Not So Foreign: Unpacking the Currency Market and USX Options Strategies

If you have already traded options on equities but are now looking for a new asset class, you might be wondering if it is possible to blend exposure to interest rates, commodities, cryptocurrencies, geopolitics, and the global economy.

In fact, you have just described the foreign exchange (FX) market and, in particular, options on the U.S. dollar versus the Canadian dollar (trading on Montréal Exchange under the symbol USX). Here follows an overview of the foreign exchange market, plus a few options strategies to consider when trading USX.

A Currency by Any Other Name

The market goes by several names—currencies, currency pairs, exchange rates, foreign exchange, forex, FX—but whatever you call it, each currency “pair” is a ratio: the value of one nation or bloc’s currency relative to that of another.

On average, over $5 trillion of foreign exchange changes hands every day. Major currency pairs including the dollar (CAD), U.S. dollar (USD), British pound (GBP), Japanese yen (JPY), euro (EUR), and others are dynamic and liquid. Before we jump into the specifics of USX—call and put options on the value of USD in CAD terms—it is important to understand a few FX basics.

- Currency pairs. In the FX market, pairs are quoted as ratios. For example, if USD/CAD is trading at 1.2540, that means it costs CAD 1.25 and 4/10 of a penny to buy a U.S. dollar. And if you are exchanging the other way, you need to invert the pair. So CAD/USD would be:

1/1.2540 = 0.7974.

In this example, it takes a little less than 80 U.S. pennies to buy a Canadian dollar. - Interest rate differentials. What gives these currencies their value? For the most part it is due to different interest rates in the two countries in a pair, and future expectations of interest rates. A rise in interest rates in Canada relative to the U.S. would—all else being equal—make the CAD more valuable relative to USD.

- Economic fundamentals. Interest rate expectations are a function of economic fundamentals, so each data release or speech by a central banker can move the market. And in the case of CAD, commodities such as crude oil, gold and, more recently, cryptocurrencies also play a part. Commodities are a key driver of growth, but world markets are priced in USD. So in a way, fluctuations in the CAD can be a commodity proxy (see Figure 1).

FIGURE 1: INVERSE CORRELATION. Strength in USD-based crude oil (purple line) is correlated with CAD (and inversely correlated to the USD/CAD currency pair). Chart source: TradingView.

A Few Subtle Differences from Equities

If you are considering trading FX, you will want to understand how it differs from equities. First, currencies tend to be mean-reverting. That is trader-speak for the fact that, although currencies have trends and cycles like stocks, stocks generally appreciate over time. Currencies tend to ebb and flow around a band.

If you trade equity options, you know that implied volatility is typically skewed to the downside. Because stocks gradually rise by default—with occasional panic-driven meltdowns—, downside put options tend to trade at a higher level of implied volatility. Some traders say stocks take the stairs up and the elevator down.

In contrast, perishable commodities tend to skew upward, as traders fear and therefore avoid potentially running out of a commodity. This is not always the case, but it is a general tendency.

In the FX market, skew can fluctuate depending on current supply/demand dynamics. But in general, USX options—based on USD/CAD—usually skew slightly toward upside calls.

Another difference between USX and equities is contract size and the minimum fluctuation (or “tick”). Equity options contracts use 100-share increments. The contract size of a USX option is USD 10,000, and the tick size is 0.01 Canadian cents. So the USX option feels similar to an equity option in how the option’s premium translates into dollars. For example, an options premium of CAD 1.25 equals CAD 125 in notional terms. For the full USX contract specs, refer to the fact sheet.

Now for similarities. If you are comparing USX options to equity options, you should know that the same basic math applies to both. The software used to calculate theoretical values, delta, vega, and the rest of the risk metrics you might follow (collectively known as “Greeks”) works in the same way.

The same can be said of options strategies—calls and puts, bullish and bearish strategies, and any spread you might want to put on—the mechanics are the same, whether it is on an equity derivative or a currency derivative.

USX Options Strategies to Consider

Even given the similar strategy mechanics, some strategies are well suited to currency markets. Not only do currencies tend to revert to the mean, they also tend to trade at lower implied volatility than equities. Here follows an overview of options strategies for mean-reverting, low-volatility products.

- Long options for directional plays. All else being equal, lower volatility translates into lower option premiums. If you are looking for capital-efficient ways to play direction—perhaps as an interest rate play or as a proxy for the commodity or cryptocurrency market—you could buy call or put options in USX. Consider options with a delta of 30 to 40, and with enough time before expiration—30 days or more—to limit time decay (“theta“). If you are using USX as part of a commodity play (something that is quoted in USD in world markets), remember to trade the opposite direction—refer to Figure 1. So if you think crude oil might be headed higher, you could buy a put option on USX.

- Short strangles. If you see USX reverting to a mean—stuck in a range with natural endpoints—you could sell a strangle, with the strikes set just outside the perceived band. If the USD/CAD stays within the band, both options will expire worthless, and you will keep the premiums (less any transaction costs). But note: This strategy is somewhat risky, as any move outside either of the short strikes will expose you to open-ended risk. Be sure to monitor your positions, and be prepared to liquidate or roll a position if you see movement near or outside one of your short strikes.

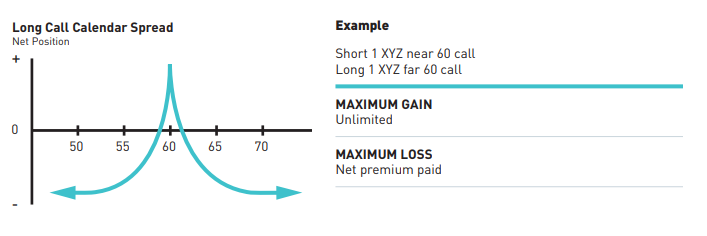

- Calendar (“time”) spreads. A calendar spread is the purchase of a call (or put) option with a deferred expiration date—say 60-90 days—along with the sale of a shorter-date call (or put) with the same strike. The objective with a calendar spread is that, as time passes, the short-term option sold will decay faster than the longer-term option, and the trade might deliver a profit if the spread can be sold for more than you paid for it. Plus, any rise in implied volatility from its low level can give this spread a tailwind. If you want some directional bias, pick strikes that are out-of-the-money in the direction you expect the market to move (see Figure 2).

FIGURE 2: LONG CALENDAR SPREAD. The max profit point of a calendar is at the strike price on the expiration date of the front leg. Be sure to liquidate or roll, either on or before that first expiration.

The bottom line: If you are looking for a new type of asset class to trade, and you have a view on the interest rate or commodity markets, consider options on the U.S. dollar (USX). You can use the same options strategies you employ in the equity options market, but with targeted exposure. Interested in learning more about these and other options strategies? Look into our regularly scheduled educational events.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange, MX and USX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. and are used under license.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.