Simplifying Complex Orders

One of the best features of options is that they can facilitate a wide variety of strategies. Are you bullish on a stock but don’t expect a rise in volatility? Then a call or put spread might be for you. Do you expect a big move in an ETF, but don’t know which direction is more likely? Then a straddle may be the correct trade to capitalize on that. Any order that uses a combination of options or combines options with stocks is considered a “complex order.” This can be an unfortunate misnomer, as many complex orders are in fact quite straightforward – especially if your broker supports the ability to enter complex orders as a single trade.

Many of you are familiar with terms like “strangle,” “butterfly” and “iron condor.” If not, I would highly recommend it. There is a concise, user-friendly guide to options strategies available here on the MX website. This guide is a wonderful introduction that will help you understand how options can be combined with other options or their underlying instruments to create strategies that express bullish or bearish views on the price or volatility of stocks and ETFs. Some strategies allow users to limit their risk, while others may allow them to generate additional income. Some might even accomplish both.

Let’s assume that an investor is fully invested in equities, but is getting nervous about the market. It would be logical for her to consider buying protective puts on XIU to hedge her broad market exposure. Using prices from May 26, 2020, when XIU closed at $23.01, a 22 strike put expiring on August 21 was offered at $0.80. The breakeven on that trade is $21.20 (the $22 strike minus the $0.80 premium), meaning that XIU will need to fall by over 8.5% before that hedge becomes profitable. The investor is indeed protected against a market correction, and the put can profit substantially if there is a significant selloff, but a fairly significant cash outlay is required to achieve that protection.

Suppose instead that the investor was willing to cap her downside protection in order to substantially reduce her cost. One way to do this would be to simultaneously sell a 21 strike put with the same August expiration for $0.52. This trade is known as a bear put spread or a bear vertical put spread. Adding the sale of a put with a lower strike reduces the cost of the protection to $0.28, and raises the breakeven to $21.72. This means that the protection begins to take effect if XIU drops by about 6%, rather than 8.5%. The tradeoff is that there is a limit to this protection. The maximum profit is capped at $0.72 (the $1 difference in strikes, less the 28-cent net cost) and is achieved no matter how much XIU might fall below $21.

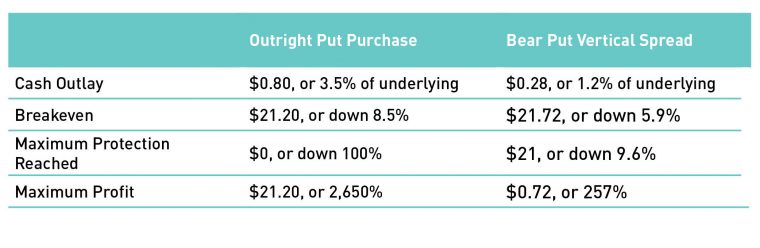

Compare the two potential trades:

Table 1: Comparison of Outright Put Purchase with Bear Put Spread Purchase

Some might be seduced by the incredible profit potential provided by the outright put purchase, but this needs to be put into perspective. It is unrealistic to expect XIU to fall to zero. It makes more sense to compare the level at which the outright put purchase would match the maximum percentage profit of the put spread. A 257% profit on the $0.80 purchase would require a payout of $2.06. That would occur if XIU closes at or below $19.94 on expiration, or 15.4% below the current price. The outright put provides more protection in the event of a catastrophe, but at a higher cost and with less protection from a smaller decline. The vertical spread is far less costly, and its higher breakeven point means that it is more likely to provide protection (small moves are statistically more likely than large ones), although that protection is limited.

If the investor opts for the vertical spread, there is a significant advantage to using a broker who can directly handle complex orders. The investor could certainly try to execute both sides of the trade manually – paying the offer for the 22 puts and hitting the bid on the 21 puts in rapid succession – but there is no guarantee that both sides will be executed. In fact, there is a chance that the short put could be executed without buying the long put. She could also try to place 2 limit orders inside the posted bid and ask, but that exposes her to an even greater risk of getting one side executed but not the other.

It would be far preferable to place one limit order for the entire package with a broker who can directly handle complex orders. All legs of the trade would be entered and executed as one. This allows a customer to place a limit order inside the posted bid and ask prices while eliminating the possibility that only one side of the trade is filled. In the example above, the customer could place a limit order bidding $0.26 for the spread. That would be a one cent improvement on each leg of the trade, and would reduce the cost by 7%. There is no guarantee that the limit order would be filled, but either both sides are executed at once or neither one is.

Experienced traders and investors frequently use complex orders to achieve a wide range of objectives. Everyone who utilizes options as part of their investment strategies should consider these powerful tools. There are ample resources to learn more about complex orders, and brokers who are able to facilitate them almost as easily as if a customer trader placed an individual options order. I encourage you to familiarize yourself with how complex orders can be made simple.

The author is a senior officer of an affiliate of Interactive Brokers Canada Inc. (IBC), an approved participant of the Bourse de Montréal Inc. (MX) and a clearing member of the Canadian Derivatives Clearing Corporation (CDCC). Nothing in this article should be considered an investment or trading recommendation by IBC or any of its affiliates. Trading in options is highly speculative in nature and involves a high degree of risk. Before trading options listed on the MX and issued by the CDCC, one should read and fully understand the current CDCC disclosure document entitled “The Characteristics and Risks of Listed Canadian Options.”

Chief Strategist, Interactive Brokers

Steve Sosnick is the Chief Strategist at Interactive Brokers. He also serves as Head Trader of Timber Hill, the firm’s trading division, and is a Member of Interactive Brokers Group, the firm’s holding company. Steve has held numerous roles in the organization since joining Timber Hill in 1995 as Equity Risk Manager and Options Market Maker. He led the firm into Canada in 1998 and managed Timber Hill Canada from its inception. Much of Steve’s career was spent quietly developing and implementing algorithmic and electronic trading strategies for stocks and options before moving into a more visible role as the firm’s Chief Options Strategist and later as Chief Strategist. Steve has guest-authored several columns in Barron’s and makes regular live appearances on Bloomberg TV and Radio, as well as Yahoo Finance. He has held board memberships at various stock exchanges, serving as a board member of CBSX, NSE and ISE-SE. In Canada, he is a member of the MX Regulatory User Group and the IIAC Derivatives Committee. Prior to joining Interactive Brokers, Steve held senior trading roles at Morgan Stanley, Lehman Brothers, and Salomon Brothers, where he completed the firm’s famed training program. He holds both an MBA in Finance and a BS in Economics from The Wharton School of the University of Pennsylvania.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.