Currency Options University – Part 1

Part 1: Welcome to the world of currencies

It is very common for Canadian investors to invest in American stocks. Yet, it is surprising how few retail investors understand the impact currency fluctuations have on their returns. More often than not, investors look at the price fluctuation of an asset price assuming a constant value of the currency – example: my XYZ shares went up $1.00.

Currency fluctuations do impact your returns!

More importantly, there are ways investors can manage those currency risks. In order to address this topic at its fair value, I am going to break this down into a new article series called “Currency Options University”. This series will be focused on currency risks Canadians face regarding the Canadian and U.S. dollar and on options strategies they can use to manage them.

In this first part, we will focus on the macro drivers of the Canadian dollar value.

Central Banks and Monetary Policy

Arguably, one of the most important drivers of currency trends is monetary policy dictated by central banks. For Canadians, this fact is twofold because it involves not only the policies from the Bank of Canada, but equally from the Federal Reserve.

The Bank of Canada walks on the tightrope with our neighbours south of the border. The correlation of interest rates in Canada with the U.S. is strong, only diverging if material economic disparities emerge.

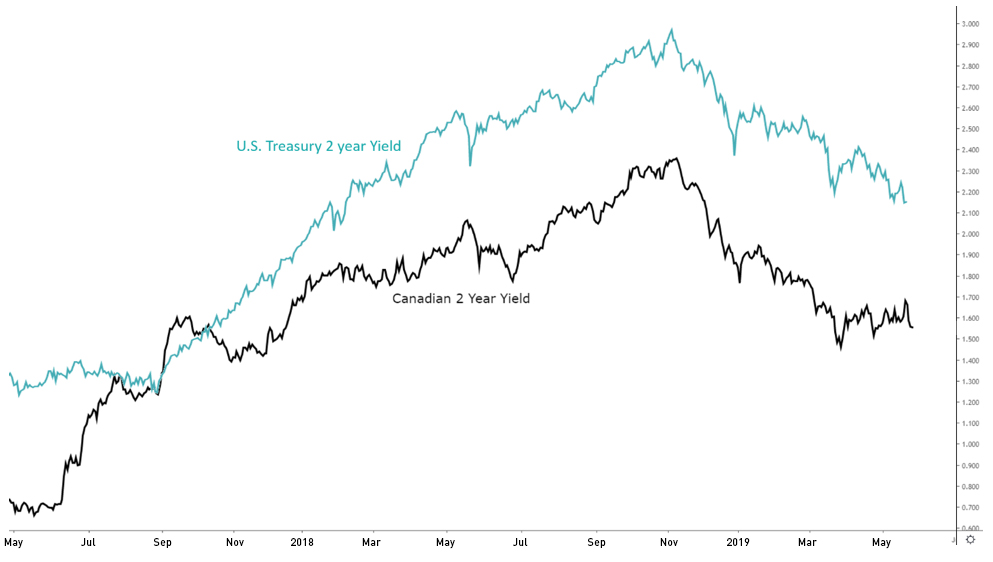

FIGURE 1

Overlay the 2 year yields in Canada and the U.S.

Source: tradingview.com

While central bank interest policy directly focuses on overnight lending rates, the two-year yield illustrates clearly the correlations between the interest rate policies of the two countries. The Bank of Canada does need to focus on the needs of the Canadian economy, but also needs to balance that focus with keeping currency stability with its largest trading partner.

When considering the Federal Reserve, one must recognize that the U.S. dollar remains the world reserve currency and the primary currency of global trade. Through intermarket relationships, the U.S. dollar influences trends in commodities, money flow into emerging markets and the amount of dollars available for global trade.

This materially impacts Canada and the Canadian dollar, largely because a tightening of credit in the U.S. often results in slower global growth and weakness in commodities. This often acts as the primary headwind for the trend in the Canadian dollar.

-

Political Impact

The political developments in a country can add variables to the currency trends. Since currency trends are about money flow, a change in the political landscape creates more uncertainties for investors. In Canada, one source of uncertainty lies with the NAFTA1 deal and the new CUSMA2 replacement. Many international companies that settle in Canada look to the stability of the trade agreements with the U.S. as a variable in deciding the attractiveness of investing here.

-

Economic Data

The strength or weakness of the economy plays a role in the trends of the currency. The most actively tracked economic monthly economic figures are GDP, jobs numbers, inflation and retail sales. But arguably, there is a much bigger shadow on Canadians. That is the level of Canadian household indebtedness. This has been discussed for years with little short-term impacts, but with Canadian real estate having slowed down, many are looking to see if this leads to a household deleveraging which certainly adds heightened risk to a contraction in growth. If this results in an economic slowdown that diverges from its southern American neighbour, it could result in further pressure on the Canadian dollar.

-

Capital Flow and Foreign Investment

Canada is a resource-rich country. This results in an economy that has a disproportionate overweight exposure to those resource markets. While mining, lumber and farming are important components, undisputedly, the most important is energy. So, when global growth is running hot and there is a global appetite to invest in energy projects, there are very few countries that are more politically safe than Canada. This adds further cyclicality to the Canadian dollar as a booming resource market drives capital flow and foreign investment, which in turn strengthens the currency while during global economic slowdowns adds further pressure.

Final Remarks

The Canadian dollar is volatile and notably impacts one’s investment returns. In the upcoming Part 2, we will focus on the impact of currency fluctuations on portfolio performance and then subsequently discuss all the alternatives to hedging those risks, particularly the use of currency options. In the meantime, you can visit Montréal Exchange’s U.S. dollar currency option specification page here.

1. NAFTA : The North American Free Trade Agreement

2. CUSMA : Canada-United States-Mexico Agreement

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.