Options Brief-Week of August 28

Everyone looks forward to something for different reasons. When investors choose to invest in a company, they will wait impatiently for the most crucial announcement: earnings season. Last week, Royal Bank of Canada (TSX:RY) reported a strong third quarter which led to a dividend hike of 5 per cent to 91 cents per share. This dividend increase came as a surprise for investors mainly due to the current state of the Canadian housing sector. However, the low unemployment rate and the recent rate hike by the Bank of Canada appear to have rekindled investors faith in the financial sector. Last Friday, August 25th, RY was trading at $93.25, up $1.00 from the previous week.

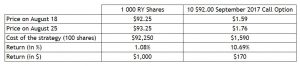

Prior to the earnings release, bullish investors could have positioned themselves to profit from this unexpected outcome. Below is a table comparing a stock purchase with buying call options to profit from an increase in the underlying stock. In order to benefit from a rise in the stock, an investor can purchase 1,000 shares of RY or as an alternative, purchase 10 $92.00 September 2017 call options. Remember that each call option controls 100 shares.

Both strategies will have benefited from the increase in the stock, but the use of options comes with a few added benefits. Even though from an absolute return perspective, the stockholder would make a greater profit than the options buyer, he would also have a much greater risk exposure ($92,250 vs $1,590). Moreover, given the options ability to provide leverage, the long call position will generate a more attractive return percentage (10.69% vs 1.08%). Note that investors will also be left with extra uninvested capital to pursue other investment opportunities, which has the potential to add extra diversification to their portfolio. For investors having a bearish outlook, the purchase of put options could have positioned them accordingly.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.