Cash-Secured Put Writing on the iShares S&P/TSX Capped Energy ETF

Although the broad Canadian stock market index has almost recovered to its pre-COVID crisis high, there is one sector that has lagged badly. The energy sector has not recovered to anywhere near the levels seen in early 2020.

Chart 1: iShares S&P/TSX Capped Energy ETF (symbol XEG) 2019-2020

Source: Bloomberg

For those who are bullish, it is tempting to buy the XEG ETF outright, but so far the security has not given much in terms of technical reasons to be bullish.

For some, it makes sense to wait until the technical picture becomes clearer.

However, for others who are interested in buying XEG at lower levels, engaging in a cash-secured put writing strategy might be attractive.

With this strategy, the investor writes (sells) a put with the hopes of being assigned on the contract and buying the stock at the strike price. The investor does not use leverage, having all the cash needed to pay for the assignment in full.

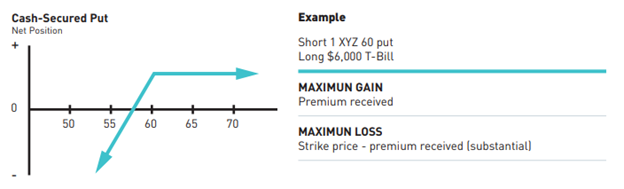

The payoff profile of the actual option strategy looks as follows:

Source: The Montréal Exchange – link https://www.m-x.ca/f_publications_en/strategy_cash_secured_put_en.pdf

However, the investor is engaging in this strategy as a method of getting long into a decline. The strategy’s ultimate profitability will be measured by how the security performs after it has been purchased.

A technician looking at the XEG chart might believe that XEG will test the $3.90 level of support in April. Getting long at that level could be an attractive entry point.

Chart 2: iShares S&P/TSX Capped Energy ETF (symbol XEG) 2019-2020 Support

Source: Bloomberg

Therefore, selling the 18-Dec-2020 $4 put for $0.23 would be a good strategy (as of 09/25/20).

If XEG wanders around the current levels for next three months to the December expiration, then the investor will pocket the $0.23 per share (5.2% of underlying) when the option expires worthless.

If XEG declines to the forecast level by the December expiration, the investor would be long with a cost basis of $3.77 ($4 strike minus $0.23 earned by writing the put).

For investors sitting on cash and hoping that the market will decline before purchasing securities, engaging in cash-secured put writing is one way to lock in those lower-priced purchases and still earn some extra income if the decline does not materialize.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.