Writing covered call options to generate more income

With interest rates currently at all-time lows, finding ways to generate income in our security portfolios is a challenge. However, the strategy of writing covered call options (WCCO), whether applied systematically or on an ad hoc basis, allows us to generate additional income through the premiums received.

This is the third in a series of four articles on writing covered calls. It explains how to generate revenue using this strategy either systematically or on an ad hoc basis.

Systematically generate income

The strategy of writing covered calls to systematically generate income consists of writing one call option contract for every 100 securities held in a portfolio, repeatedly from one expiration date to the next, regardless of market conditions. This strategy is generally executed on units of exchange-traded funds (ETFs) because they are less sensitive to the publications and news that can affect corporate shares. Although investors often tend to choose at-the-money call options that expire in approximately 30 days for this purpose, in-the-money or out-of-the-money options with weekly or annual expirations can also be used. The fourth article will discuss these differences in more depth.

Simulation of a portfolio involving the repeated writing of covered call options on XIU

For the purposes of this article, we have simulated a portfolio in which covered call options have been written repeatedly on iShares’ S&P/TSX 60 ETF (XIU). Let us call it the “XIU WCCO” portfolio. The portfolio included both a long position in units of the XIU ETF and a short position in nearly at-the-money call options on XIU with an expiration of approximately 30 days. Whenever a series of options could be exercised at expiration, they were bought back at a loss in order to retain the underlying units. This systematic use of covered call option writing produced results that were comparable to simply holding XIU units.

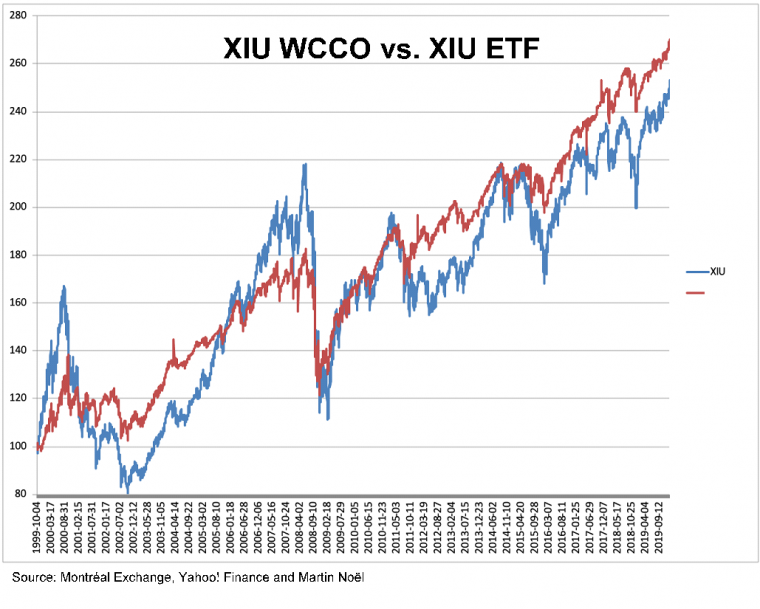

Chart 1: Comparison of the XIU WCCO portfolio with XIU units from October 4, 1999 to January 17, 2020

As the above chart shows, during the period from October 4, 1999 to January 17, 2020 the XIU WCCO portfolio generated higher returns with lower volatility than the XIU ETF. We can also see that the XIU WCCO portfolio underperformed the ETF during periods of sustained growth due to the lost income above the strike price of the call options written. In contrast, the portfolio performed better than the ETF during periods of sharp decline due to the premiums received on writing the call options. Although nothing is fail-proof, similar results could be obtained by executing this strategy on other index ETFs.

Generating income on an ad hoc basis

Instead of writing covered calls systematically, the strategy could be implemented on an ad hoc basis. In this case, the investor chooses the best time to execute the strategy based on an analysis (usually technical) of the underlying security. The investor will be trying to predict a trend reversal, which may occur following a sharp rise in the price of a security when such growth is slowing. The most widely used technical indicator for anticipating such reversals is the Relative Strength Index (RSI), which is used to measure the strength of movement in one direction or another. When the movement runs out of steam and the security is overvalued or undervalued,[1] the conditions for a trend reversal are very likely present (of course, nothing is guaranteed).

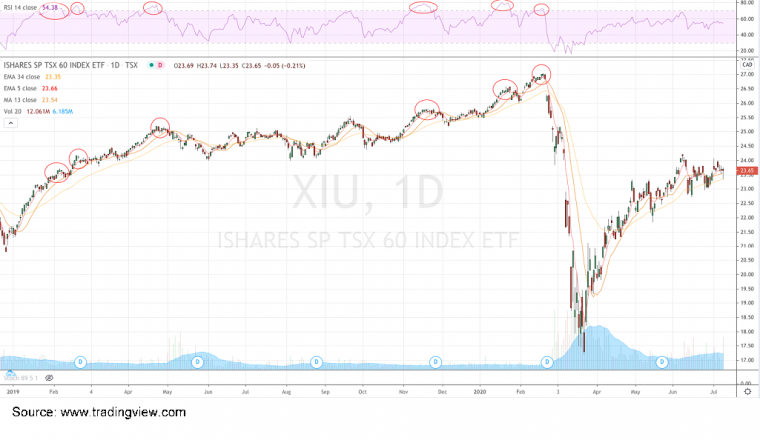

Chart 2: RSI indicator based on daily price changes in XIU to July 9, 2020 ($23.65)

The above chart shows changes in the RSI indicator[2] as a function of daily changes in the price of XIU from January 2019 to July 9, 2020.[3] The chart shows six periods when the RSI indicator was in the overbought zone, indicating that units in the ETF were overvalued. For the purposes of generating income on an ad hoc basis, these periods presented opportunities to write covered calls. While this very simple technique may not be perfect, it has the advantage of allowing an investor to avoid writing call options when prices are at their lowest. Several other indicators or techniques may be used in combination to determine more conclusively whether or not the security is indeed in overbought territory. Here the objective is to hold the security for as long as possible before writing the calls. Once the options have been written, the position will be held until the call options we have written either expire or can be repurchased for a price between 10% and 20% of their initial value. If the price of the security continues to rise rather than pause or decline, the call options will likely be exercised by their holder, and the investor will be forced to sell the underlying assets. In this case the investor will receive a notice of assignment. So the investor always needs to decide whether to hold the options until expiration and run the risk of being assigned. If an investor does not want to be assigned, the call options written can be bought back before expiry, possibly at a loss.

Conclusion

It is possible to use the covered call writing strategy to generate income, either on a systematic or ad hoc basis. Applied systematically and independent of what may be happening in the market, this technique generally makes it possible to generate returns that are equal to or even better than those received by simply holding the underlying security, and with much less volatility. Investors interested in trying to optimize this strategy should consider the ad hoc approach. In this case, the investor will try to hold the underlying security for as long as possible as it trends upward and only write covered calls when the trend shows signs of weakening. Several indicators may then be used to arrive at this decision. The fourth and final article of this series will discuss the various issues that must be taken into account when writing covered calls, such as the selection of a strike price, the choice of an expiration date and the impact of dividends on the premature exercise of call options by the holder.

“Before you start using the strategies mentioned in this article, we suggest that you test them using the Montréal Exchange’s trading simulator.

Good luck with your trading, and have a good week!

The strategies described in this blog are for information and training purposes only. They should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

[1] The RSI indicator moves in a range of 0 to 100. A reading below 30 generally indicates that the security is becoming oversold and a reading above 70 indicates it is becoming overbought. To learn more about this indicator, conduct a search on the topic using your preferred search engine.

[2] We used the default settings for the RSI indicator, i.e. a period covering 14 trading sessions.

[3] Note that this analysis is of no real significance and is used here for educational purposes only. An analysis covering a longer period of time, combined with other indicators, may produce more conclusive results in either direction.

President

Monetis Financial Corporation

Martin Noël earned an MBA in Financial Services from UQÀM in 2003. That same year, he was awarded the Fellow of the Institute of Canadian Bankers and a Silver Medal for his remarkable efforts in the Professional Banking Program. Martin began his career in the derivatives field in 1983 as an options market maker for options, on the floor at the Montréal Exchange and for various brokerage firms. He later worked as an options specialist and then went on to become an independent trader. In 1996, Mr. Noël joined the Montréal Exchange as the options market manager, a role that saw him contributing to the development of the Canadian options market. In 2001, he helped found the Montréal Exchange’s Derivatives Institute, where he acted as an educational advisor. Since 2005, Martin has been an instructor at UQÀM, teaching a graduate course on derivatives. Since May 2009, he has dedicated himself full-time to his position as the president of CORPORATION FINANCIÈRE MONÉTIS, a professional trading and financial communications firm. Martin regularly assists with issues related to options at the Montréal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.