Currency Options University – Part 3

Part 3: Specifications of USX Options

To summarize, in Part 1 we reviewed the macro drivers that influence a currency’s value, and in Part 2 we focused on the impact of those changes in the currency’s value on investors. The focus in Part 3 will be on understanding the specifications of Canadian USX options and how to size and manage your positions.

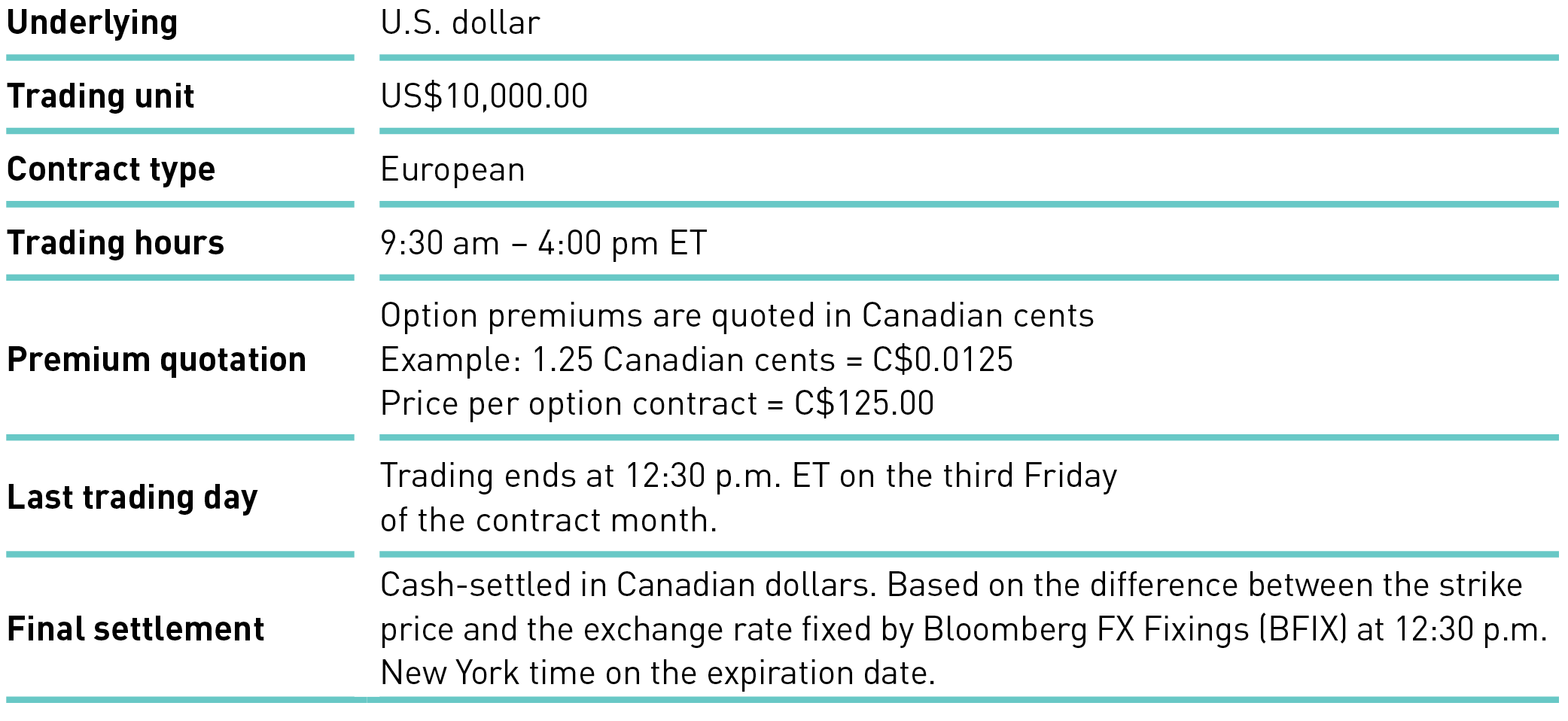

Options on the U.S. dollar (USX)

Frequently Asked Questions

Q: Is the option traded in U.S. dollars or Canadian dollars?

A: While each option gives you a notional exposure to $10,000 U.S. dollars, it is quoted in Canadian dollars and traded through the TMX Montréal Exchange.

Q: How do I track the underlying currency?

A: While the settlement price is based on the Bloomberg FX Fixings (BFIX), you can track the price with any Forex quote of the USD/CAD pair.

Q: How is the premium quoted?

A: The Montréal Exchange quotes the price in Canadian cents. This means that the U.S. dollar vs. Canadian dollar (USD/CAD) Forex quote at 1.3311 dollars would be 133.11 in cents. Similarly, a call option at 1.3300 would show the strike in cents as 133.00.

Q: What does European settlement mean? Can I still buy or sell them freely?

A: European-style options may be exercised only on the expiration date. In the case of USX, this means at 12:30pm ET on the 3rd Friday of its expiration month. This does not mean that you cannot buy or sell the option freely prior to its expiration. In the case of the USX, an exercise of the option would be settled in cash based on the intrinsic value of the option using the BFIX rate.

Illustration of a Position

In this example, the investor is looking for $250,000 USD of exposure through USX options over the next 4 months.

- This investor would purchase 25 call contracts (25 x $10,000 USD = $250,000 USD).

- The options are quoted at 1.73 cents CAD. Let’s do the math:

- We first convert the quote back to dollars (1.73/100 = 0.0173).

- Then we apply the multiplier (0.0173 x 10,000 = $173.00).

- The investor buys 25 contracts ($173.00 x 25 = $4,325.00).

To be clear, these 25 contracts of the USX 133.00 calls give the investor $250,000 USD notional exposure to the upside above the 133.00 strike. This was at a cost of $4,325.00 CAD.

Part 4 of the Currency Options University will go through a more thorough breakdown of directional trading with USX options.

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Derivatives Market Specialist

Big Picture Trading Inc.

Patrick Ceresna is the founder and Chief Derivative Market Strategist at Big Picture Trading and the co-host of both the MacroVoices and the Market Huddle podcasts. Patrick is a Chartered Market Technician, Derivative Market Specialist and Canadian Investment Manager by designation. In addition to his role at Big Picture Trading, Patrick is an instructor on derivatives for the TMX Montreal Exchange, educating investors and investment professionals across Canada about the many valuable uses of options in their investment portfolios.. Patrick specializes in analyzing the global macro market conditions and translating them into actionable investment and trading opportunities. With his specialization in technical analysis, he bridges important macro themes to produce actionable trade ideas. With his expertise in options trading, he seeks to create asymmetric opportunities that leverage returns, while managing/defining risk and or generating consistent enhanced income. Patrick has designed and actively teaches Big Picture Trading's Technical, Options, Trading and Macro Masters Programs while providing the content for the members in regards to daily live market analytic webinars, alert services and model portfolios.

The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

All references on this website to specifications, rules and obligations concerning a product are subject to the rules, policies and procedures of Bourse de Montréal Inc. and its clearinghouse, the Canadian Derivatives Clearing Corporation, which prevail over the content of this website. Although care has been taken in the preparation of the documents published on this website, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information published on this website and reserve the right to amend or review, at any time and without prior notice, the content of these documents. Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions on this website or of the use of or reliance upon any information appearing on this website.

BAX®, CADC®, CGB®, CGF®, CGZ®, LGB®, MX®, OBX®, OGB®, OIS-MX®, ONX®, SCF®, SXA®, SXB®, SXF®, SXH®, SXM®, SXO®, SXY®, and USX® are registered trademarks of the Bourse. OBW™, OBY™, OBZ™, SXK™, SXJ™, SXU™, SXV™, Montréal Exchange and the Montréal Exchange logo are trademarks of the Bourse. All other trademarks used are the property of their respective owners.

© 2024 Bourse de Montréal Inc. All Rights Reserved.