Peak Optimism Weighing on Canadian Banks

Reflecting on the last 9 months, we can decisively identify the global reflation trade as the primary driver of the equity rally. This was considerably accelerated by the Republican sweep in the U.S. elections driven by expectations of new growth driven by tax cuts and fiscal spending. During that roaring bull advance, it was the financials and particularly the money center banks that decisively took on the leadership role. After so much easy money being made, there is an aura of optimism that brings out the skeptic in me.

With the failure for the Republicans to repeal Obamacare, each passing day allows the reflation trade investors to begin second guessing their narrative. Since the start of the new year, we have seen the flattening of the yield curve, relative outperformance of the defensive sector, the turn down in oil prices and the growing concerns that the tax cuts and infrastructure spending will be considerably smaller than expected.

Some of the key catalysis for the financials rallying was the idea that they would be less regulated, benefit from a Trump economic boost and the net interest margins would increase based on a belief that a yield curve would bull steepen. So, what if? What if the infrastructure build does not materialize as expected? What if the yield curve continues to flatten and the much-anticipated rise global risk premiums does not occur? Was the material rally in these banks justified?

Further to all the growing uncertainties south of the border, the situation in Canada adds further uncertainty. By their own admission, the major Canadian banks are starting to acknowledge that there is a real estate bubble, now particularly being fueled by the roaring Toronto market. http://www.cbc.ca/news/business/toronto-housing-bmo-td-1.4028032

The banks are particularly well insulated from any initial decline in homes as the riskiest mortgages have been insured by the CMHC and private mortgage lenders, but it is more the economic contagion from a reversal in home prices that could slow growth, slow new lending on the already overly extended Canadian. http://www.cbc.ca/news/canada/toronto/stephen-poloz-toronto-housing-1.4044206

While I do not want to be labeled as an alarmist and permabear, one does need to remember how the banks performed during the oil bear market decline from the summer of 2014 through early 2016. There are times when playing defense and focusing on preservation of capital should take precedence over return optimization.

So, should you sell?

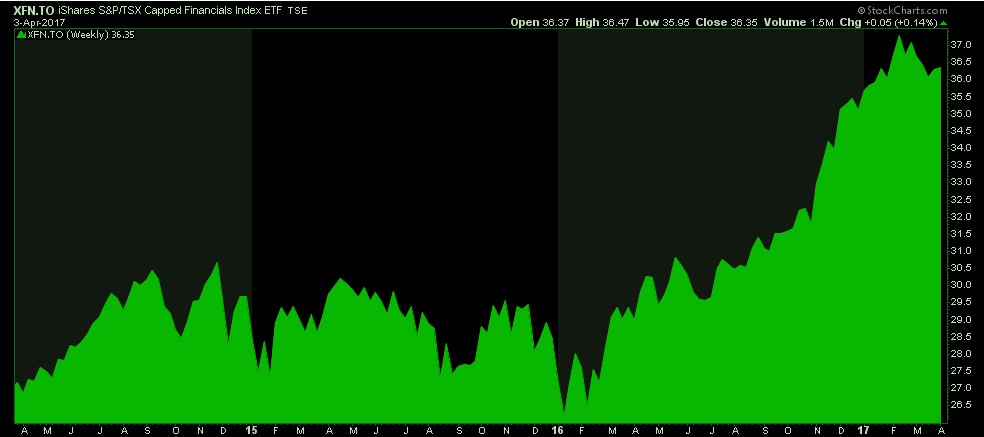

That is always the tricky proposition. There is a great quote suggesting that being out of the market early is the same as being wrong. So, anyone that sells and the market continues to advance looks foolish. Therefore, considering to hedge your bank shares with protective puts is a very viable alternative. Each investor can consider alternative ways of hedging, but one simple consideration is to calculate your total exposure to Canadian financials and to buy some out-of-the-money puts on the XFN, the iShares S&P/TSX Capped Financial Index ETF. At the time of writing, the XFN was trading at $36.35. A December 2017, $32.00 put option is asking $0.95. This represents 2.60% cost to overlay a broad hedge for the remainder of the year. For investors that find the cost of the insurance to be too costly, one can consider offsetting the costs with strategically written covered calls. The point being, if you made some solid returns over the last 6 months on your bank stocks, why not lock in some of those gains with a strategic hedge.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.