Bulling the Market with a Ratio Call Spread

Investors have had a good run over the last two months as we have seen the Canadian TSX 60 index roar higher 9% from a September low of 877.00 to its highs near 955.00. The question on everyone’s mind – is it over or is there more room to go? Is it too late to buy or should an investor wait on the sidelines for a pullback?

This is the dilemma we investors face after such dramatic moves. Historically, after a market move of this magnitude, a correction driven by mean reversion would commonly ensue, but I think we can all agree that there is nothing “common” about today’s markets.

The conundrum facing investors that are on the sidelines is two-fold:

- If the market keeps rallying and they didn’t buy, they risk remaining on the sideline indefinitely

- If they buy and the market mean reverts, they would have bought at the top and are now in the challenge of how to manage the losing position

This is where considering the ratio call spread is an interesting proposition. Those unfamiliar with the strategy can review the particulars on the TMX Equity Options Strategy Summary.

The strategy is to gain upside bullish participation if there is a further sharp rise in the market, while risking very little if the market corrects lower.

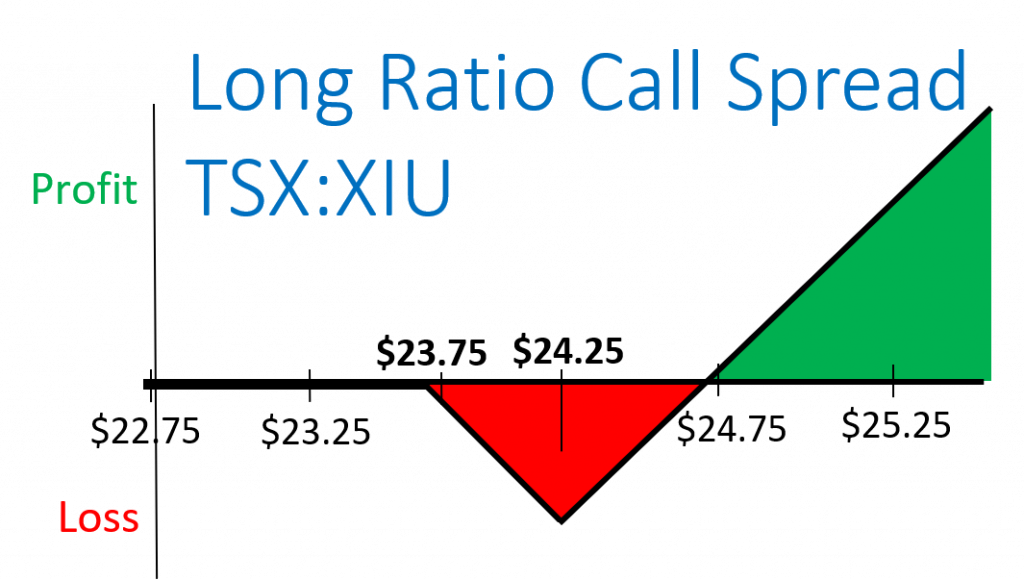

Let’s build an example using the S&P/TSX 60 ETF (TSX:XIU).

- November 27, 2017 the XIU is trading at $23.83

- Investor sells 10 contracts of the February $23.75 calls for $0.50

- The proceeds create a $500.00 credit

- Investor buys 20 contracts of the February $24.25 calls for $0.25

- The 20 contracts cost a $500.00 debit

- The total trade is at a zero-cost outlay

The first observation to clarify is that it is not relevant to the trade if the position is open at a net credit/debit or at a zero-cost. It just so happens that this example nets out that way.

What is the trade off from a traditional bullish position of buying call options?

The key difference is that to be profitable, you need a solid bullish continuation with the XIU advancing another 5%+ into February of next year. A modest rally has very little benefit to the trader.

What makes the trade generally appealing over buying calls outright is that if the market was to stay the same or go down:

- There is little time decay impact (Theta)

- There is little to no loss if the XIU begins correcting lower

The max loss point in the trade lies with a modest shallow rally that only advances to $24.25 as the February expiration approaches.

Alternatively, if you are correct about a further bullish breakout, any rally above $24.75 by the expiration becomes a delta 1.00 position with unlimited upside (synthetically controlling 1000 shares).

To summarize, to utilize the ratio call spread you need a market stance anticipating considerable volatility where there is potential big upside, but an increasing downside risk. Alternatively, if you are rather just modestly bullish, there are better strategies to consider like straight out bull call spreads.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.