Is the Extreme Bullish Speculation in Oil a Warning?

The OPEC agreement to cut production back in late 2016 ushered in a further wave of enthusiasm that pushed oil and the energy sector higher, with the belief that the oil bear market was over and long gone. Coupled with the Trump reflation trade enthusiasm, we have witnessed a very strong finish in 2016. The price of WTI oil finished the year up over 100%, from its $26.05 low on February 11, 2016. At the same time, the iShares S&P/TSX Capped Energy Index ETF (TSX:XEG) ended the year up over 68% from its low of $8.33 on January 20th 2016.

The big question- is the enthusiasm overextended?

One only needs to turn to the commitment of trader reports provided by the CFTC to get an interesting clue. The CFTC has been publishing the report for many decades to better inform and disclose to the public the dealings in the futures markets. Since being published, traders have sought to read the tealeaves to gain an understanding the positioning of speculators and commercial hedgers.

How do the CoT reports get broken down? They seek to categorize all traders into 3 categories, commercial hedgers, large speculators and small speculators. The commercial hedgers are generally described as large traders, most commonly large corporations, using the futures markets primarily for hedging their business activities. Alternatively, the large speculators are commonly large funds that are positioning speculatively, in an attempt to profit from anticipated moves higher or lower. The small speculators are then classified as all the nonreportable activity, because they do not meet the size requirement to be reported.

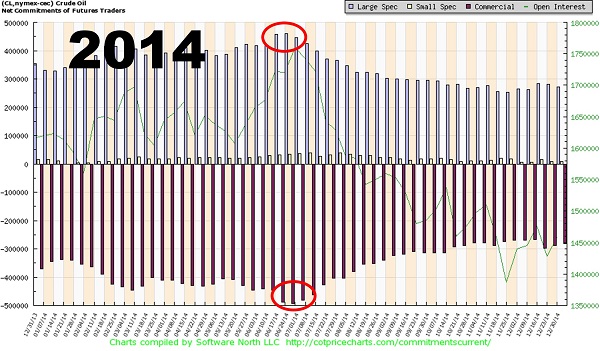

First observation in the crude oil market is that because commercial hedgers are primarily using the futures market to lock in production costs, they are perpetually short as seen with the burgundy bars below. The purple bars signify the open interest by the large speculators. The first chart below is the 2014-year report. Note that peak level of speculation was reached on July 1st 2014, well over 450,000 contracts net-long when oil was trading at $105.00 a barrel. Subsequently oil began a significant bear market that devastated oil for the subsequent 18 months.

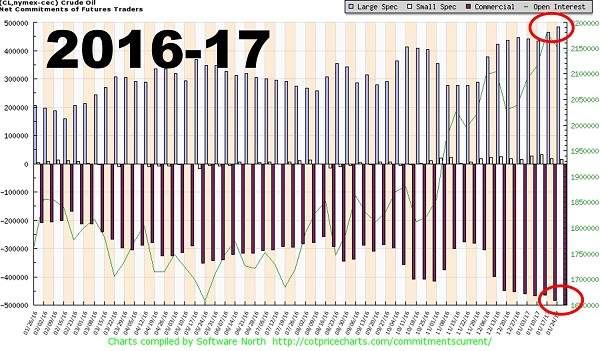

Interestingly, we find ourselves today with just shy of 500,000 net contracts long amongst large and small speculators, exceeding the levels seen back in 2014.

The reports are not short-term market timing tools and there are no guarantees that this plays out the same way, considering today’s global macro and geopolitical situation. But, if there is any change in sentiment, the process of speculators unwinding their long positions could provide an imbalance of liquidity that could drop prices lower. This could quickly act like a buzzkill for those that continue to anchor themselves on a continued recovery in the energy space.

At minimum, there is ample reasons for investors that own energy companies and oil exposure to buy protection to hedge downside risk. I covered the process of hedging in prior blog articles like this one:

For those that are not risk adverse and are willing to speculate, consider buying longer term put options on oil and vulnerable energy companies. While there is the risk of loss, you may find asymmetry to downside opportunities.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.