Locking In Profits on a High Flyer

Once again, despite the risk of controversy, I find myself compelled to write about pot! In my last article, Embracing Volatility on a Canadian Disruptor, I looked at a couple of ways one might participate in a bullish technical pattern developing in the TSX:WEED price chart. At the time (August 28th, 2017) the shares were trading at $8.81. Since then, the stock has hit a high of $36.00, pulled back to $30.00 and is now at the time of writing pushing $42.00.

Chart: Courtesy of StockCharts.com

Chart: Courtesy of StockCharts.com

If we observe the price action alone, it’s easy to assume that the only way is up. Investors continue to be optimistic about the future valuation of these companies as federal and provincial governments sort out just how they will regulate both tax and distribution. That said, much of this optimism is based on speculation.

Efficient Markets

It is important to realize that in an “efficient” market, there are two sides. Investors that believe in a company’s current and future valuations who go long the stock and those that interpret the data otherwise, believing a company to be overvalued and who subsequently short the stock.

It is not unrealistic to believe that there are many investors and money managers who have a different perspective then the current “herd” of marijuana bulls. The challenge, is that shorting shares of TSX:WEED and others in the industry is not all that easy.

According to a recent article by Jenn Skerritt (Bloomberg) published in the Financial Post entitled Why it’s so difficult to bet against Canada’s Marijuana boom, “Short-selling Canadian marijuana stocks is expensive as the values of companies continue to climb and few shares are available to borrow, a key step in betting against a security. The brokerages of top Canadian banks don’t trade those stocks, and smaller firms charge prohibitive interest rates to lend them.”

The process of shorting shares of a company begins first with “borrowing” them and then selling them to an investor who believes the shares will trade higher. The short seller collects the proceeds of the sale but has an obligation to return the shares. The short seller’s expectation is that the shares will drop in value at which point they can “buy to cover” at a lower price than what they borrowed. The profit is the difference less the cost of borrowing, and therein lies the rub.

The Cost to Borrow

In the above article, Jenner sites Ihor Dusaniwsky, head of predictive analytics for S3 Partners out of New York. Dusaniwsky suggests (as an example) that the annual cost to borrow shares (to short) of Aurora Cannabis Inc TSX:ACB is 26%. He compares this to the 0.5% cost for most stocks that trade in the S&P 500 index.

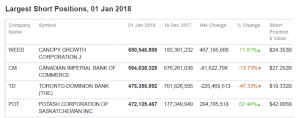

With all that in mind, there is still a short interest in TSX:WEED. While the article suggests a decline as of mid-December, 2017, there has been a significant upswing since.

The Short Sellers are Mobilizing

Clearly, there are many traders and investors that are prepared to pay the cost to borrow in order to short the stock as the share value continues to defy gravity. However, my real interest in the article was the following quote by Chris Damas, editor of BCMI Cannbis Report: According to ShortData.ca, short interest is up 71.8% since December 18th (See chart left)

Clearly, there are many traders and investors that are prepared to pay the cost to borrow in order to short the stock as the share value continues to defy gravity. However, my real interest in the article was the following quote by Chris Damas, editor of BCMI Cannbis Report: According to ShortData.ca, short interest is up 71.8% since December 18th (See chart left)

If you don’t have short sellers in the market, you have no ability for anyone to bet against a company plus you have no ability to hedge,” Damas said by telephone. “It directly feeds into the massively euphoric bull market we’ve had in these stocks.”

As mentioned earlier in the article, short sellers help maintain an efficient market, however, if the outlook for the industry changes, the value will drop as investors rush to sell. This is where the options market comes in. The options market offers a means for both a bet against the underlying company as well as a tool for hedging.

Implied Vol Explosion

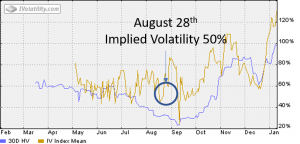

The expensive proposition of shorting the stock also plays in to the options market. The cost of taking a bearish stance or hedging with options has increased significantly. Back in August, implied volatility (IV) was sitting at 50%. As of now, IV is sitting over 120%.

Chart: Courtesy of IVolatility.com

Chart: Courtesy of IVolatility.com

What one must realize is that the above chart is merely an average of IV across a number of strike prices and expiration dates. A closer look at the option chain suggests that near term option contract premiums are trading at a much higher IV factored in. TSX:WEED OPTION CHAIN

So, What’s an Investor To Do?

This of course depends on the position, however, let’s assume the investor is currently holding the shares and is looking to hedge. Given the meteoric rise in value, it is not unrealistic to want to lock those profits in. The challenge however is that the cost of insurance (put protection) is expensive. This is where a Collar strategy can help the investor lock in profits at a reduced price.

The Strategy

The Collar strategy involves the sale of a call option and purchase of a put option. The sale of the call creates an obligation to deliver the shares at the price specified by the strike of the contract written. For taking on this obligation, the seller is a paid a premium. The benefit of being the seller in this situation is that you take advantage of the inflated option premiums due to the high IV.

The purchase of the put locks in the sale price of the shares should they drop in value. The investor pays a premium to guarantee the sale of the shares at the price specified by the strike of the option contract purchased. As a reminder, 1 option contract represents 100 shares of the underlying security.

The Logistics, Part 1

Currently, the 44 strike call option, expiring February 16th 2018 has a bid of $4.95. By selling this call, the investor is obligated to deliver the shares at $44.00 anytime prior to the February 16th expiration. Note that if the shares are trading below $44.00 on the expiration date, the investor keeps the premium.

The Logistics, Part 2

This Covered Call strategy alone offers the investor a $4.95 or 11% downside buffer should the share value fall. However, for the investor concerned about a more significant drop, the addition of a put option will lock in a downside sale price should the shares fall precipitously.

To circle back to IV, the very opportunity the call seller is taking advantage of, is a liability to the put buyer. The buyer of the put is forced to pay for the high volatility. By selling the call and collecting the premium, the intension is that the proceeds will offset the cost of the put and subsequently mitigate the cost of Implied Volatility.

Let’s assume the investor is comfortable with selling the shares at $40.00 (perhaps they purchased them at $9:00 back in August)

The current ask for the 40 strike put option expiring on February 16th is $6.20. If the premium from the sale of the call is applied, the total cost to lock in the sale of the shares at $40.00 is $1.25.

The Maximum Risk

With the shares at $42.00, the investor has the right to sell at $40.00. This right is valid regardless of how low the shares fall between now and the February 16th expiration. As such, the maximum risk on the position is $2.00/share. The cost to “insure” the sale at $40.00 for this time frame is $1.25. As a result, the investor can not lose more than $3.25 on the position.

The Trade Off

The decision to sell the shares at $40.00 by exercising the put is up to the investor. If the investor wishes to continue to hold the position, the put can be sold back to the market before expiration and the call will be left to expire worthless.

The trade off comes if the shares rally above the $44.00 strike of the call. If the shares are trading above the strike of the call sold, the call seller has an obligation to deliver the shares. As such, they “give up” any opportunity to benefit from a further share appreciation above $44.00.

Considerations

When it comes to hedging, there will always be a cost. For hard to borrow stock which limits a traders ability to short and in an industry that is unpredictable and highly volatile this cost increases significantly. With that in mind, the investor has to be more concerned about the risk of loss, and deem the cost of protection to be far less than what they may lose in a sell off., or for what they may further gain by any near term continued upside.

CEO and Director of Business Development

R.N. Croft Financial Group

Jason is CEO and Director of Business Development at R N Croft Financial Group, a member of the Croft Investment Review Committee and a Derivative Market Specialist by designation. In addition, he is an educational consultant for Learn-To-Trade.com and an instructor for the TMX Montreal Exchange.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.