Considering a Long Call Position in Air Canada

The COVID crisis has been especially hard on airline stocks. The stock price of Canada’s largest airline, Air Canada, collapsed from over $50 in January to $10 in March. Although the stock has recovered somewhat since then, when compared to other equities the bounce has been anemic.

Chart 1: Air Canada (symbol AC) over past year

Source: Bloomberg

To get flying again, it is essential for Canadians to feel safe, and some of the more pessimistic forecasts assume that airlines will not return to normal until we have a vaccine.

However, recently there have been improvements in the technology used for rapid COVID-19 testing, and this has opened up new possibilities. From the Travel Off Path website:

- A new pilot project for Canada has been launched at the Calgary International Airport that will drop the mandatory quarantine in lieu of Rapid COVID-19 testing.

- The federal government of Canada, along with the provincial government in Alberta, have jointly announced that a new pilot program launched in Alberta will see the mandatory 14-day quarantine greatly reduced to around 48 hours for travelers returning home.

- The pilot project will launch on November 2, 2020 at the Calgary International Airport.

If this pilot program is successful, it could result in a dramatic increase in Canadian airline travel.

There are still risks, so it is understandable if an investor does not feel comfortable buying stock in Air Canada until the program is officially adopted.

However, there is an alternative strategy which will allow the investor to participate in an improvement in Air Canada’s stock price, while limiting the risk.

The investor can purchase call options on Air Canada.

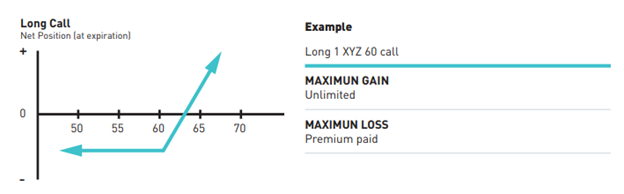

According to the Montréal Exchange Strategy guide, a long call strategy can be described as follows:

- A long call strategy typically doesn’t appreciate in a 1-to-1 ratio with the stock, but pricing models often give us a reasonable estimate about how a $1 stock price change might affect the call’s value, assuming other factors remain the same. What’s more, the percentage gains relative to the premium can be significant if the forecast is on target.

- The call buyer who plans to resell the option at a profit is looking for suitable opportunities to close the position out early: usually a rally and/or a sharp increase in volatility. Some investors set price targets or re-evaluation dates; others ‘play it by ear.’ Either way, timing is everything for this strategy, because all value must be realized before the option expires. Being right about an anticipated rally does no good if it occurs after expiration.

Chart 2: Long Call Strategy Diagram

Source: Montréal Exchange

The December 18, 2020 call with a strike of $17.00 can be purchased for $1.75 (price on October 22, 2020). By purchasing this call option, the investor will have the right, but not the obligation, to purchase Air Canada stock at $17.00/share at any time up until expiry in December.

If the pilot program is unsuccessful, and Air Canada stock falls back to a low of $10.00/share, the investor will only lose the initial outlay of $1.75 for the cost of the option.

| Drop in the stock price | $6.77 ($16.77 stock price – $10.00 low price of the stock) |

| Cost of the call option | $1.75 |

| Total Loss | $1.75 (limited to the premium paid) |

However, if the program is successful and Air Canada’s price appreciates towards its $24.00 June high (before the December expiration), then the profit could be:

| Gain on the stock | $7.00 ($24.00 stock price – $17.00 strike) |

| Less the cost of the call option | $1.75 |

| Total Profit | $5.25 ($7.00 – $1.75) |

In a situation such as this, where there is considerable risk in the underlying asset price, purchasing a call instead of owning the stock can be an attractive alternative that defines the worst-case risk scenario yet captures the upside potential if market sentiment toward the stock starts to shift.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.