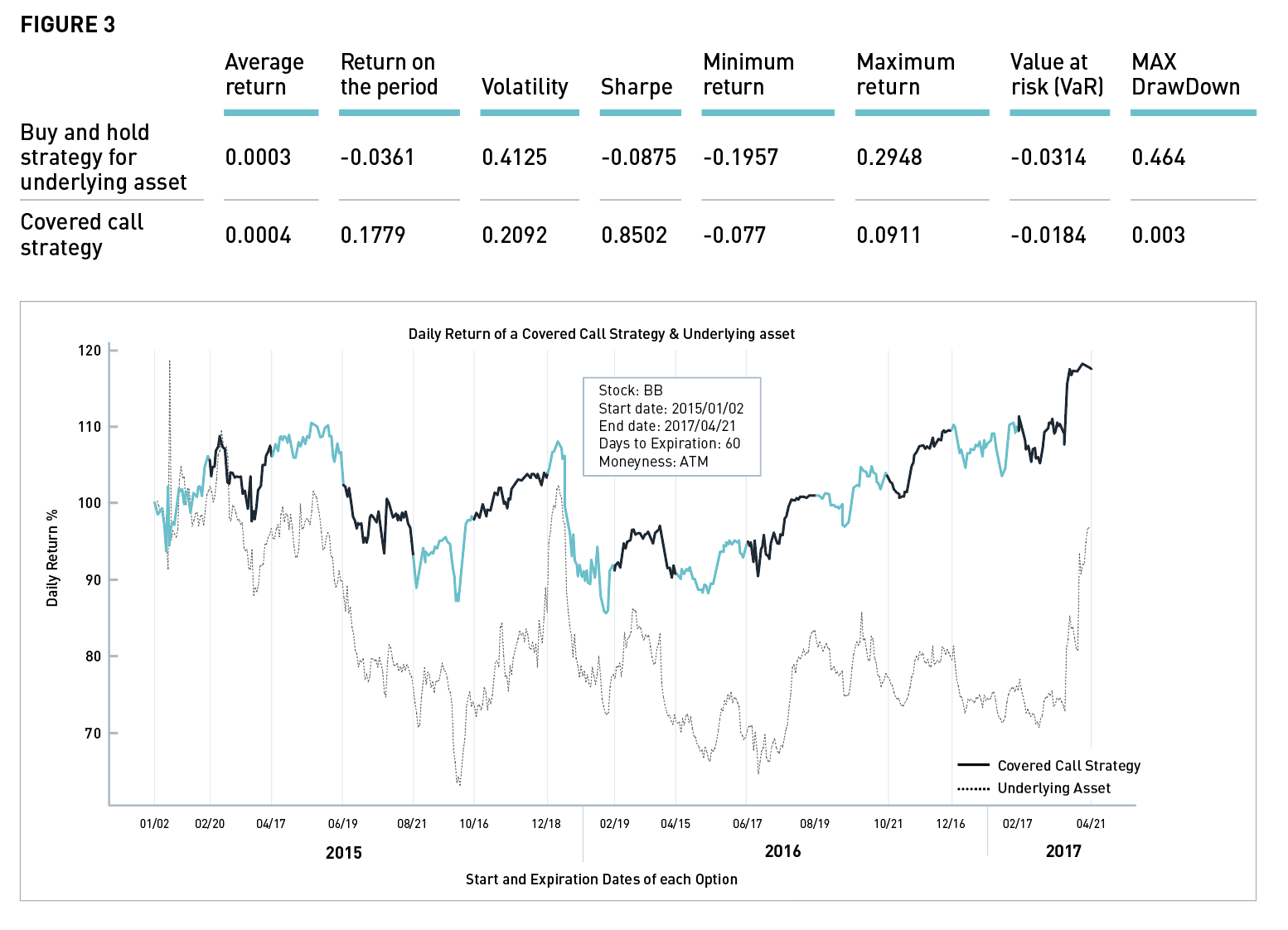

All this uncertainty is reflected in the stock’s dynamic, presented in Figure 3. Although the stock price barely moved in the period from 2015 to mid-2017 (-4% across the entire period), an annualized daily volatility of more than 40% indicates the market’s doubts over the company’s future. This uncertainty is reinforced by a maximum drawdown of almost 50%.

All these characteristics (i.e. a stock caught in a sideways drift and high volatility) represents an interesting scenario for deploying a covered call strategy to generate income due to the richness of the option’s premium. In fact, in this example, if we compare the results of deploying a systematic at-the-money (ATM) 60-day call writing strategy with the BH strategy, the results accumulated after 2-1/2 years are significant. Not only is the CC strategy profitable (17.79% vs. -3.61 %), it achieves this result with half the volatility of the BH strategy (20.92% vs. 41.25%).

Not only is the CC strategy profitable (17.79% vs. -3.61 %), it achieves this result with half the volatility of the BH strategy (20.92% vs. 41.25%).

This example shows how selling rich options (i.e. options with a high premium due to the high volatility of the underlying asset) can be a profitable strategy throughout a sideways market.

Conclusion

In moments of high uncertainty (i.e. high volatility), a savvy investor can use a covered call strategy to either extract revenue from the market or partially protect a position. If the investor believes that the underlying asset will begin a moderate upward trend, using an OTM covered call may produce good results. On the other hand, if the investor believes that the stock will continue to move sideways, using an ATM covered call may deliver better results. Finally, an investor who wants to reduce the potential losses on a position during a downward trend could consider an ITM covered call strategy.

These selected examples demonstrate the mechanics of deploying a systematic covered call strategy. Investors willing to delve deeper into the world of options will strongly benefit from learning when to use different variations of the covered call strategy to optimize their investments.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

1 Source: https://www.m-x.ca/f_publications_en/options_strat4_en.pdf

2 Source: https://m-x.ca/marc_options_info_calc_en.php

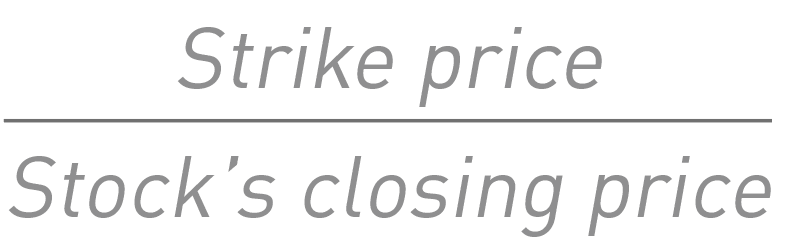

3 Moneyness is usually defined as  and presented as a %. Hence, a call that has a moneyness of 5% out-of-money (OTM) has a strike that is 5% above the stock’s current price. Conversely, a call that has a moneyness of 5% in-the-money (ITM) has a strike that is 5% below the stock’s current price.

and presented as a %. Hence, a call that has a moneyness of 5% out-of-money (OTM) has a strike that is 5% above the stock’s current price. Conversely, a call that has a moneyness of 5% in-the-money (ITM) has a strike that is 5% below the stock’s current price.

4 Source: Bloomberg, June 18, 2019

5 Source: Toronto Stock Exchange (TSX)

6 Source: Montréal Exchange (MX)

7 Source: https://www.blackberry.com/us/en/company/investors

8 Source: https://www.wsj.com/articles/blackberry-to-launch-android-smartphone-1443181465

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.