Selling Options: Single-Leg vs. Vertical Spreads

When you sell options, you can collect premiums. But you might be better off selling spreads, just in case the market does not move in your favour.

Takeaways:

- Understand the difference between selling single options and selling vertical spreads

- Know the risks and benefits of selling single options and selling vertical spreads

- Learn how to identify the maximum profit, maximum loss, and breakeven points of a bull put spread (short put vertical spread)

Collecting a premium when you sell a call or put may seem like a good way to generate income. It might be a great plan if market moves confirm your forecast. But what if they do not? It may be worth considering trading credit spreads (selling vertical spreads).

Selling Single Options

A naked call is a type of option strategy where an investor writes (sells) a call option without owning the underlying stock. The investor must take the short side of the call option to deliver shares of the underlying security if the option is exercised before the expiration date. This is risky, since there is no limit to how much a stock price can rise.

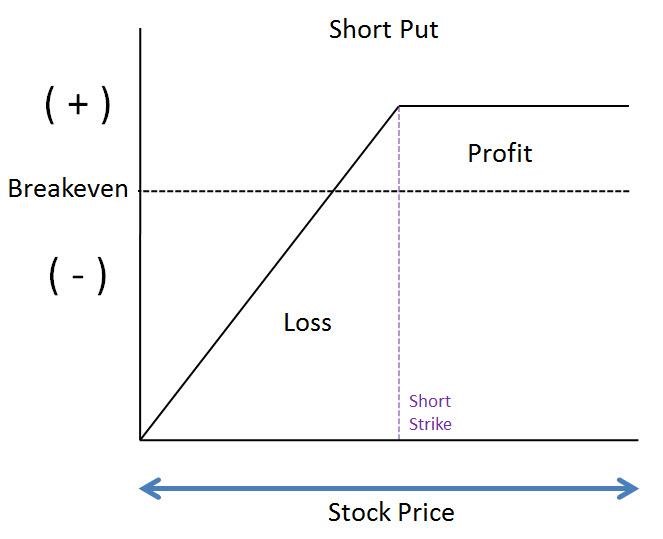

A naked put is when an investor writes (sells) a put option without holding a short position in the underlying stock. If you sell a naked put, you need to be quite confident about which way the price will move. And be prepared to accept the risk that the position could move against you very quickly. The risk curve of a short put makes this concept clearer (see Figure 1).

Figure 1: Risk Curve for a Short Put. When selling a short put, your profit is limited to the premium.

Consider this example. Say XYZ is trading at $265, and you sell one 265-strike put contract and collect a premium of $840 ($8.40 x 100). If the stock goes up and is trading higher than $265 when the contract expires, your put expires worthless. Your maximum profit is the $265 you collected. If the stock is below $265 at expiration, you will likely be assigned and have to purchase 100 shares of the stock at the strike price.

Selling the put, which is similar to selling a naked call, has unlimited downside risk to the seller of the contract (margin is an important factor to consider when selling a naked put). Because of this, brokers are less inclined to let you trade them. Another disadvantage is that they tend to tie up capital.

Selling Spreads

You might make better use of your capital in a credit spread. We will now take a look at a bullish credit spread as an example.

To open a bullish credit spread, an investor simultaneously writes a put option and buys another put option that expires at the same time, but with a different strike price.

The written (or sold) option contract is closer to the price of the underlying issue (the stock) than the purchased option, so it has a higher premium. This produces a net credit in the investor’s account, hence the name “credit spread.”

The objective is for both options to expire worthless, so that the investor can keep all of the credit (profit) in the account. Typically a credit spread investor trades front-month options only, since time value decays rapidly. With each passing day, credit spreads continue to profit due to theta, or time decay. This assumes that there are no changes in the other variables affecting option pricing, such as the underlying security’s price, volatility, dividends, or interest rates.

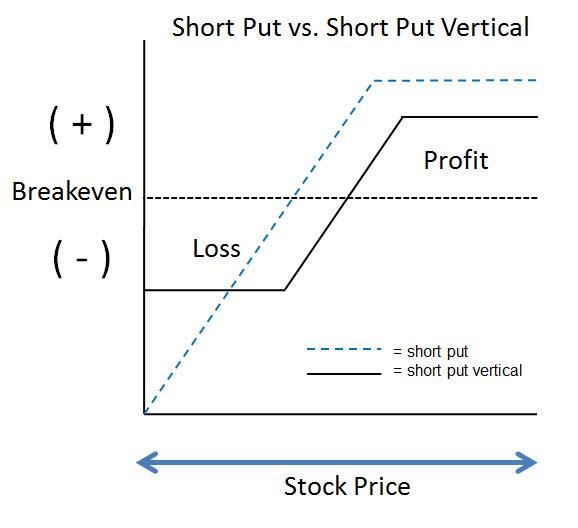

Figure 2 shows the risk curve of a short put versus a bull put vertical spread.

Figure 2: Risk Curve of a Short Put vs. a Bull Put (Short Put Vertical) Spread. Both your potential maximum profit and potential maximum loss are defined when you structure a bull put spread.

The downside risk and upside gain for the spread are defined. Typically, you would employ the spread strategy if you are bullish on a stock or if you feel that it will not go down much further.

Consider the following example of a bull put spread.

- Sell a 265 put for $840

- Buy a 260 put for $608, for a net credit of $2.32 per share or $232 (we are assuming that these are standard contracts, where one contract represents 100 shares). Both options have the same expiration date.

- The upside profit is limited to the net premium received, or $232, when the stock price is at or above $265.

- The downside loss is limited to $268, which is the width of the strikes less the premium received (5.00 -2.32 = 2.68, multiplied by 100). You will need no money up front and could end up with a net cash position, depending on how the price moves.

- The strategy’s breakeven price is the short strike minus the net credit, or $262.68 (265.00 – 2.32).

How is this different from a bull call spread?

- You will need to put up net cash to initiate the bull call spread, whereas with a bull put spread you will not need to provide any money up front, and could end up with net cash.

- A bull call spread usually has a higher maximum profit and lower maximum loss than a bull put spread with the same two strike prices.

- The bull put spread has a lower breakeven point, yet it generates a profit with less of a gain in the underlying stock’s price.

Bottom Line

Options trading offers a plethora of strategies that range in complexity from the basic to the sophisticated. Markets are uncertain, and sometimes your best laid plans go awry. When the market or stock moves beyond what you expected, do you become a deer in headlights, or can you adapt? Options offer investors considerable flexibility. Explore different strategies, apply various scenarios, and determine how comfortable you are with the risk/reward of selling single options vs. selling spreads.

PLACING A BULL PUT SPREAD TRADE

Legging into a trade. When trading spreads, you can trade the legs of the spread together or leg into the trade by entering/exiting each leg separately. You could enter the long leg and then hope to get a better fill on the short leg for a higher net credit. But if the underlying stock’s price declines, the short put could drop in price and lower your net credit.

Order type. When placing trades, keep in mind the different types of orders. Two of the more popular types are market orders and limit orders.

- Market order. You get filled at the next available bid or ask prices. The order may be filled quickly, but not necessarily at a favourable price.

- Limit order. You get to choose your fill prices by indicating that you want to buy or sell at a specific price or better. The downside: the order may take a while to get filled, or it may not get filled at all.

Spread price. Your trading platform may offer you the choice of entering either the natural or the mid-price for the spread.

- Natural. This represents the bid price for the short option and the ask price for the long option.

- Mid. This represents the middle price of the vertical spread.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.’s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this article reflect those of the individual author. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. and are used under license.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.