An Electrifying Yield on a Utility Stock

Utility stocks are often loved by yield investors. They provide steady dividends, are regulated businesses, and are less cyclical. Generally they can be called “boring,” but for the investors who own utility stocks that is what they love about them. We’ve seen this sector do well over the last few decades as interest rates have come down and investors seek yield.

Fortis (FTS) has raised its dividend for 43 consecutive years. The company currently derives 96% of their earnings from regulated businesses which makes their earnings very stable and helps to secure the dividend. Looking at performance over the last decade, the stock has an annualized return of 9.64%. At present, the year-to-date total return is 11.44%. Rather than buying the stock to collect the ever-increasing dividend, an investor can consider selling a Put as a different way to generate income.

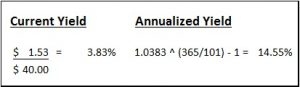

Currently, Fortis shares are trading at $40.25 (as of October 11, 2016). An investor can collect $1.53 in premiums for the January $40 Put. This premium represents 3.83% of the underlying strike price (96% of the annual dividend) in just 101 days. If we annualize that number (calculation below), we come up with 14.55%, which is significantly more than the 10 year annualized return. If at expiry the stock is below $40, the net purchase price on delivery will be $38.47. This represents a 14% discount to the 52 week high and gives a yield on cost of 4.15%. If delivery is taken on the stock, an investor can either put the stock in the long-term hold portion of their portfolio and collect that dividend, or look to sell some Calls. However, keep in mind that the Call market on utility stocks is often dampened by the dividends.

I think this is an opportunistic trade, taking advantage of the recent uptick in interest rates that pushed down utilities. When trying to decide what options to sell, part of the process is taking a look at how they are priced. At the risk of getting too technical, these options are priced with an implied volatility of 17.91%, compared to the 30 day realized volatility of 13.93%. Ultimately, sellers are getting paid more for the option than recent history would suggest they should. The reason in this case is that Fortis is reporting earnings on November 4, 2016. Earnings announcements and other events often create enough uncertainty to increase the price of the options. If it is a company that is suitable to your investment objectives, and that you are comfortable owning at that level, that is when you should step in and take in the premium.

The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Christopher Thom may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your financial advisor before acting on any matter discussed herein. Individual situations may vary.

Portfolio Manager

Odlum Brown Limited

Christopher’s investment philosophy is based on the principles of value investing. Following an investment style consistent with that of Odlum Brown’s Research Department, he focuses on good companies with solid balance sheets trading below their fundamental valuations. As a Portfolio Manager, Christopher works with clients to build portfolios based on their individual needs. A large part of his business includes using options. By incorporating various options strategies in client portfolios, Christopher aims to increase investment income, reduce portfolio volatility and hedge against large moves in the market or currency fluctuations. Christopher has completed numerous industry courses and achieved the Canadian Investment Manager (CIM), Derivatives Market Specialist (DMS) and Fellow of the Canadian Securities Institute (FCSI®) designations. In addition, he has made several guest appearances on Business News Network (BNN) segments, such as Business Day and The Close, on the topic of options and equities. Investing in the equity markets often consists of following a buy low, sell high strategy. For suitable investors, the use of options strategies can help investors protect their portfolio from downside risk, align their cash flows, improve returns, and achieve their objectives given their comfort with risk. By incorporating the use of options, Christopher helps his clients achieve their long-term financial goals. Many clients have come to Christopher after trading options on their own for years, looking for professional advice, and he enjoys the relationships he has built with them over the years.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.