Covered Call on West Fraser Timber

There is nothing more Canadian than lumber stocks. On the institutional desks, traders often refer to them as trading the “trees.” And no stock is more iconic than West Fraser Timber (symbol WFT).

During the March COVID panic, the price of West Fraser fell more than 65%, from a high of $65.11 to a low of $21.60.

Chart 1: West Fraser Timber (symbol WFT) over past year

Source: Bloomberg

However, since then, WFT has recouped all of the ground lost and even pushed to new highs, trading above $70 in late summer.

Investors are finding plenty of reasons to be bullish of “tree” stocks. American millennials have been slow to form families and buy houses, but the COVID crisis has encouraged many of them to leave their big-city condos and adopt the suburban lifestyle. U.S. homebuilders are finding themselves busier than at any time in the past decade, and this has meant more lumber purchases.

An investor who wishes to benefit from this trend continuing might well consider buying stock in West Fraser Timber. But the rate of ascent appears to have slowed, and although it does have a yield of 1.24%, that alone might not be a good enough reason to buy the stock.

But there is a strategy called the covered call which can increase that yield, and hopefully still allow the investor to participate in some of the company’s upside.

What is a covered call?

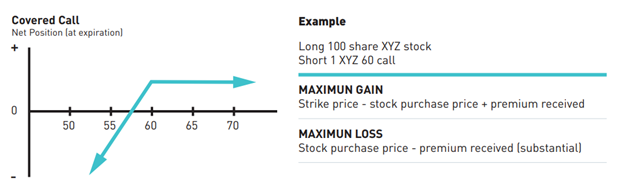

According to the Montréal Exchange Strategy guide, a covered call can be described as follows:

An investor who buys or owns stock and writes call options in the equivalent amount can earn premium income without taking on additional risk. The premium received adds to the investor’s bottom line, regardless of outcome. It offers a small downside ‘cushion’ in the event the stock slides downward and can boost returns on the upside. Predictably, this benefit comes at a cost. For as long as the short call position is open, the investor forfeits much of the stock’s profit potential. If the stock price rallies above the call’s strike price, the stock is increasingly likely to be called away. Since the possibility of assignment is central to this strategy, it makes more sense for investors who view assignment as a positive outcome.

Chart 2: Covered Call Strategy Diagram

Source: The Montréal Exchange

An investor who is interested in this strategy could purchase WFT at $64.61 per share (prices as of 10/22/20), and simultaneously sell the December 18, 2020 call with a strike of $68 for $3.50 per contract (prices as of 10/22/20). This option has 58 days until expiry, and the option premium represents 5.4% of the price of the underlying.

One of two things is going to happen by expiration in December. First, the stock could rally above the $68.00 strike and the investor will have the stock called away at $68.00 (the stock is sold through assignment). If this happens, the profit will be:

| Capital gain on the stock | +$3.39 ($68.00-$64.61) |

| Option premium income | +$3.50 (+5.41%) |

| Total profit over 58 days (December expiry) | $6.89 (+10.66%) |

At this point, the investor will no longer own any shares of WFT, but he or she will have made a 10.66% return in 58 days, and can simply repeat the strategy if it is still attractive.

The second potential outcome is that the stock will be trading below $68.00 at expiration and the option will expire. In this case the $3.50 premium income will be the strategy’s full profit. The stock might be flat or even lower, but at this point, the investor is able to implement another covered call and, hopefully, collect another lucrative return on the stock.

Example of the situation if the stock trades at $60.00 at the December expiration:

| Capital gain / loss on the stock | -$4.61 ($64.61-$60.00) |

| Option premium income | +$3.50 (+5.41%) |

| Loss if sold at the December expiry | -$1.11 ($3.50 – $4.61) |

It is worth noting that although the investor is faced with the possibility that the price of WFT will fall precipitously, makeing this strategy unprofitable, in a regular market the repeated selling of out-of-the-money calls can produce an attractive return when the strategy is applied systematically.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.