Why and how to use an Options Calculator

The Montreal Exchange (MX) offers users an online tool to help understand and calculate the theoretical value of options. Known as the Montreal Exchange option calculator, users can take advantage of a free offering to better understand potential investment returns and risk management decisions.

Montreal Exchange option calculator: why you should use it

The MX option calculator is used to evaluate the premium of a Canadian equity, ETF, index, and currency option. It can be used for both American or European style options and can be tailored to factor in dividends.

Users have the ability to input a delayed quote from an existing options contract or use theoretical data.

The option calculator can be accessed at https://m-x.ca/optionscalculator

How to use the Montreal Exchange option calculator

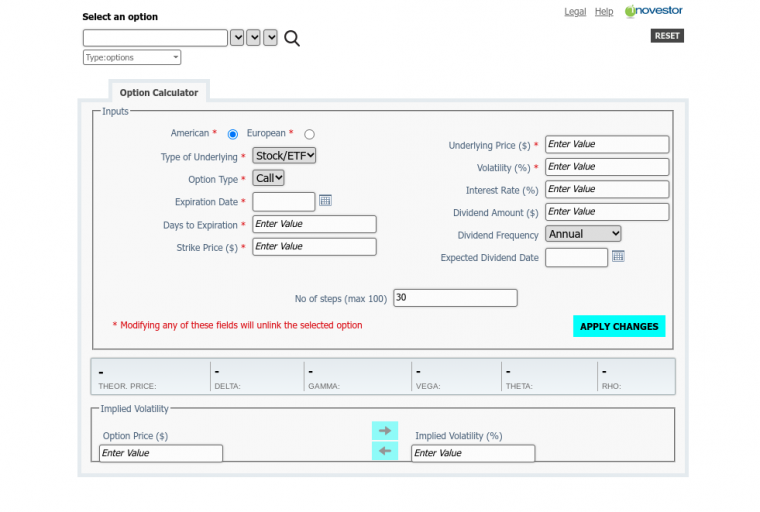

Once you access the free to use Montreal Exchange option calculator, you will need to input data in the blank fields. Important to note that the first step required is to select American or European style options.

The S&P/TSX 60 index options (SXO) are European-style options. The same is true for currency options, especially options on the US dollar (USX). European style options can only be exercised on the expiration date.

This contrasts with iShares S&P/TSX 60 Index Fund (XIU) options that are American-style options. Also, options on stocks and ETFs are American style. This type of option can be exercised on or before the expiration date.

With that out of the way, you will need to input eight inputs.

- Type of Underlying = the desired stock, ETF, index, or currency.

- Option type = call or put.

- Expiration Date = the expiration month or the days until expiry.

- Strike Price ($) = the strike price of the option you wish to evaluate.

- Underlying Price ($) = the current price of the stock or index.

- Volatility (%) = the fluctuation in the market price of the underlying asset. This can be obtained through your stock broker, another financial source, or an estimate.

- Interest rate (%) = the risk free interest rate that in most cases is equal to the annualized Treasury Bill rate for the period corresponding to the maturity of the option.

- Dividend amount ($) = the quarterly dividend amount paid to shareholders.

Once all the variables are entered into the option calculator, simply press the calculate. The results will generate the theoretical price of the option, along with several other variables that are known as the “Greeks” because they are represented by Greek letters.

Understanding the ‘Greeks’

The Montreal Exchange options calculator offers more than just the theoretical price of an option. Specifically, the value of the five “Greeks” are very important for measuring the change in value of an option given a change in one of the pricing variables.

The five “Greeks” include:

- Delta represents the change in option price given a small change in the underlying stock price.

- Gamma is the rate of change of an option’s delta derived on a single-point move in the delta’s price.

- Vega measures the change in price of an option for a small change in the level of implied volatility.

- Theta, also known as the rate of decay, represents the rate of change in price of an option for a small change in the time to maturity.

- Rho represents the change in value of an option given a small change in the value of the risk-free interest rate.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2022 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.’s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this article reflect those of the individual author. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. and are used under license.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.